Form 1099

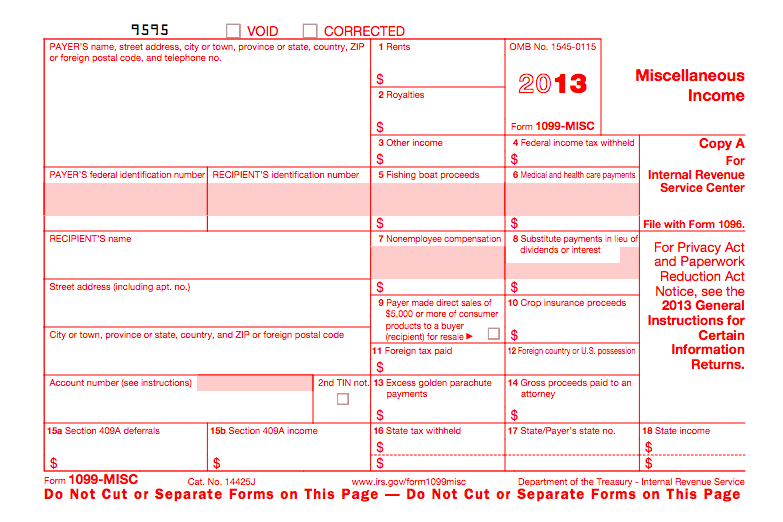

Printable And Fileable Form 1099 Misc For Tax Year 17 This Form Is Filed By April 15 18 Irs Forms Fillable Forms 1099 Tax Form

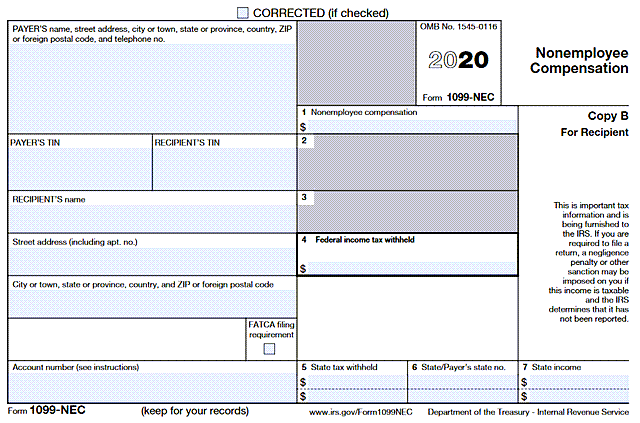

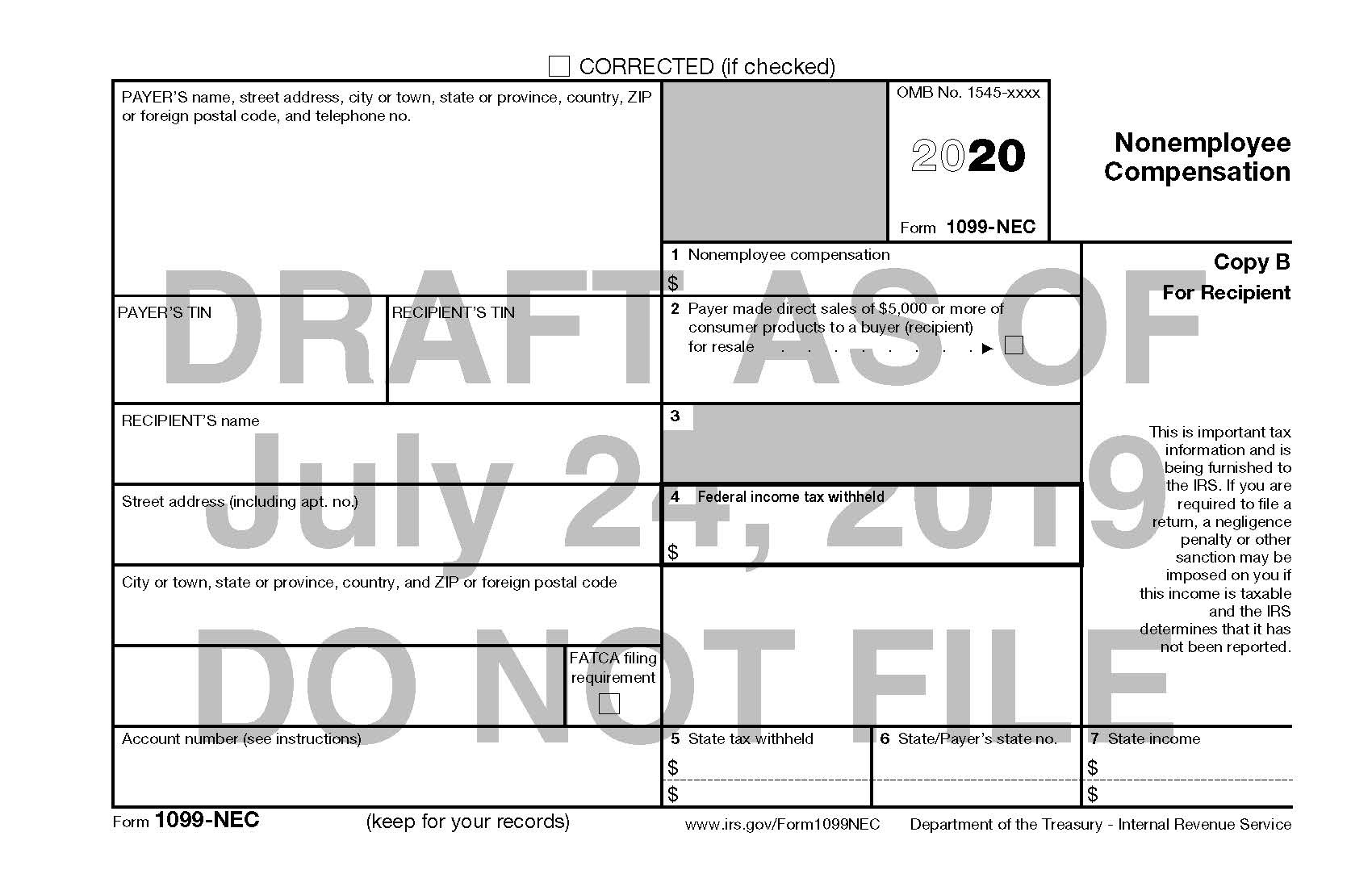

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Faqs Benefits Kansas Department Of Labor

1099 R Software To Create Print E File Irs Form 1099 R

Form 1099 Misc It S Your Yale

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

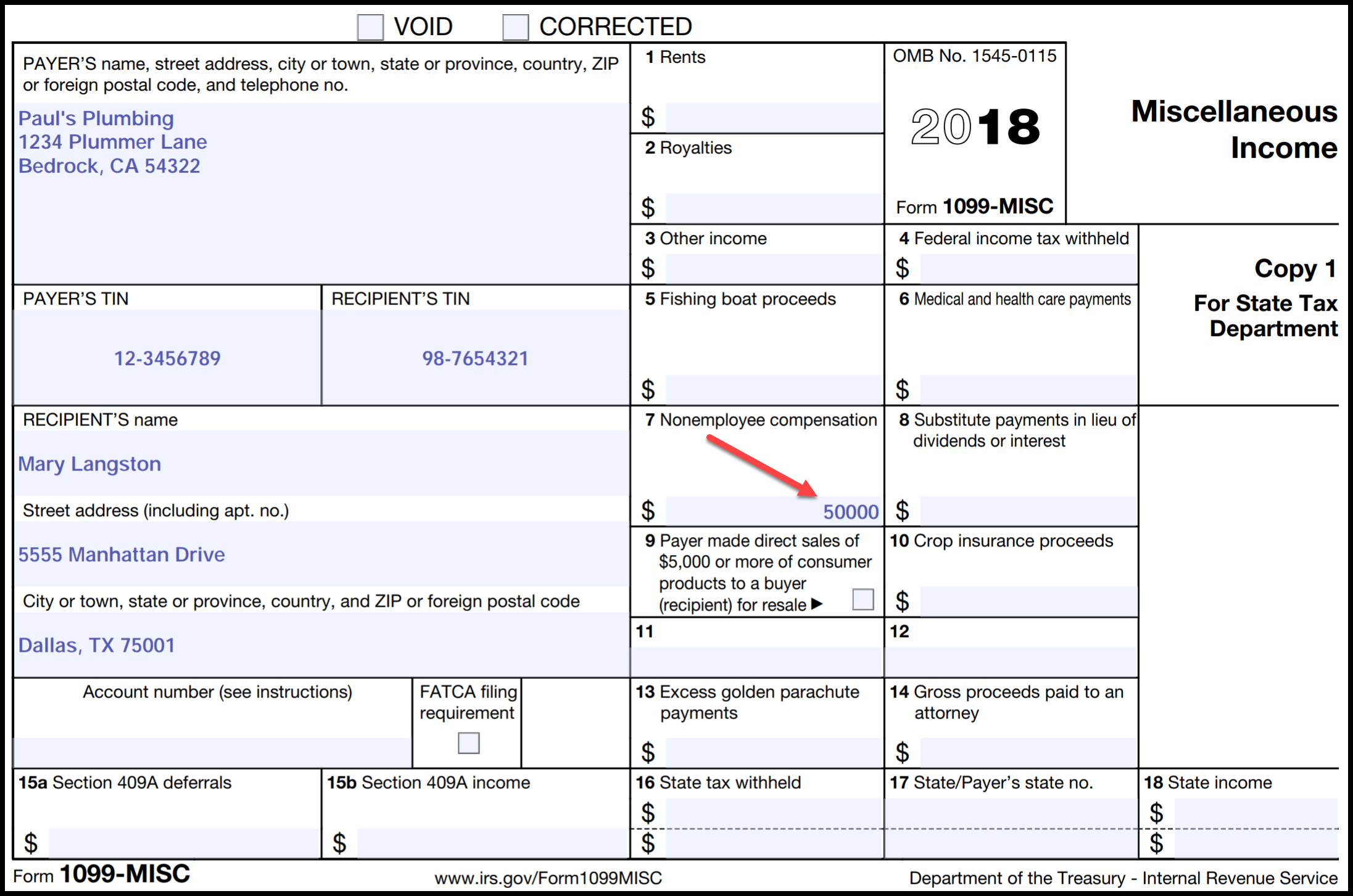

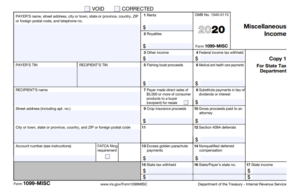

A 1099 Form is a tax form used for independent contractors or freelancers The 1099MISC Form is a specific version of this that is used for anyone working for you that is not a true employee 1099MISC for 19, 18, 17 1099MISC Document Information.

Form 1099. Federal Form 1099G, Certain Government Payments, is filed with the Internal Revenue Service (IRS) by New York State for each recipient of a New York State income tax refund of $10 or moreIf you received a refund in a particular year, you may need federal Form 1099G information when filing your subsequent year’s federal tax return. Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds. The 1099 form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns" There are a number of different 1099 forms that report the various types of income you may receive throughout the year other than the salary your employer pays you.

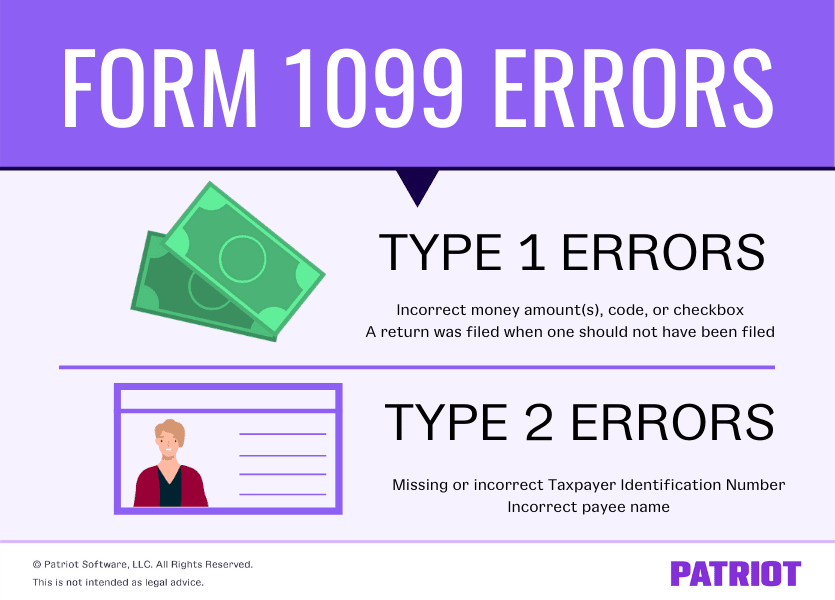

The first 1099 will be with the exact same payer and recipient information as the originally filed form, but the amounts on the form will be all zeros and the “CORRECTED” box will be checked This will remove the originally filed form from the IRS records. How to request your 1099R tax form by mail Sign in to your account, click on Documents in the menu, and then click the 1099R tile We'll send your tax form to the address we have on file You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab. IRS Publication 1 A document published by the Internal Revenue Service that identifies a taxpayer's rights and outlines the processes followed by the IRS when it examines a taxpayer, issues a.

1099 NEC Tax Forms (Replaces 1099 MISC) for 4Part Form Sets for 5 Vendors, 2X 1096 Summary, and Confidential Envelopes (Filings for 5) 42 out of 5 stars 154 $14 $ 14. The 1099 Form 19 is used by business owners and freelancers to document and report their outsideemployment payments/earnings To put it simply, Form 1099 is for reporting your outside payments (for business owners) or nonemployment income (for independent vendors) 1099 IRS FORM HELP. Form 1099G information is used when preparing your federal income tax return Sign up now to go paperless To be notified when your Form 1099G is available in January, give your email address when you sign up View Form 1099G VIDEO What's A Form 1099G?.

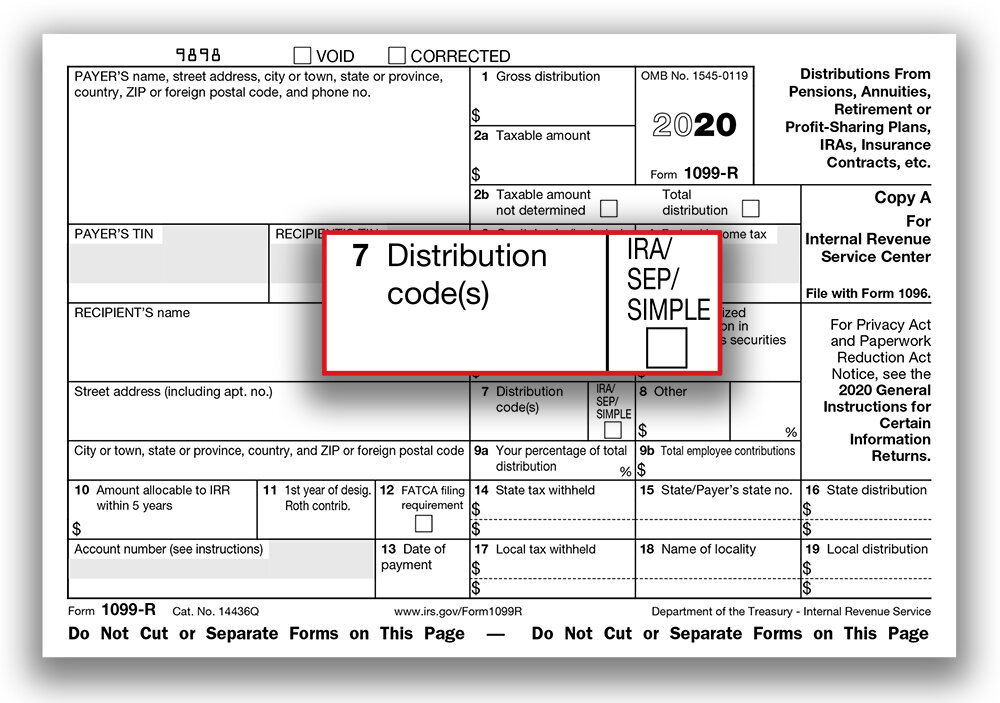

The code (s) in Box 7 of your 1099R helps identify the type of distribution you received We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty 1 – Early distribution (except Roth), no known exception. If you have a 1099C form but did not include the forgiven debt as taxable income, you can file an amendment to your tax return Use Form 1040X , and be prepared to pay any extra tax you might owe. Depending on the state, the employer may need to send the 1099 forms, along with possible other information, to their state or the applicable state Unless the state participates in the Combined Federal/State Filing (CF/SF) program and does not require additional information filing, you should assume filing will be necessary.

Follow these steps to prepare and file a Form 1099 Obtain a blank 1099 form (which is printed on special paper) from the IRS or an office supply store Fill out the 1099 Each Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper. A 1099 form is a tax record that an entity or person — not your employer — gave or paid you money See how various types of IRS Form 1099 work. What is a 1099 tax form?.

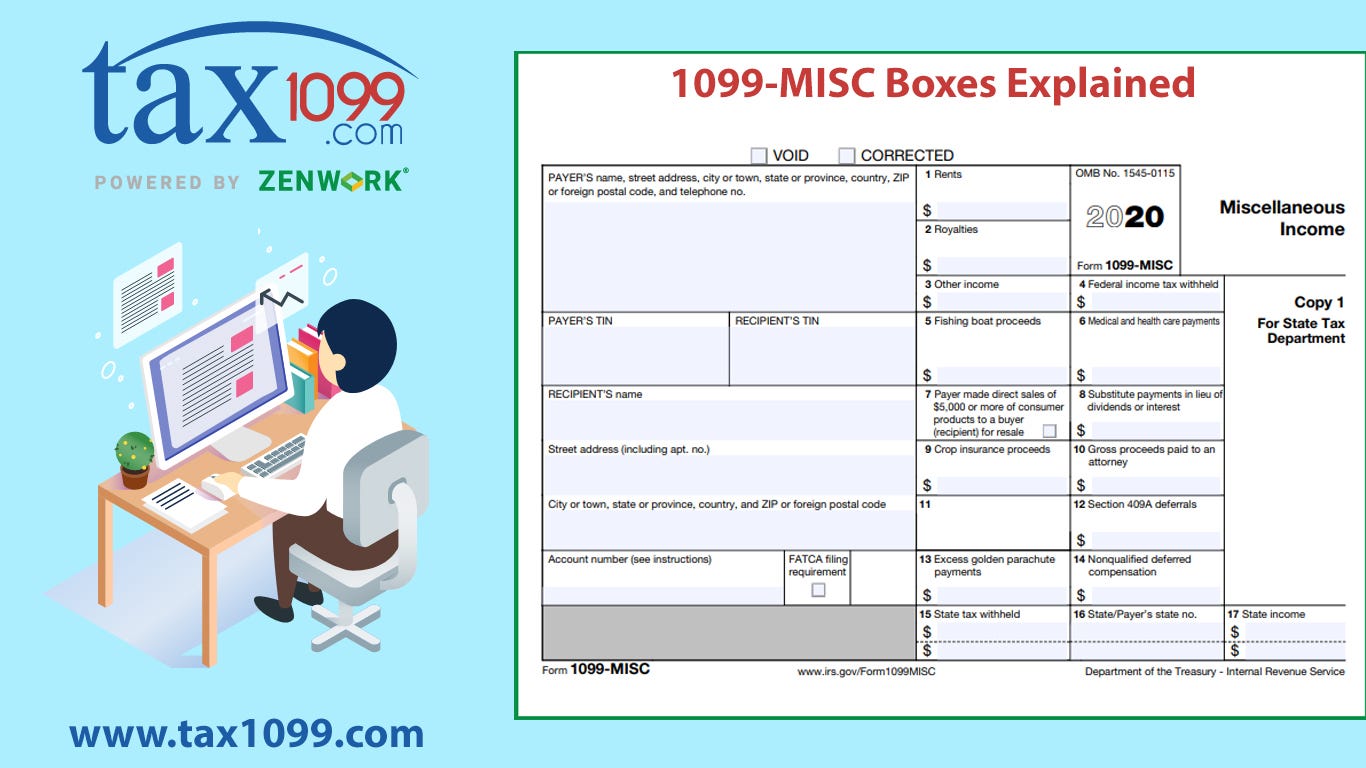

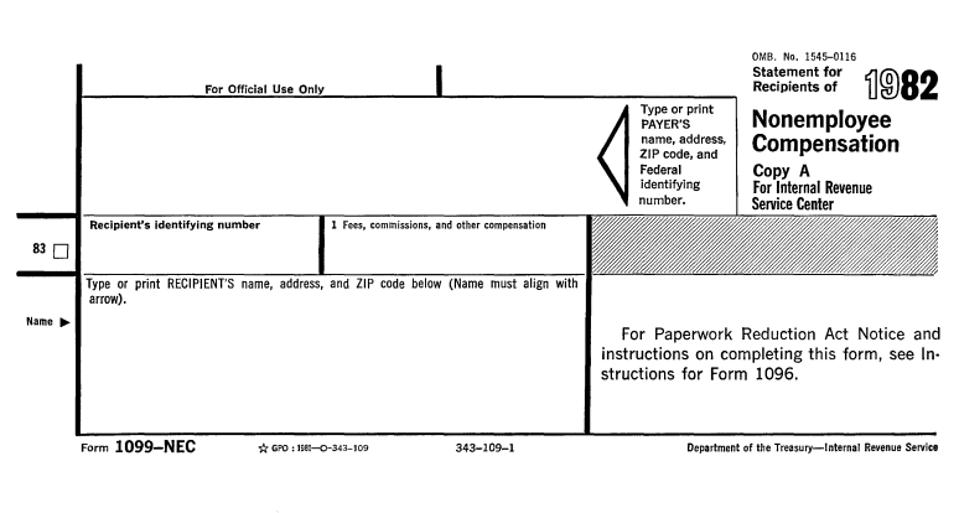

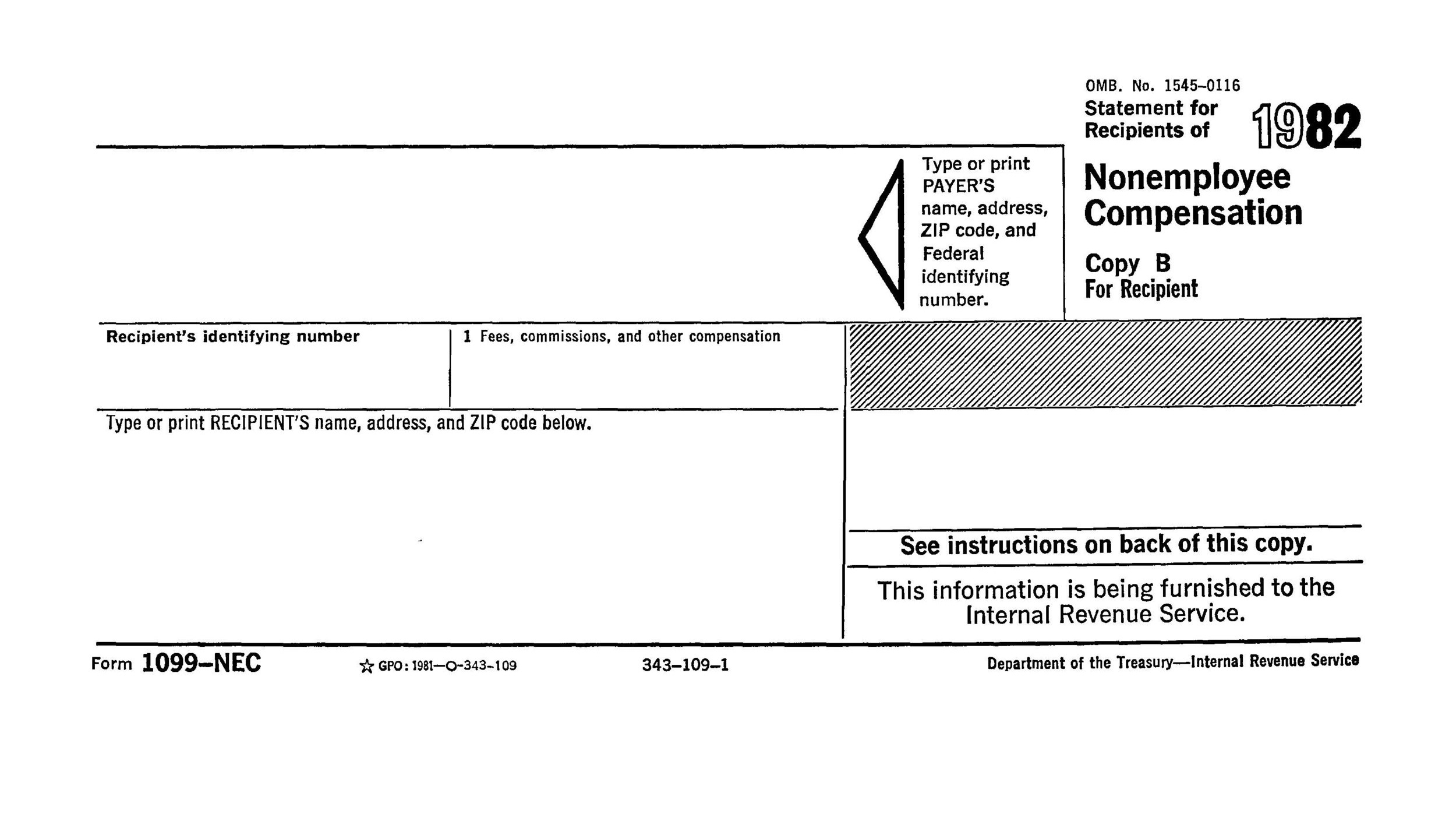

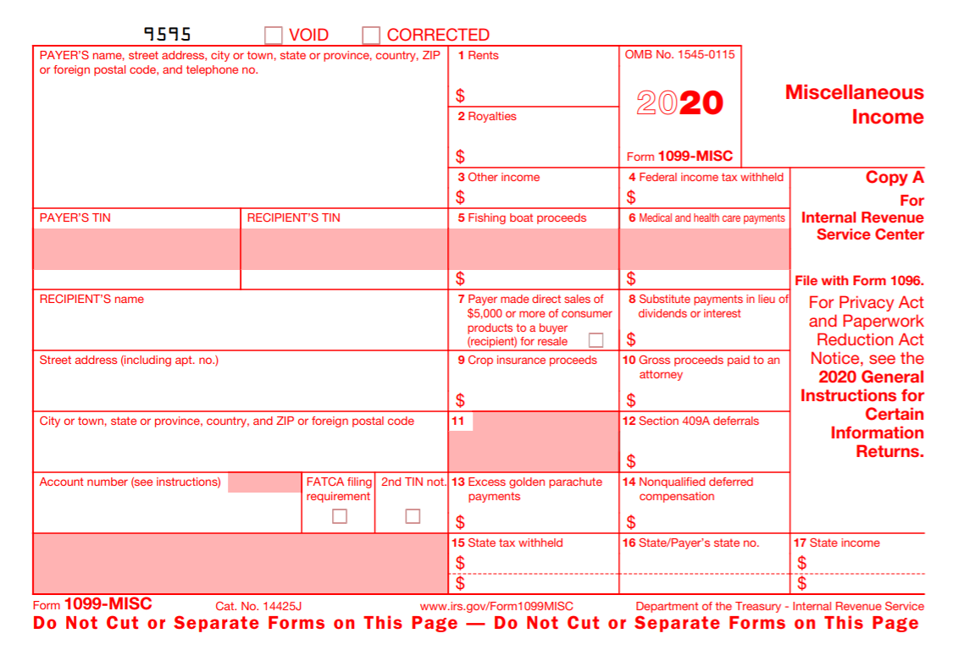

Form 1099MISC is a generalpurpose IRS form for reporting payments to others during the year, not including payments to employees This form has been redesigned for to remove the reporting of nonemployee income (from independent contractors, for example). Form 1099 ( 1099MISC, 1099NEC ) Form W2 Wage and Tax Statements;. Before its reintroduction, the last time form 1099NEC was used was back in 19 Since then, prior to tax year , businesses typically filed Form 1099MISC to report payments totaling $600 or more to a nonemployee for certain payments from the trade or business.

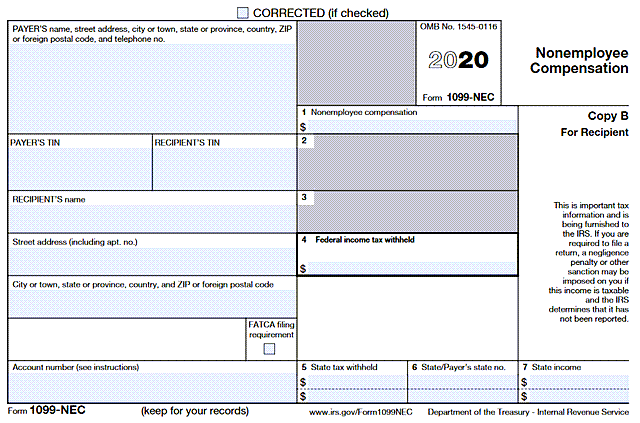

A different Form 1096 is required for each type of Form 1099 filed For electronic filing, you do not need to send in a Form 1096 Other Items to Note in 1099 Corrections If the recipient of the form has different information in their records, they will likely contact you for an explanation or correction of the 1099 Form. Form 1099 for 19 Tax Year with Instructions Typically, nonemployment money is beyond taxation But reporting them to the IRS is a must Otherwise, you will definitely experience some really unpleasant consequences sooner or later For business owners who have received over $600 in services or other income variations, sending this document to. Form 1099 NEC is a new federal tax form that payers must file with the Internal Revenue Service to report payments paid to noneemployees such as contractors, vendors, consultants and the selfemployed The formal name of the Form 1099NEC is “Nonemployee Compensation” How does form 1099NEC work?.

IRS Forms 1099 match income and Social Security numbers Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out The tax code requires companies making payments to attorneys to report the payments to the IRS on a Form 1099. File 1099, W2 and 1098 tax forms online, anytime Adams® Tax Forms Helper® Online is the quick and easy way to prepare your 1099, W2 and 1098 tax forms for the tax season Fill forms quickly without CDs, downloads or waiting It's fast, safe and easy. Form 1099MISC Miscellaneous Income is an Internal Revenue Service (IRS) form taxpayers use to report nonemployee compensation This is generally a business payment—not a personal payment.

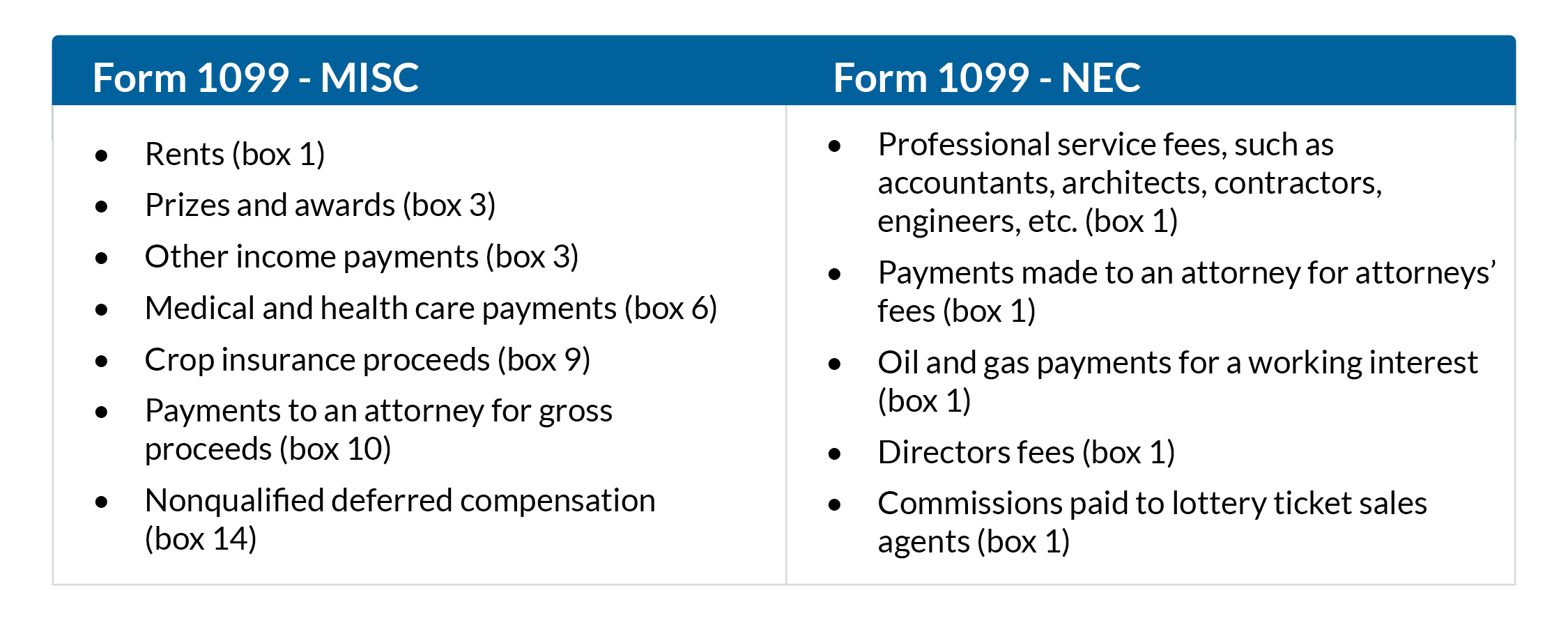

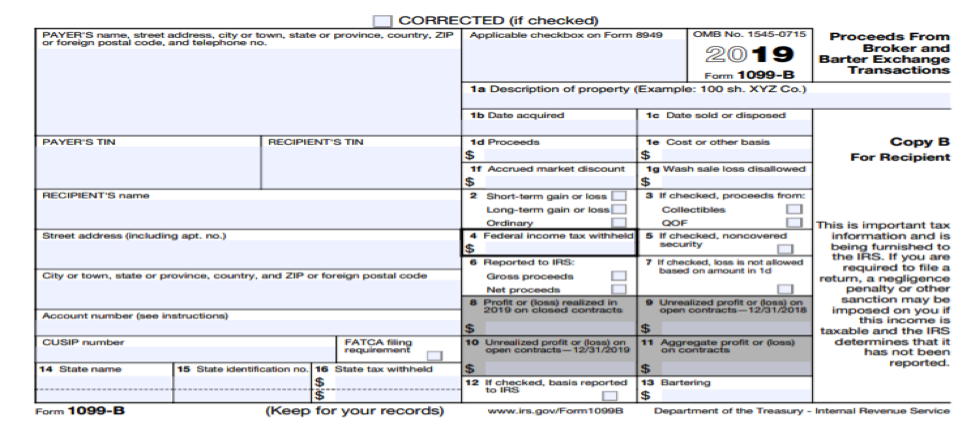

A 1099 form is a tax record that an entity or person — not your employer — gave or paid you money See how various types of IRS Form 1099 work. Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 12/03/ Form 1099C Cancellation of Debt (Info Copy Only) 21 11/04/ Form 1099C Cancellation of Debt (Info Copy Only) 19 11/06/19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only). Since form 1099NEC was introduced by the IRS for , we have been receiving a lot of questions from our customers about the similarities and differences between form 1099NEC and form 1099MISC This article compares the two forms sidebyside, including what to report, submission deadline, mailing address and what software to use for filing.

Follow these steps to prepare and file a Form 1099 Obtain a blank 1099 form (which is printed on special paper) from the IRS or an office supply store Fill out the 1099 Each Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper. A 1099INT tax form is a record that a person or entity paid you interest during the tax year Sometime in February, you might receive a 1099INT tax form (or more than one) in the mail You need. The renewed 1099NEC form separates out nonemployee compensation from other sections of the 1099MISC and imposes a filing deadline of Feb 1, 21 To be clear, you may still need to use both.

Form 1099NEC isn’t a new form, but it's set to replace 1099MISC for nonemployee compensation Learn about the changes taking place for tax year 21. Tax Forms Helper® empowers small businesses, accountants, CPAs and individuals to order, fill, print and mail W2 and 1099 forms, all without breaking the bank. Form 1099MISC is a generalpurpose IRS form for reporting payments to others during the year, not including payments to employees This form has been redesigned for to remove the reporting of nonemployee income (from independent contractors, for example).

Deadline to File Michigan Filing Taxes February 1, 21 for Michigan State Taxes withheld February 1, 21 for Without Tax Withheld. The tax form that is sent each year by employers or clients who have paid for this kind of work is called a 1099 The IRS has many tax return forms and schedules, and it breaks them down into “information” forms and returns 1 The 1099 form is an information form. Form 1099NEC, Nonemployee Compensation, is a form that solely reports nonemployee compensation Form 1099NEC is not a replacement for Form 1099MISC Form 1099NEC is only replacing the use of Form 1099MISC for reporting independent contractor payments And, the 1099NEC is actually not a new form It was last used in 19.

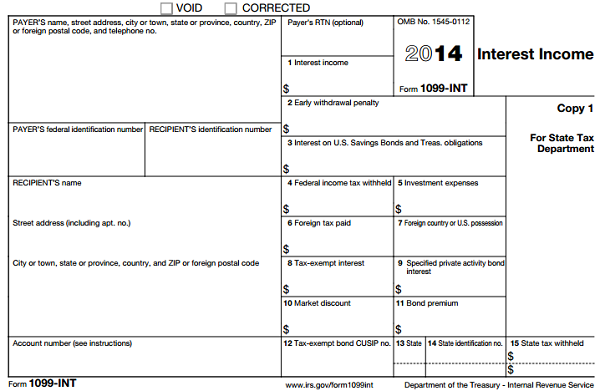

The 1099NEC form is the independent contractor tax form Use it to report to your contractors, and to the IRS, how much they were paid over the course of the tax year You only need to file 1099s. A 1099INT tax form is a record that someone — a bank or other entity — paid you interest If you earned more than $10 in interest from a bank, brokerage or other financial institution, you. IRS Form 1099A is an informational statement that reports foreclosure on property Homeowners will typically receive an IRS Form 1099A from their lender after their home has been foreclosed upon, and the IRS receives a copy as well The information on the 1099A is necessary to report the transaction on your tax return.

Form 1099R is used to report distributions from pensions, annuities, retirement or profitsharing plans, IRAs, and insurance contracts You may also receive Forms SSA1099, RRB1099, or RRB1099R from the Social Security Administration or Railroad Retirement Board to report the benefits you received during the year. Form 1099NEC isn’t just for fees paid to service providers It can also report benefits, commissions, prizes and awards for service performed by a nonemployee as well as the general catchall of. A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a W2 for a person that's not an employee.

Easy 1099 Efile Overview EDelivery to Recipients Tax Pro Teams Pricing State Efiling IRS TIN Matching file CSV Importing, all form types Transfer From Last Year or W9s Affordable Care Act (ACA) Efile Online W9s Postal Mail Fixing Many Recipients with Errors Corrections. The 1099 G form is available at the IRS site here Who Is the Form 1099G Filed For?. Tax Form w9, 1099misc, 1099k on a white background Getty Most Forms 1099 arrive in late January or early February, but a few companies issue the forms throughout the year when they issue checks.

What is a 1099NEC tax form?. Information about Form 1099MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file Form 1099MISC is used to report rents, royalties, prizes and awards, and other fixed determinable income. The recipients of unemployment compensation, state or local income tax refunds, credits, or offsets;.

Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in will be mailed to the last address on file no later than January 29, 21 Email alerts will be sent to the claimants that elected to receive electronic notifications, advising that they can view and print their 1099G online. A 1099 form is a record of income All kinds of people can get a 1099 form for different reasons For example, freelancers and independent contractors often get a 1099MISC or 1099NEC from their. Or one of the other listed government payments, will be sent a copy of Form 1099G by Jan 31 by the filing agency.

A 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it sees that forgiven debt as a form of income. Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 12/03/ Form 1099C Cancellation of Debt (Info Copy Only) 21 11/04/ Form 1099C Cancellation of Debt (Info Copy Only) 19 11/06/19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only). The 1099 form is an information form The tax code provides numerous 1099s, all of them differentiated by numbers or letters tacked on at the end or beginning of the form number They indicate that money has changed hands from Party A to Taxpayer B, but not as income resulting from an employer/employee relationship, such as with a W2.

The Key to Form 1099 Is Matching Every Form 1099 includes the payer's employer identification number and the payee's Social Security number, and the IRS matches Forms 1099 with the payee's tax return If you need help with a 1099, you can post your legal need on UpCounsel’s marketplace UpCounsel accepts only the top 5 percent of lawyers to. A 1099INT tax form is a record that a person or entity paid you interest during the tax year Sometime in February, you might receive a 1099INT tax form (or more than one) in the mail You need. The 1099G form will be available by the end of January 21 Additional FAQs are available here With questions about tax filing, please visit the IRS Tax fraud can result in criminal penalties Some of the criminal activities in violations of federal tax law include deliberately underreporting or omitting income or hiding or transferring.

Form 1099R is used to report distributions from pensions, annuities, retirement or profitsharing plans, IRAs, and insurance contracts You may also receive Forms SSA1099, RRB1099, or RRB1099R from the Social Security Administration or Railroad Retirement Board to report the benefits you received during the year Social security benefits. Redesigned Form 1099MISC Due to the creation of Form 1099NEC, we have revised Form 1099MISC and rearranged box numbers for reporting certain income Changes in the reporting of income and the form’s box numbers are listed below • Payer made direct sales of $5,000 or more (checkbox) in box 7 • Crop insurance proceeds are reported in. A Social Security 1099 or 1042S Benefit Statement, also called an SSA1099 or SSA1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Form 1099MISC, Miscellaneous Income, is for reporting certain payments made to 1099 vendors, like royalties and rent On the other hand, Form 1099NEC, Nonemployee Compensation, is solely for reporting payments to independent contractors This form works similarly to Form W2. A 1099 is an “information filing form”, used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC. Each Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper Send Copy A to the IRS, Copy 1 to the appropriate state tax agency, Copy B and Copy 2 to the income's recipient (they get two copies so they can attach one to their return and keep one), and keep Copy C for.

The 1099 Form 19 is used by business owners and freelancers to document and report their outsideemployment payments/earnings To put it simply, Form 1099 is for reporting your outside payments (for business owners) or nonemployment income (for independent vendors) 1099 IRS FORM HELP. Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 12/03/ Form 1099C Cancellation of Debt (Info Copy Only) 21 11/04/ Form 1099C Cancellation of Debt (Info Copy Only) 19 11/06/19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only). A 1099 form is a record of income All kinds of people can get a 1099 form for different reasons For example, freelancers and independent contractors often get a 1099MISC or 1099NEC from their.

Form 1099G, Certain Government Payments, is mailed in January to anyone who received an unemployment benefits payment during the previous calendar year If your Form 1099G is mailed to an address other than your current address, the US Postal Service will forward the Form 1099G if a current forwarding order is on file.

How To Read Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

Form 1099 Int Pdf Abcgray

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

What Is A 1099 5498 Udirect Ira Services Llc

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

1099 Nec

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Form 1099 R Box 7 Distribution Codes Ascensus

New From The Irs Form 1099 Nec Hw Co Cpas Advisors

Schwab Moneywise Calculators Tools Understanding Form 1099

Issuers Of Forms 1099 Important North Carolina Reporting Obligation

Form 1099 Misc Bhcb Pc

Form 1099 Int Irs Copy A

1099 B Software To Create Print E File Irs Form 1099 B

Q Tbn And9gcsiryg2hdlma2pcdm1jwhie4u1haruddc3if4dsxzrhkh2p2cgl Usqp Cau

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Breaking Down Form 1099 Div Novel Investor

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Int Form Copy B Recipient Zbp Forms

Form 1099 Misc It S Your Yale

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Move Over 1099 Misc Irs Throwback Season Continues With Form 1099 Nec

1099 Nec 1099 Express

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

What S The Irs Form 1099 Nec Atlantic Payroll Partners

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Misc Instructions And How To File Square

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Form 1099 Misc Vs Form 1099 Nec How Are They Different

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Deadline For Forms 1099 Misc And 1099 Nec Is Feb 1 21 Cpa Practice Advisor

Form 1099 B Expands Reporting Requirements To Qualified Opportunity Funds Tax Accounting Blog

What Are Irs 1099 Forms

Form 1099 R Instructions Information Community Tax

Is Your Business Prepared For Form 1099 Changes Rkl Llp

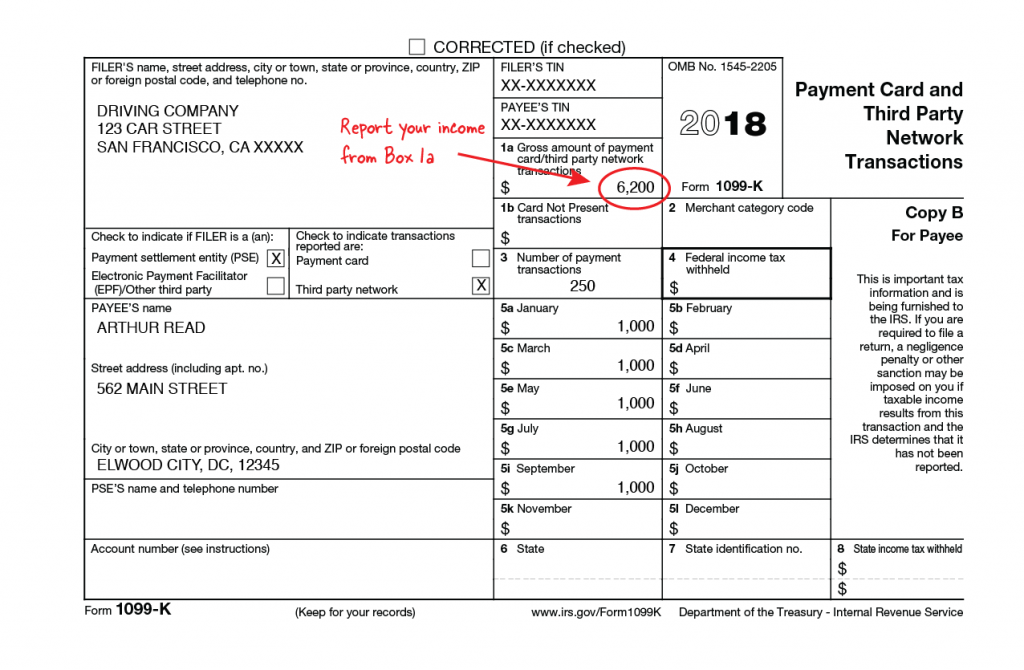

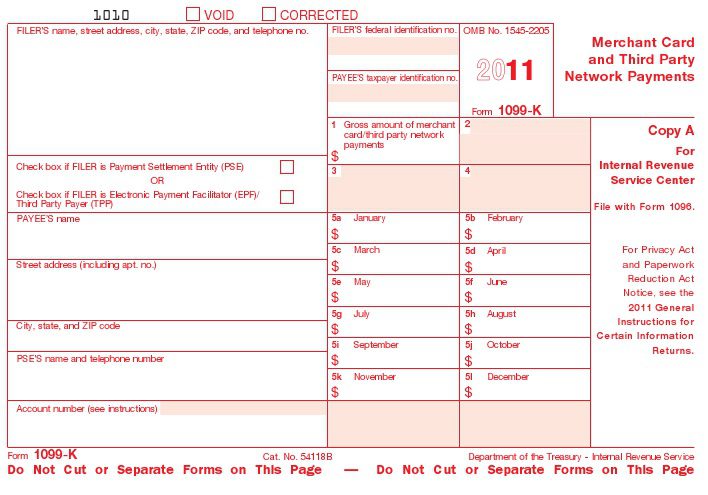

1099 K Tax Basics

Instant Form 1099 Generator Create 1099 Easily Form Pros

Tax Form 1099 K The Lowdown For Amazon Fba Sellerstaxjar Blog

Filing Taxes 1099 Form As An Independent Contractor Walk Through Everlance

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is A 1099 Misc Form W9manager

Do You Know The Difference Between The 1099 K And 1099 M And Does It Matter

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

What Is A 1099 K Stride Blog

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

Amazon Com 19 Laser Tax Forms 1099 Misc Income Copy B For 25 Recipients Park Forms Office Products

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Understanding Tax Form 1099 Int Novel Investor

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Basics Of Form 1099

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Definition

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Definition

Irs 1099 Misc Form Pdffiller

Irs Released 1099 R Instructions And Form Spsgz

1099 Rules For Business Owners Mark J Kohler

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

Form 1099 R Wikipedia

1099 Misc Tax Basics

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Request Deadline Extensions For Form 1099 Misc Asap Help Center

7 Crippling Mistakes With Form 1099 That Cost Big

E File 1099 B Form 1099 B Online How To File 1099 B

Ready For The 1099 Nec Farkouh Furman Faccio Llp Certified Public Accountants Advisors

1099 Misc Form Fillable Printable Download Free Instructions

Understanding Form 1099 Misc And Changes That Are Coming In S J Gorowitz Accounting Tax Services P C

Form 1099 Misc Miscellaneous Income State Copy 1

Form 1099 Misc 18 Tax Forms Irs Forms State Tax

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Form 1099 K Should You Expect This Surprise In Your Mailbox Next February The Timesheets Com Journal

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Quickbooks 1099 Misc 3 Part Pre Printed Tax Forms With Envelopes

Form 1099 Misc What Is It

Interest Income Form 1099 Int What Is It Do You Need It

How A 1099 C Affects Your Taxes Innovative Tax Relief

What S New For 19 Form 1099 B Irs Compliance

1099 Misc Form Fillable Printable Download Free Instructions

Where Is My 1099 Atbs

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Irs Form 1099 Reporting For Small Business Owners In

1

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

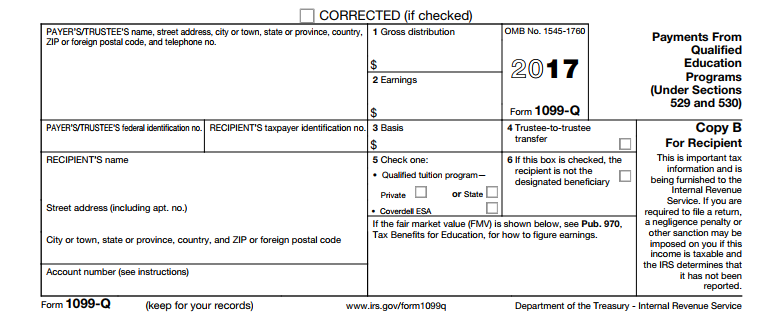

What Is Irs Form 1099 Q Zipbooks

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform