Form 1096

Irs Form 1096 Software Free No Cost 1096 Software

Form 1096 Annual Summary And Transmittal Of U S Information Returns

1099 Tax Software Blog 1099 Software How Can I Print Form 1096

Form 1096 1099 Misc Internal Revenue Service W2 Transparent Png

6 Irs Tax Forms 1099 Misc 6 Recipients 1 Form 1096 Ebay

Quantity 5 Forms Egp Irs Approved 1096 Laser Transmittal Summary Form Sareg Com

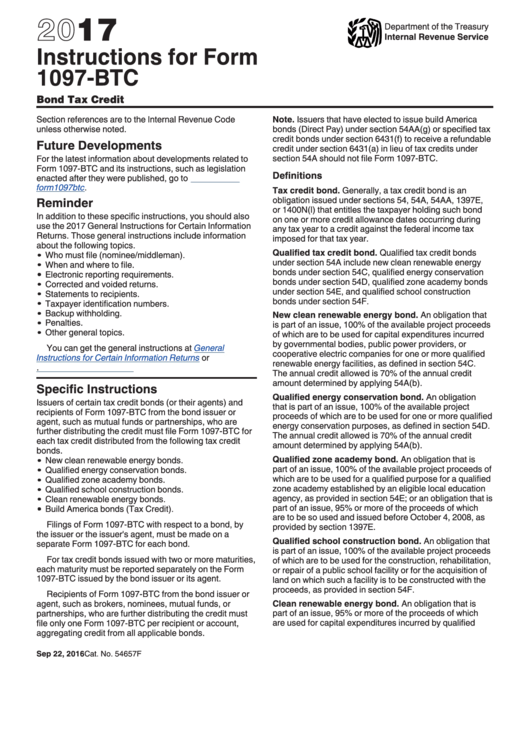

Fast Tax Reference Guide 17 4 pages, 227 KB, 02/16/18 Reference sheet with Hawaii tax schedule and credits Outline of the Hawaii Tax System as of July 1, 4 pages, 61 KB, 11/19/ A summary of state taxes including information on tax rates, forms that must be filed, and when taxes must be paid.

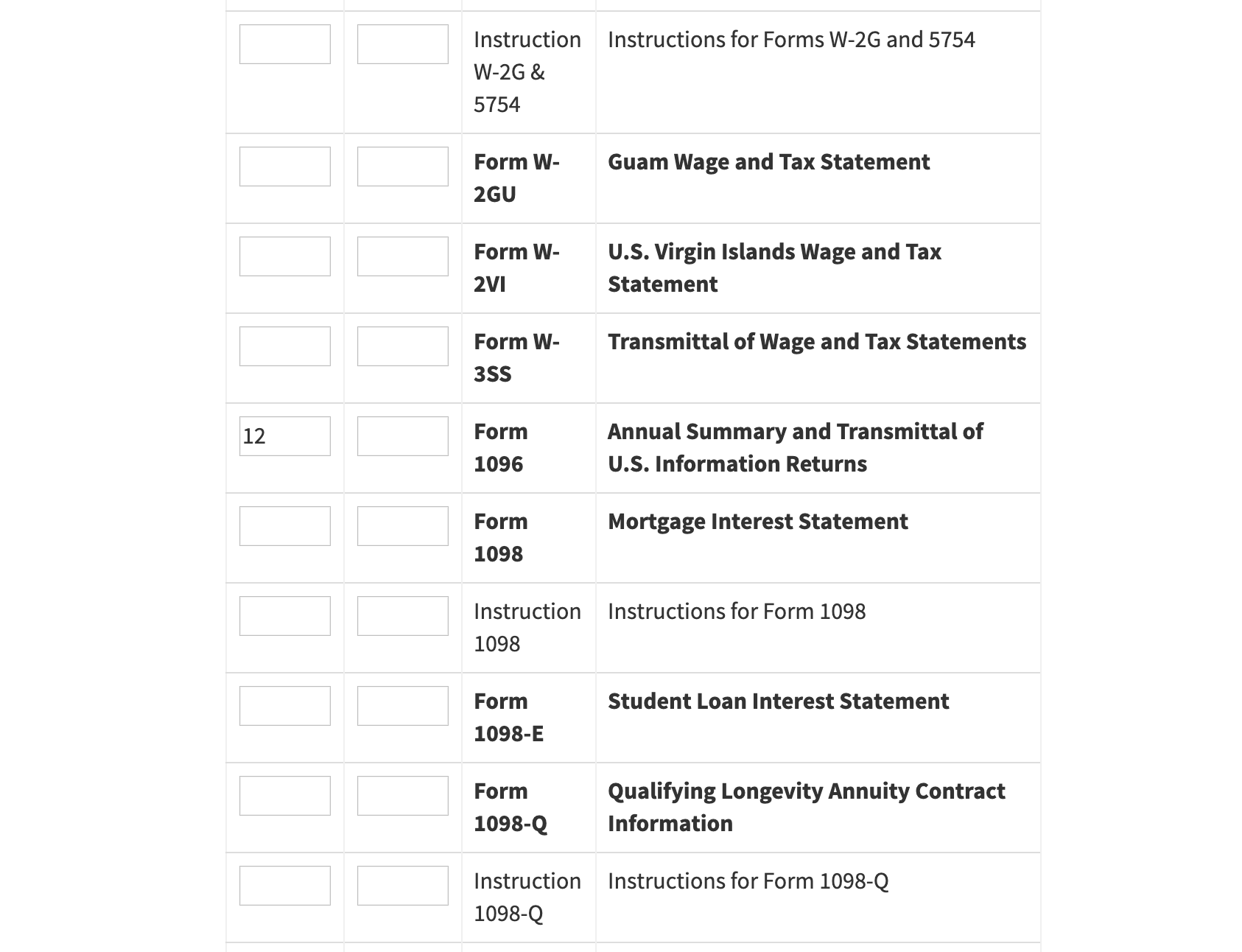

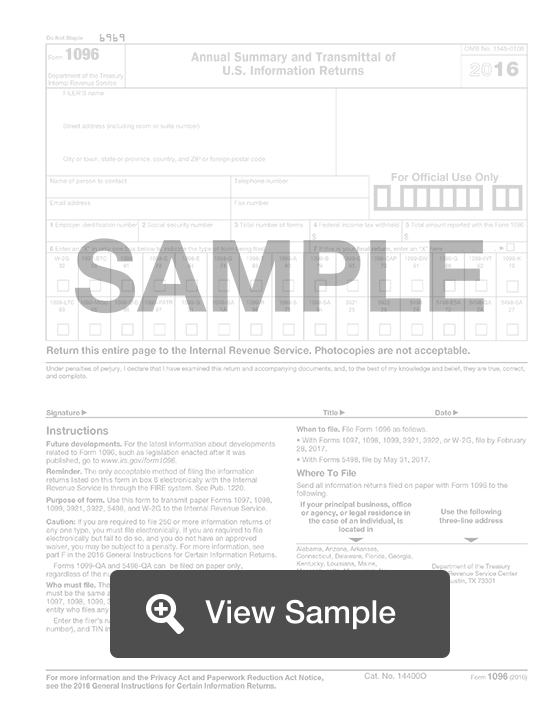

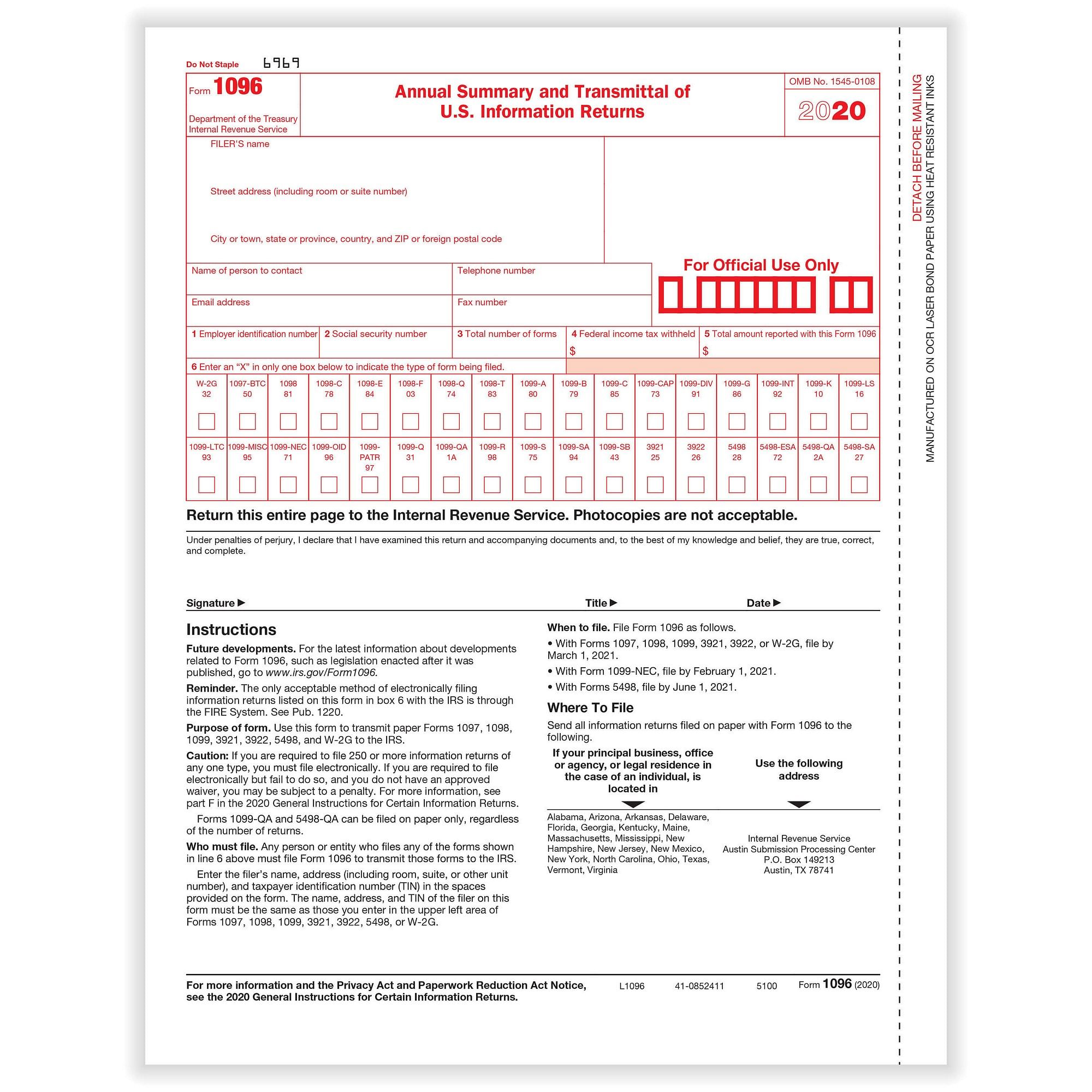

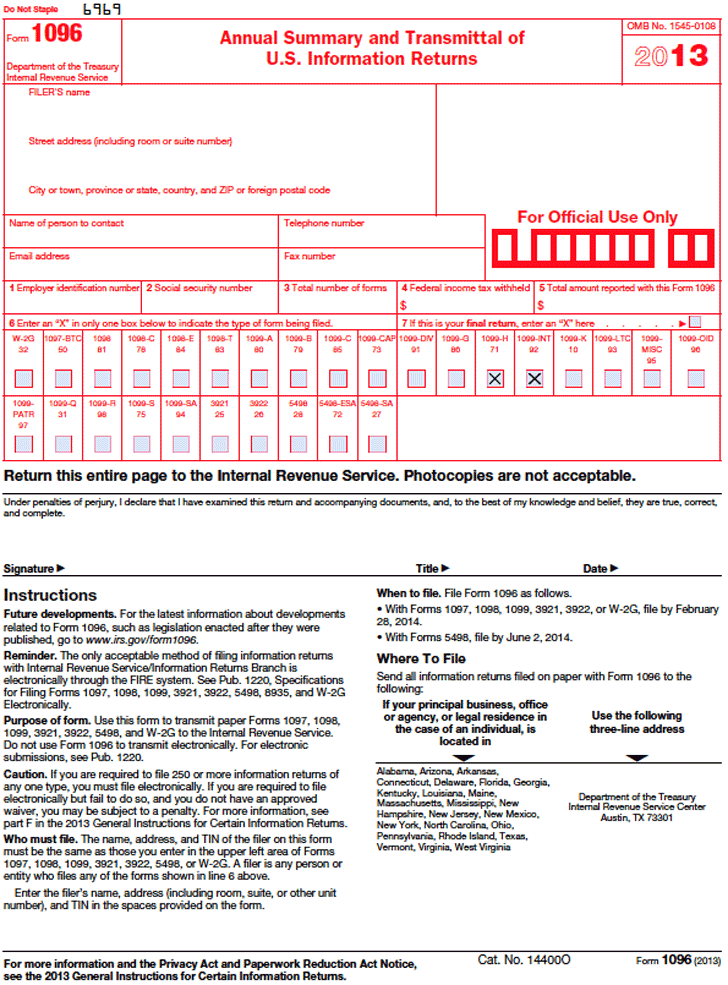

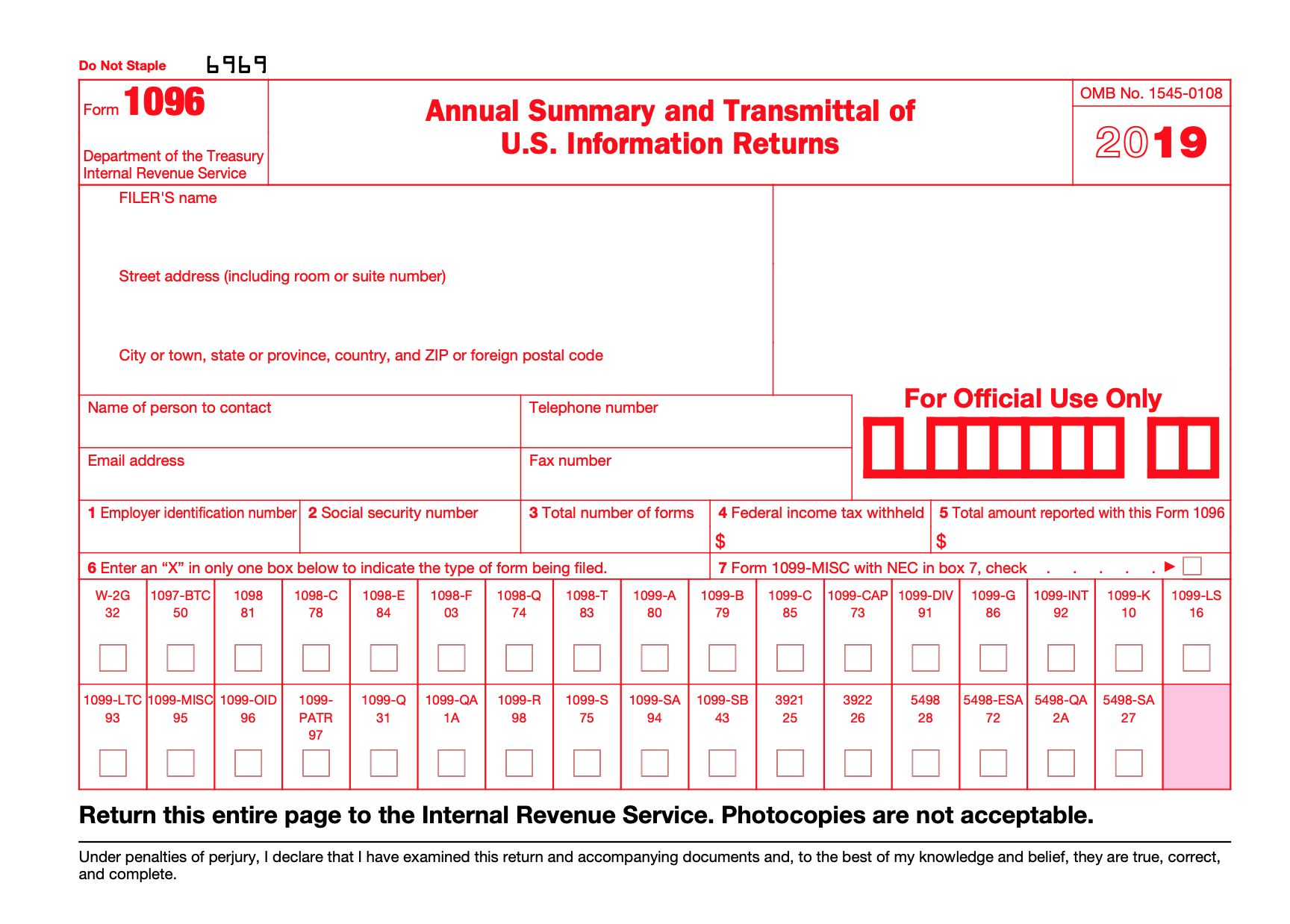

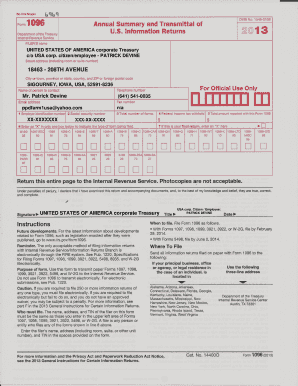

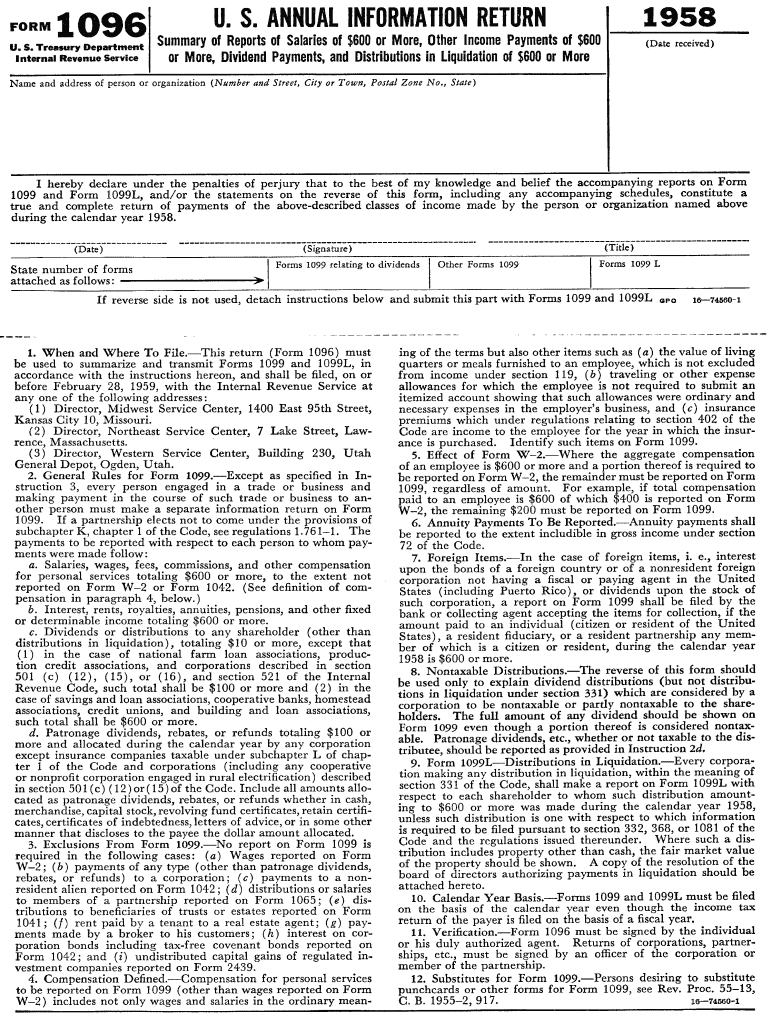

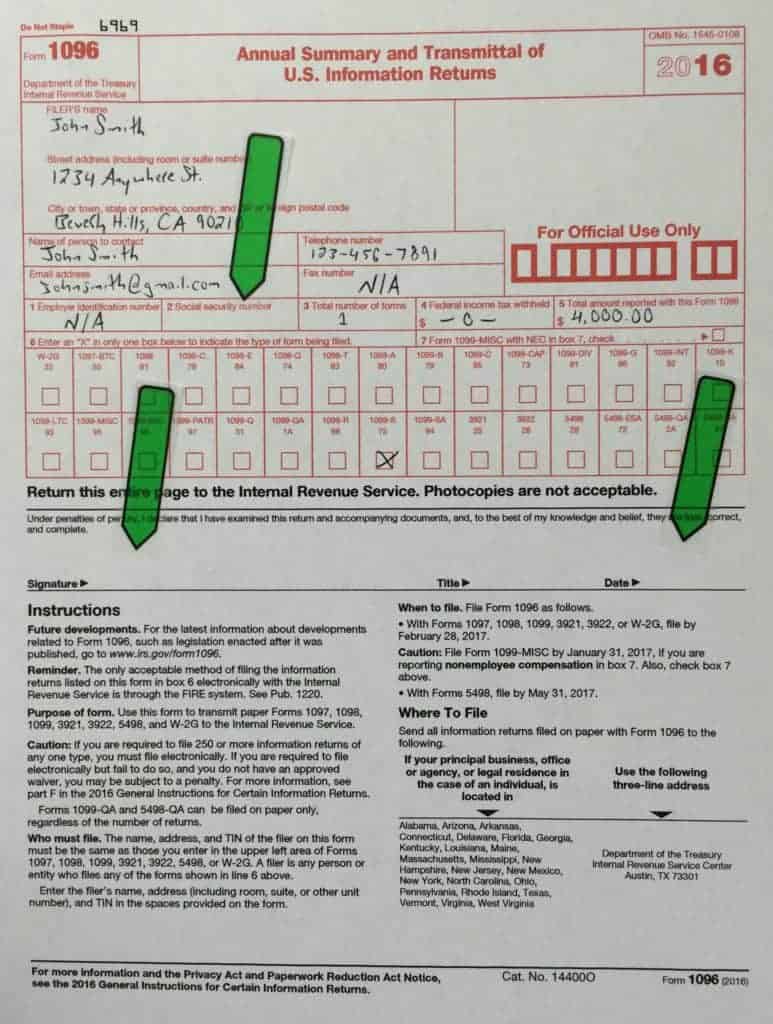

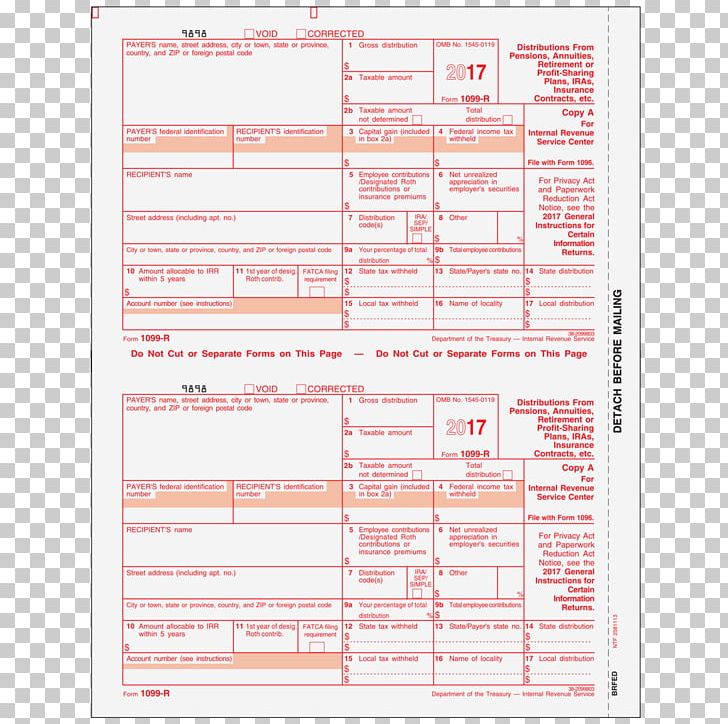

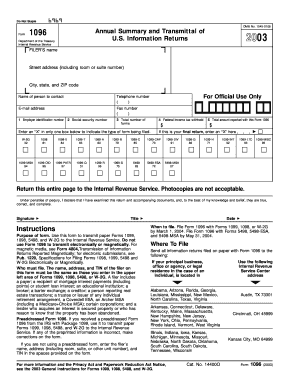

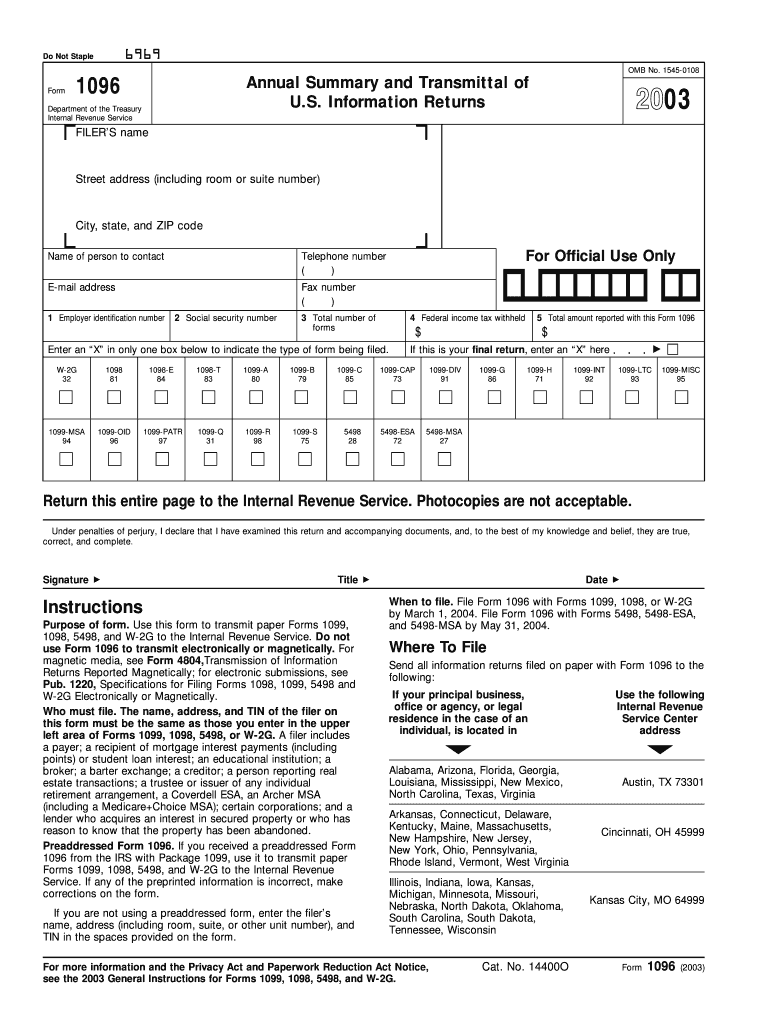

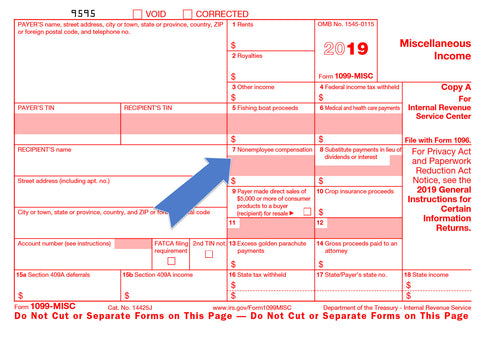

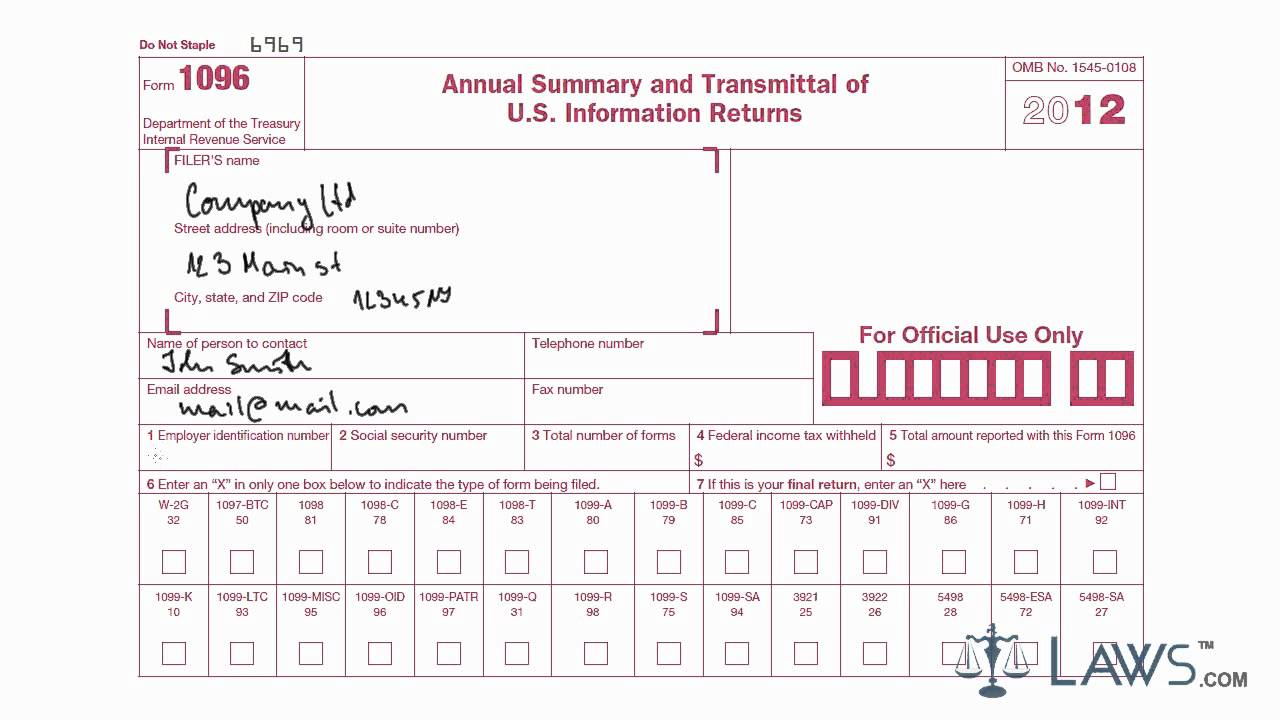

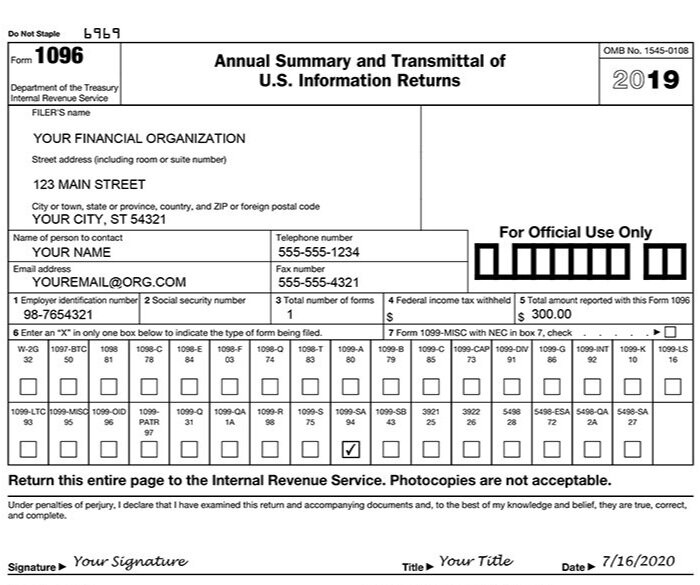

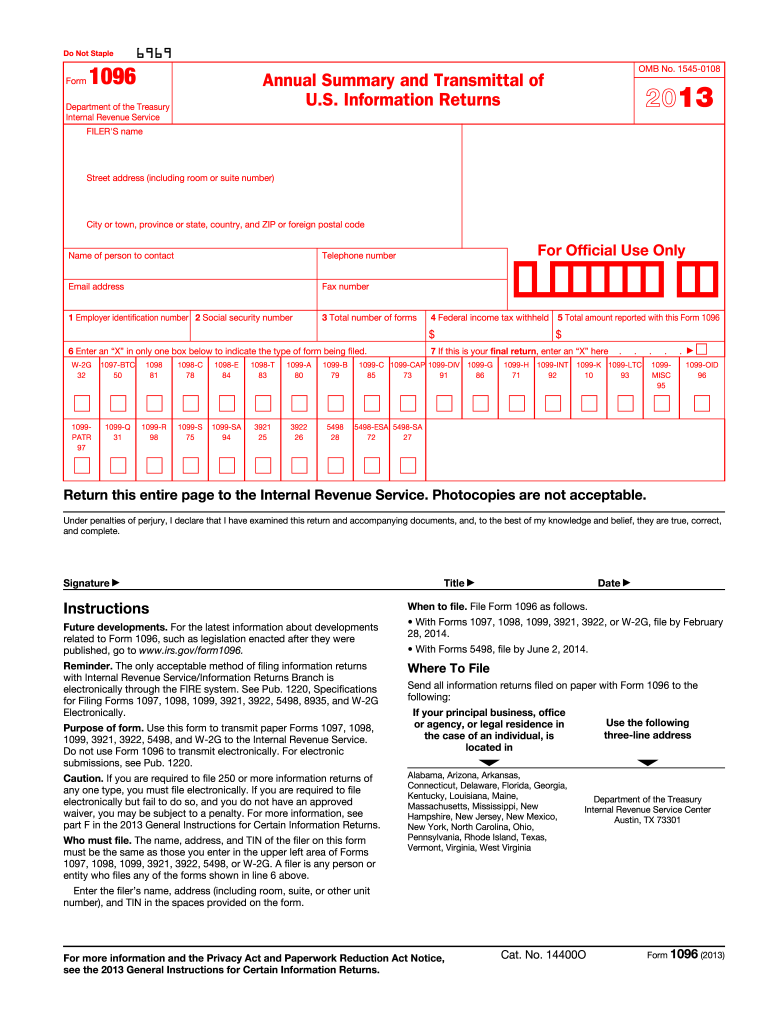

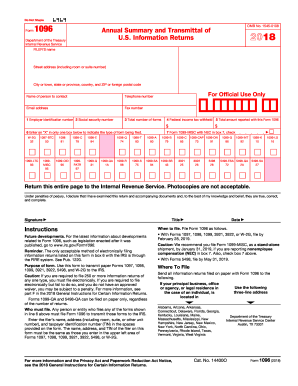

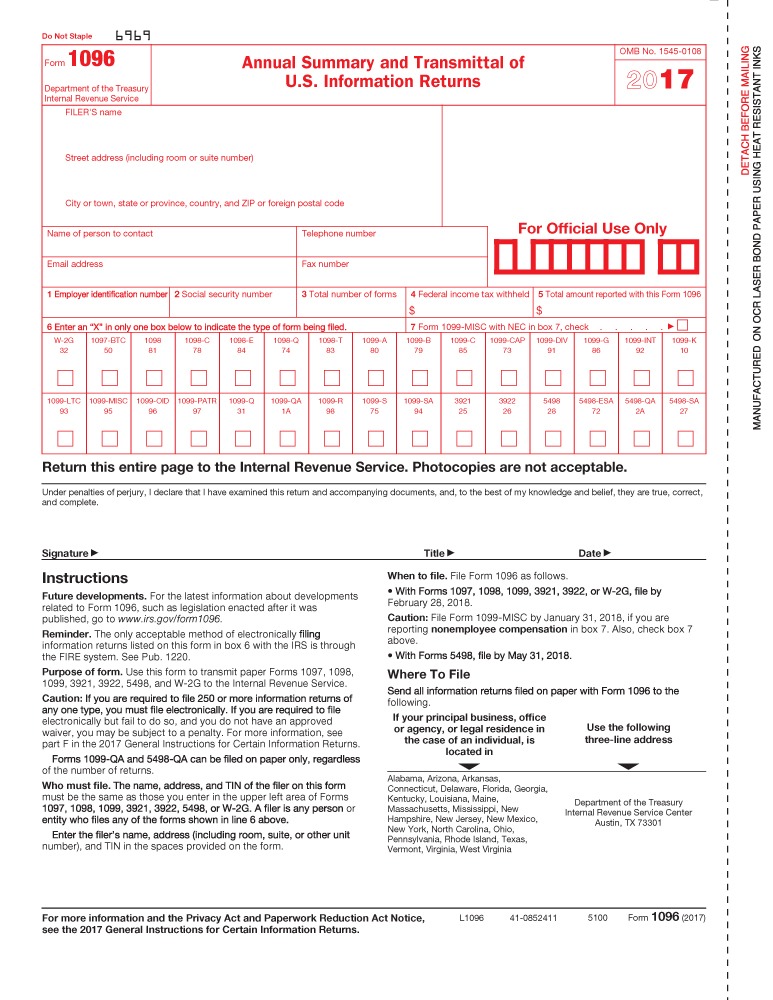

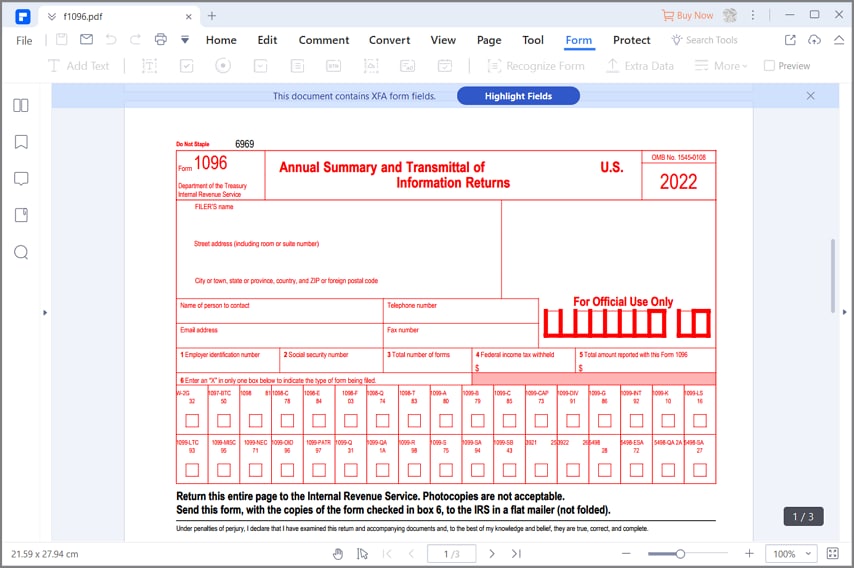

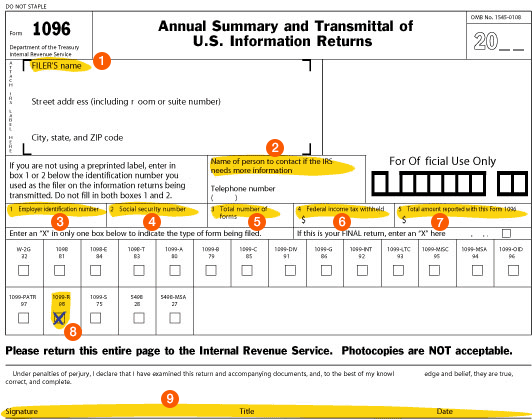

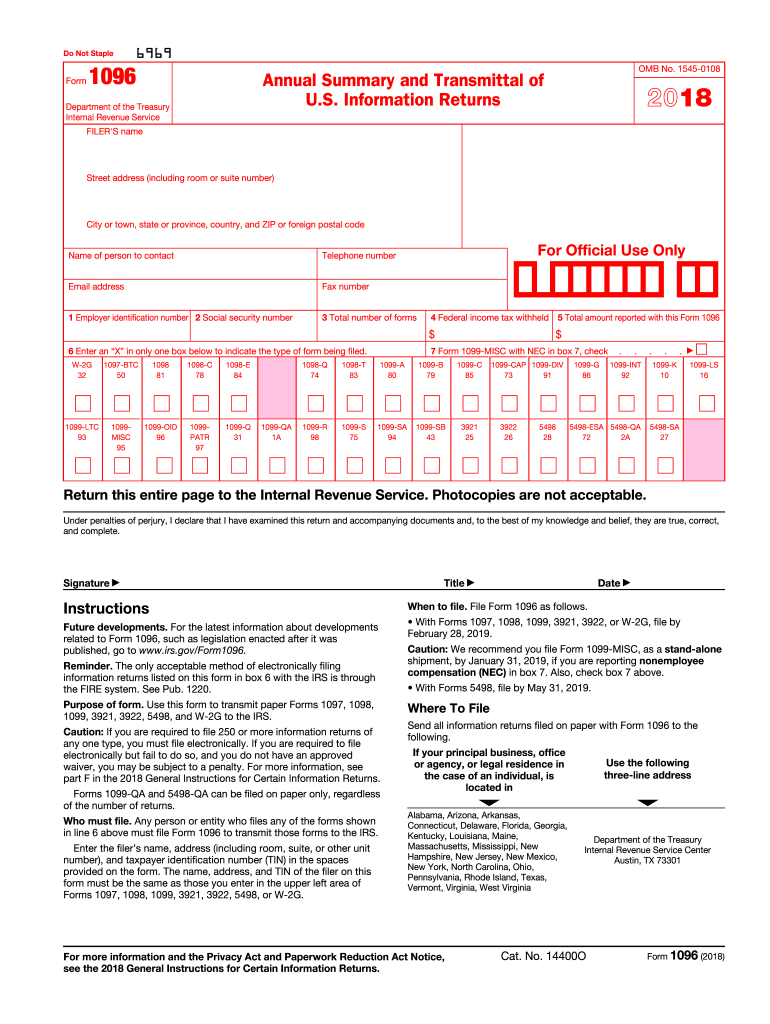

Form 1096. A separate Form 1096 must be used for each type of form the organization submits For example, one Form 1096 is prepared for an organization’s 1099s and another 1096 is prepared for their W2Gs Due Date The due date is included in the directions for the form An organization filing tax year 09 Forms 1098, 1099, 3921, 3922, or W2G are due. Any person or entity who files any of the forms shown in line 6 above must file Form 1096 to transmit those forms to the IRS Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (TIN) in the spaces provided on the form. The IRS site says you must use the "red Shaded" 1096 form for them to be able to scan it Does the 1096 printed in Turbo Tax for Home and Business work or does it have to be printed on the Red Shaded form If so, where can you print the Turbo Tax information on the IRS form 1096.

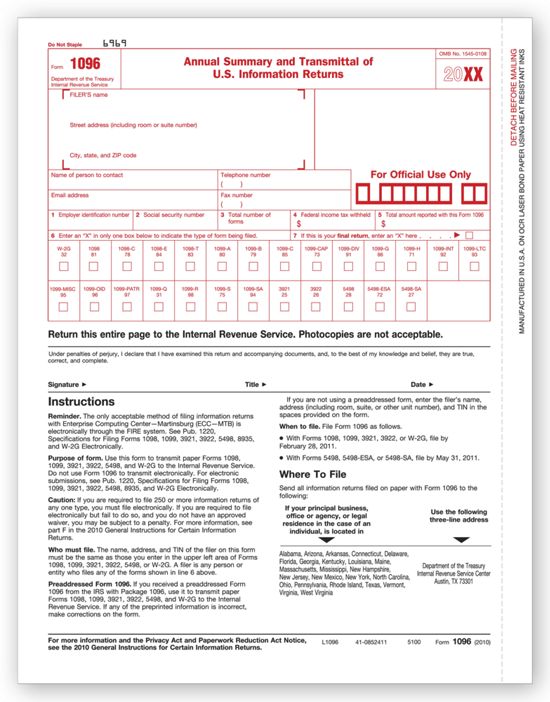

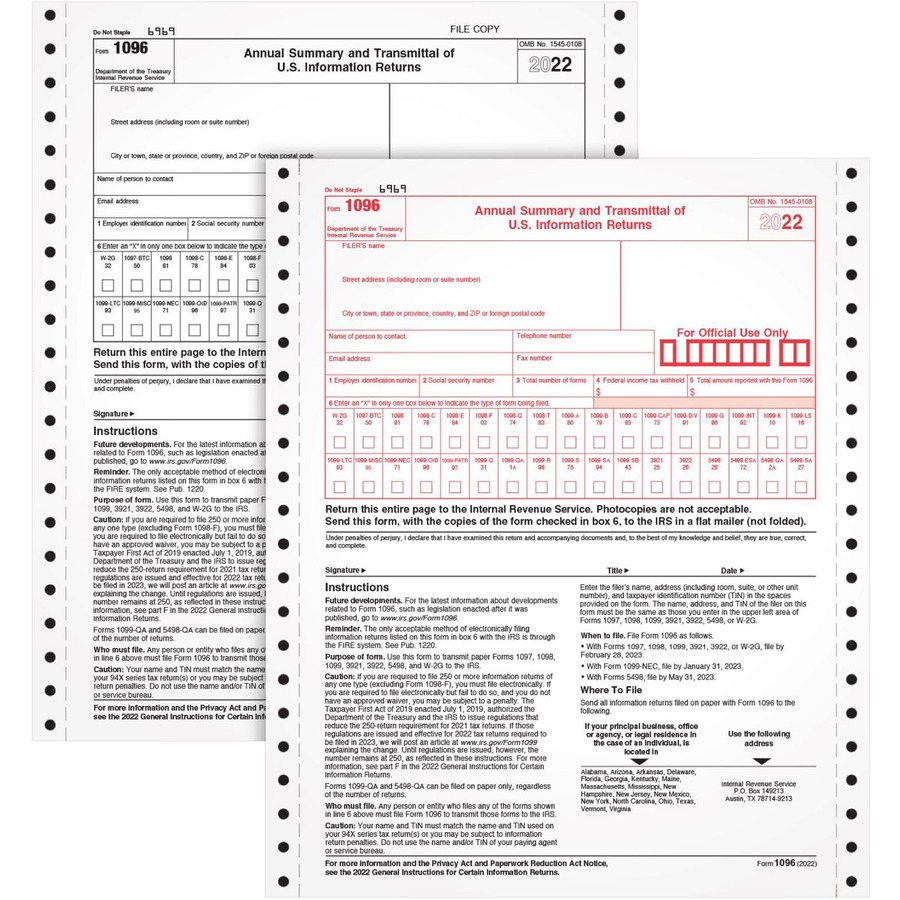

Helps you transmit paper forms 1098, 1099, 3921, 3922, 5498 and W2G to the IRS Acidfree paper with heatresistant ink for use with laser printers Comes with transmittal forms to help you show the totals of the information returns you have mailed to the IRS Back to Menu. The 1096 form is required whenever you submit paper 1099 forms When you mail 1099s to the IRS, you must group them together and attach a separate 1096 for each group of 1099s Because the 1096 is a special machinereadable form, it should always be printed on preprinted rather than plainpaper forms. The totals from the 1099 forms are shown in the IRS 1096 Form This is a compilation/summary return which have to be forwarded to the Internal Revenue Service along with one of 1099 papersThe document has to be submitted separately for every type of information return you have provided to a recipient.

Helps you transmit paper forms 1098, 1099, 3921, 3922, 5498 and W2G to the IRS Acidfree paper with heatresistant ink for use with laser printers Comes with transmittal forms to help you show the totals of the information returns you have mailed to the IRS Back to Menu. Form 1096, or Annual Summary and Transmittal of information Returns, is a summary return, which shows the totals from information returns and must be submitted to the IRS along with these returns, such as forms 1099, 1098, 3921, 3922, 5496 and W4G Form 1096 includes information specific to the employer as well as information specific to the. Form 1096 is a cover sheet used to mail forms for reporting nonemployee income to the IRS If you’re a small business, odds are you’ll mainly be using it to submit Form 1099, the form you use to tell the IRS whenever you’ve paid an independent contractor more than $600 in a financial year.

Form 1096, or Annual Summary and Transmittal of information Returns, is a summary return, which shows the totals from information returns and must be submitted to the IRS along with these returns, such as forms 1099, 1098, 3921, 3922, 5496 and W4G Form 1096 includes information specific to the employer as well as information specific to the. Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) 11/25/ Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) 01/22/21. Helps you transmit paper forms 1098, 1099, 3921, 3922, 5498 and W2G to the IRS Acidfree paper with heatresistant ink for use with laser printers Comes with transmittal forms to help you show the totals of the information returns you have mailed to the IRS Back to Menu.

Form 1096 is a coversheet, so you must indicate the type of form you are filing, by entering an X in the appropriate box Only one form may be filed with the Form 1096, meaning you may end up filing several Forms 1096 For example, if you file Form 1098 and Form 1099K, you'll need two copies of Form 1096. Choose the 1096 form If everything looks good, select Yes, looks good!. Because IRS Form 1096 is a cover letter that simply reports how many of a particular form you’re filing, mistakes on the form itself are pretty rare Simple math errors on the cover sheet may get corrected—or simply ignored—by the IRS Again, Form 1096 is more of a cover letter than its own.

With QuickBooks, you can easily efile your 1096's form along with your 1099's instead of filing manually However, once you've filed the form, it’ll go along with the IRS To print your 1096’s, you’ll need to contact the IRS and get a copy from there. Because IRS Form 1096 is a cover letter that simply reports how many of a particular form you’re filing, mistakes on the form itself are pretty rare Simple math errors on the cover sheet may get corrected—or simply ignored—by the IRS Again, Form 1096 is more of a cover letter than its own. Visit http//legalformslawscom/tax/form1096annualsummaryandtransmittalofusinformationreturnTo download the Form 1096 in printable format and to.

WORD Template for IRS Form 1096 I am looking for either a WORD or Excel template to complete IRS Form 1096 Does anyone have a template they have created I would be most appreciative Thank you This thread is locked You can follow the question or vote as helpful, but you cannot reply to this thread. Form MO96 Enter the total number of Federal 1099MISC forms if substituted for the Missouri Form MO99 Misc _____ Mail to Taxation Division Phone (573) PO Box 3330 Fax (573) Jefferson City, MO Email income@dormogov Form MO96 (Revised 0317) Missouri Department of Revenue. Or can we just paper clip 1096 form on top of 1099s it belongs to and mail multiple in same envelope?.

Form 1096, or Annual Summary and Transmittal of information Returns, is a summary return, which shows the totals from information returns and must be submitted to the IRS along with these returns, such as forms 1099, 1098, 3921, 3922, 5496 and W4G Form 1096 includes information specific to the employer as well as information specific to the. When tax season is upon you, you'll be glad you have these 1096 transmittal forms at your disposal The forms are designed to help you transmit paper forms 1098, 1099, 3921, 3922, 5498 and W2G Allows you to transmit paper forms 1098, 1099, 3921, 3922, 5498 and W2G For reporting an annual summary and transmittal of US information returns. This form will be used by the United States Internal Revenue Service for tax filing purposes A Form 1096 is also known as an Annual Summary and Transmittal of US Information Returns Taxexempt organizations will use this form to transmit various forms to the IRS These forms could be a 1099, 1098, 5498, or a W2G.

Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) 11/25/ Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) 01/22/21. What Is form 1096?. In addition, you have a Print Final icon which you use to print your forms and the Next Step button to proceed to the next set of reports Here is an example of the process for the Federal 1096 form Here is an example of the process for the Federal 1096 form.

What is Form 1096?. A Form 1096 (Appendix D) is the summary coversheet that must be submitted along with your paper 1099 Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2G to the. Form 1096 is a one page summary of information forms being sent to the IRS Think of IRS Form 1096 as a cover page to all other 1099 forms being filed What to Report?.

IRS Form 1096 is used to summarize the information return forms being filed to the IRS You must use a different Form 1096 for each type of 1099 form that you’re filing (ie, one for 1099MISC, 1099INT, 1099DIV, 1099B, 1099R, 1099S, etc) Form 1096 is not required when efiling, however when you efile 1099 Forms with ExpressIRSForms, we’ll provide a 1096 Form. Or can we just paper clip 1096 form on top of 1099s it belongs to and mail multiple in same envelope?. About Form 1096, Annual Summary and Transmittal of US Information Returns Use Form 1096 to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2G to the Internal Revenue Service Do not use this form to transmit electronically.

WORD Template for IRS Form 1096 I am looking for either a WORD or Excel template to complete IRS Form 1096 Does anyone have a template they have created I would be most appreciative Thank you This thread is locked You can follow the question or vote as helpful, but you cannot reply to this thread. What Is form 1096?. A separate Form 1096 must be used for each type of form the organization submits For example, one Form 1096 is prepared for an organization’s 1099s and another 1096 is prepared for their W2Gs Due Date The due date is included in the directions for the form An organization filing tax year 09 Forms 1098, 1099, 3921, 3922, or W2G are due.

For example, if you send one page of threetoapage Forms 1098E with a Form 1096 and you have correctly completed two Forms 1098E on that page, enter "2" in box 3 of Form 1096 Box 4 top Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096. Forms Revised PS Form 1096, Customer Receipt Effective November 19, 09, PS Form 1096, Customer Receipt, is revised for use by rural carriers and highway contract routes only The October 09 edition of this form replaces the April 1998 edition. A Form 1096 (Appendix D) is the summary coversheet that must be submitted along with your paper 1099 Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2G to the.

Then select Print on a 1096 Form If the form needs to be aligned, select No, it doesn't line up and select Next Then reselect the 1096 form, and select Print on a 1096 Form Do you need 1099 and 1096 forms?. You need one 1096 for each type of information form you have issued If, for example, you submit a 1099MISC and a 1099S, complete one Form 1096 to transmit with the 1099MISC. What about Correcting IRS Form 1096 Itself?.

Quote Casey Stokes (@Casey Stokes) Joined 1 year ago Posts 21 21/01/ 402 pm I have always just paper clipped each client's together, and sent all in one big envelope Reply. Forms Revised PS Form 1096, Customer Receipt Effective November 19, 09, PS Form 1096, Customer Receipt, is revised for use by rural carriers and highway contract routes only The October 09 edition of this form replaces the April 1998 edition. Then select Print on a 1096 Form If the form needs to be aligned, select No, it doesn't line up and select Next Then reselect the 1096 form, and select Print on a 1096 Form Do you need 1099 and 1096 forms?.

What is a Form 1096?. What Is 1096 form?. Fast Tax Reference Guide 17 4 pages, 227 KB, 02/16/18 Reference sheet with Hawaii tax schedule and credits Outline of the Hawaii Tax System as of July 1, 4 pages, 61 KB, 11/19/ A summary of state taxes including information on tax rates, forms that must be filed, and when taxes must be paid.

Adams 1096 Forms , Summary Forms for IRS Information Returns, 1 Part Inkjet/Laser Forms, per Pack (TXA1096), White, 81/2 x 11 45 out of 5 stars 55 $999 $ 9 99. IRS Form 1096, Annual Summary and Transmittal of US Information Returns, is filed with Forms 1099, 1098, 3921, 3922, 5496 and W4G It is simply a summary of the forms that accompany it Form 1096 includes information specific to the employer as well as information specific to the forms being filed. IRS Form 1096 is titled as Annual Summary and Transmittal of US Information Returns it is circulated and regulated by the Internal Revenue Service of United States of America You can effortlessly fill up IRS Form 1096 using PDFelement, which is the most recommended tool by any advanced level user.

Help us improve our tax forms Send us your tax form improvement suggestions You are leaving ftbcagov We do not control the destination site and cannot accept any responsibility for its contents, links, or offers Review the site's security and confidentiality statements before using the site. For example, if you send one page of threetoapage Forms 1098E with a Form 1096 and you have correctly completed two Forms 1098E on that page, enter "2" in box 3 of Form 1096 Box 4 top Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096. This form will be used by the United States Internal Revenue Service for tax filing purposes A Form 1096 is also known as an Annual Summary and Transmittal of US Information Returns Taxexempt organizations will use this form to transmit various forms to the IRS These forms could be a 1099, 1098, 5498, or a W2G.

Help us improve our tax forms Send us your tax form improvement suggestions You are leaving ftbcagov We do not control the destination site and cannot accept any responsibility for its contents, links, or offers Review the site's security and confidentiality statements before using the site. Quote Casey Stokes (@Casey Stokes) Joined 1 year ago Posts 21 21/01/ 402 pm I have always just paper clipped each client's together, and sent all in one big envelope Reply. Go to Intuit Market to get these and other tax products designed.

WORD Template for IRS Form 1096 I am looking for either a WORD or Excel template to complete IRS Form 1096 Does anyone have a template they have created I would be most appreciative Thank you This thread is locked You can follow the question or vote as helpful, but you cannot reply to this thread. Visit http//legalformslawscom/tax/form1096annualsummaryandtransmittalofusinformationreturnTo download the Form 1096 in printable format and to. What about Correcting IRS Form 1096 Itself?.

More electronic filing—now you can efile the 1098 in addition to the new 1099 NEC, 1099 MISC, 1099 DIV, 1099 INT and W2;. What is Form 1096?. Form 1096, Annual Summary and Transmittal of US Information Returns, is a document that summarizes information returns you file with the IRS, such as Forms 1099MISC and 1099NEC.

Form 1096 Annual Summary and Transmittal of US Information Returns Use this laser Form 1096 to summarize all 1099, 1098, 5498, and W2G information for the IRS You must complete one 1096 form for each payer 1096 Forms are 8 1/2 x 11" with a 1/2" side perforation and are printed with required red scannable ink. Choose the 1096 form If everything looks good, select Yes, looks good!. Forms Revised PS Form 1096, Customer Receipt Effective November 19, 09, PS Form 1096, Customer Receipt, is revised for use by rural carriers and highway contract routes only The October 09 edition of this form replaces the April 1998 edition.

Form 1096 is a coversheet, so you must indicate the type of form you are filing, by entering an X in the appropriate box Only one form may be filed with the Form 1096, meaning you may end up filing several Forms 1096 For example, if you file Form 1098 and Form 1099K, you'll need two copies of Form 1096. IRS Form 1096 is titled as Annual Summary and Transmittal of US Information Returns it is circulated and regulated by the Internal Revenue Service of United States of America You can effortlessly fill up IRS Form 1096 using PDFelement, which is the most recommended tool by any advanced level user. Smaller & bigger bundles—get just the right number of efiles with new 5, , 50 or 100 efile bundles;.

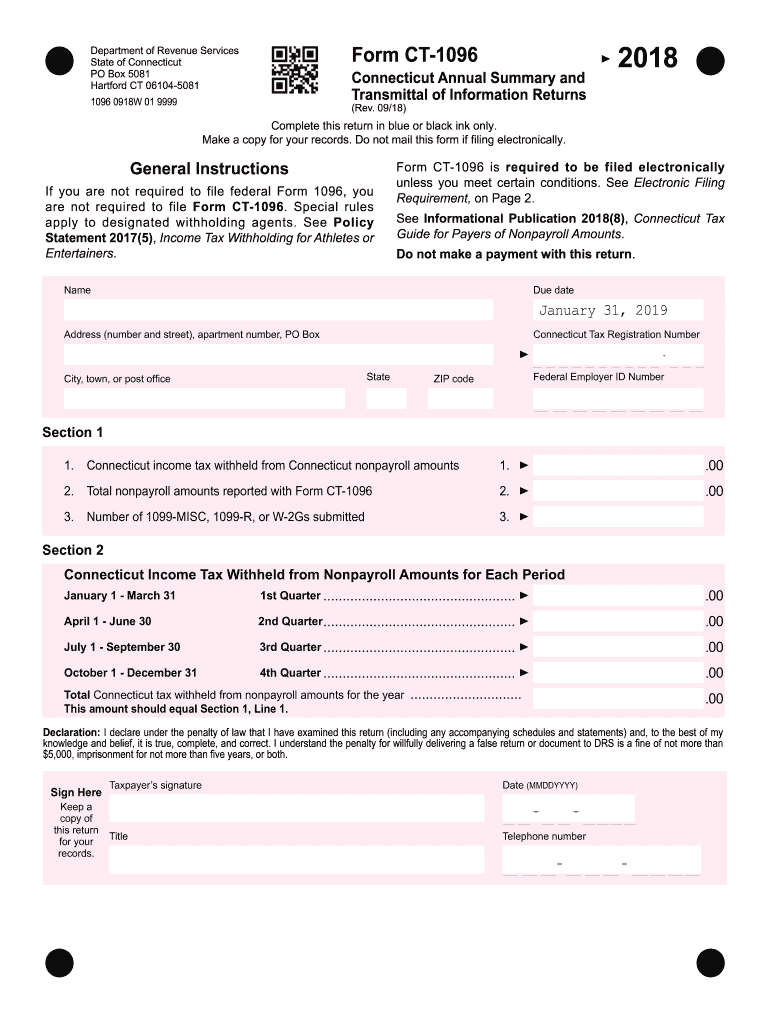

Fast Tax Reference Guide 17 4 pages, 227 KB, 02/16/18 Reference sheet with Hawaii tax schedule and credits Outline of the Hawaii Tax System as of July 1, 4 pages, 61 KB, 11/19/ A summary of state taxes including information on tax rates, forms that must be filed, and when taxes must be paid. IRS Form 1096 is a summary and transmittal tax form that gives the IRS information on the Forms 1097, 1098, 1099, 3921, 3922, 5498, or W2G your company sent out to other recipients It is used only when submitting those forms to the IRS in a paper format It should not be used when transmitting those forms electronically. Form 1096/1099 In Lieu of Alabama Form 99 and Form 96, please submit a copy of the Federal Form 1096/1099 Please see mailing link below Form 1099K Per Act Payment Settlement Entities (PSE) are now required to file Form 1099K with the Alabama Department of Revenue for payees with an Alabama address Form 1099NEC Nonemployee.

IRS Form 1096 is a summary or transmittal return that shows the totals of all 1099MISC Forms submitted to the IRS You, the employer, will need to submit a separate 1096 for each type of 1099 series return you transmit. IRS Form 1096 is a summary or transmittal return that shows the totals of all 1099MISC Forms submitted to the IRS You, the employer, will need to submit a separate 1096 for each type of 1099 series return you transmit. Form 1096 is a coversheet, so you must indicate the type of form you are filing, by entering an X in the appropriate box Only one form may be filed with the Form 1096, meaning you may end up filing several Forms 1096 For example, if you file Form 1098 and Form 1099K, you'll need two copies of Form 1096.

What is a Form 1096?. Smart Imports—pull data from last year’s 1099MISC, and Tax Forms Helper will enter it into the appropriate 1099NEC, 1099MISC (or both forms) for. Online technologies allow you to to arrange your document management and strengthen the efficiency of your workflow Look through the short guideline so as to complete IRS 1096 form?, prevent errors and furnish it in a timely manner How to fill out a editable 19 form 1096?.

If printing form 1096, you can pick Print 1096s instead, Confirm your printer settings then click Print For more information about printing 1099 forms, check out this link Additionally, you can visit our page for the available preprinted 1096 forms. If you are filing paper returns with us, attach the returns to IRS Form 1096 and mail to the following address Mail Franchise Tax Board PO Box Sacramento, CA Top electronic filing errors 1099NEC – Must be submitted via paper or electronically to FTB regardless if you sent it to IRS.

Amazon Com Egp Irs Approved 1096 Laser Transmittal Summary Tax Form Quantity 10 Forms Office Products

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Www Irs Gov Pub Irs Pdf I1099gi Pdf

Irs Tax Form 1096 Annual Summary And Transmittal For 1099 S To Irs Ebay

Amazon Com Irs Regulated 1096 Tax Forms Package Of 5 Forms Office Products

What Is Irs Form 1096 Everything You Need To Know

1096 Transmittal Form 16 Vincegray14

1096 Form 21 1099 Forms Zrivo

1096 Form Printable Template W2 Forms Printable Job Applications Template Printable

Form 1096 A Simple Guide Bench Accounting

1096 Form 21 1099 Forms

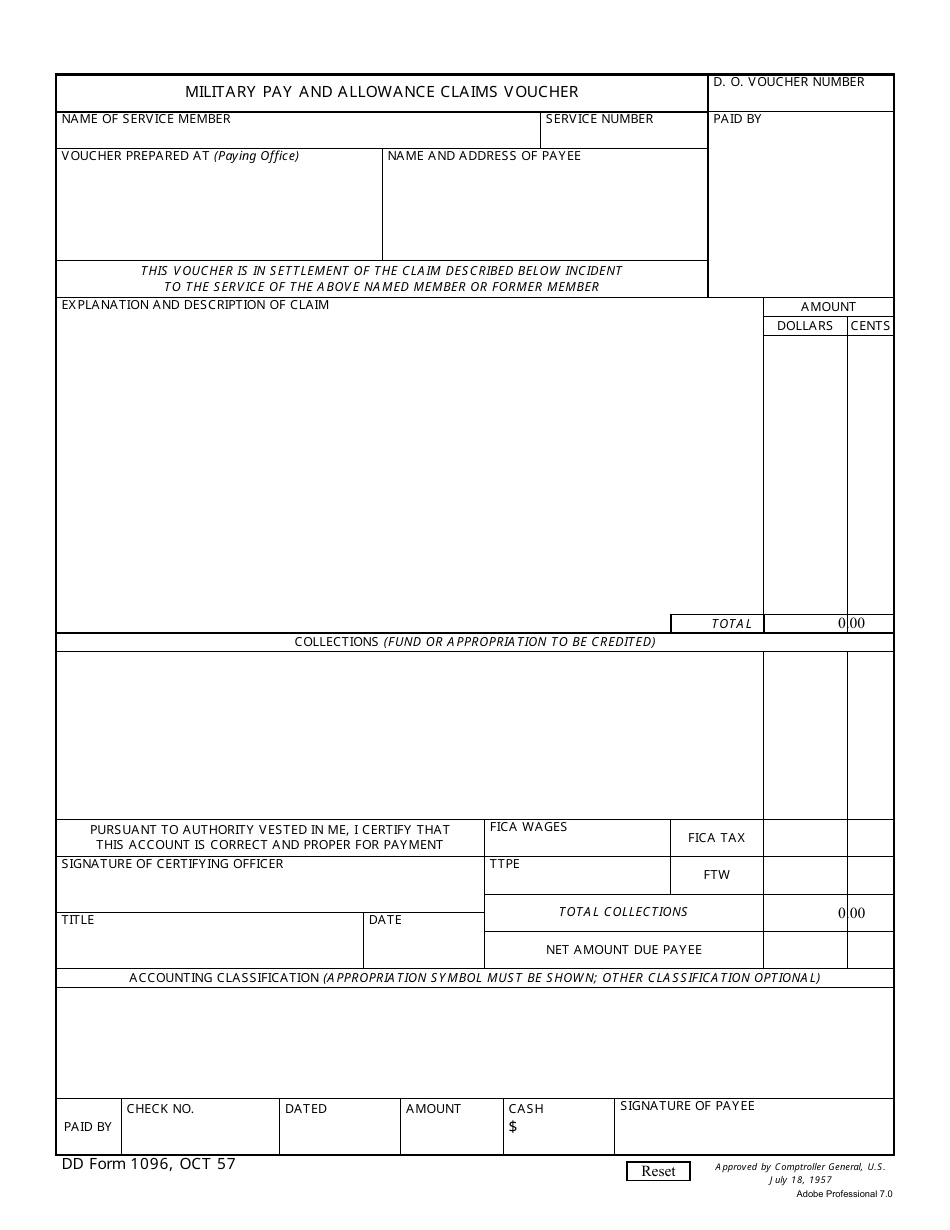

Dd Form 1096 Download Fillable Pdf Or Fill Online Military Pay And Allowance Claim Voucher Templateroller

Amazon Com Irs Approved 1096 Laser Transmittal Summary Red Form 5 Pack Other Products Office Products

Form 1099 Requirements Deadlines And Penalties Efile360

Form 1096 Misc Pdf Do Not Staple Form 6969 1096 Omb No 1545 0108 Annual Summary And Transmittal Of U S Information Returns Department Of The Course Hero

1096 Form 1096 Tax Form Printing In Quickbooks Intuit

1

Irs Form 1096 Annual Summary Of Information Returns Pdf Formswift

1096 Annual Summary Transmittal Cut Sheet 500 Forms Ctn

Form 1096 Home Facebook

Form 1096 Transmittal

2 Sheets 4 Recipients 1 Form 1096 16 Irs Tax Form 1099 Misc Carbonless

1096 Template Free Template Download Customize And Print

Form 1096 Png Images Pngwing

1096 Tax Form Annual Summary Transmittal Costco Checks

W 2 1099 Forms Filer Transfer 1099 Information To The 1096 Form Youtube

1099 Misc 14

Business Industrial Forms Record Keeping 14 Irs Tax Form 1096 Annual Summary And Transmittal For 1099 S To Irs Studio In Fine Fr

10 Pack 19 Tax Form 1096 Annual Transmittals Only For 1099 Misc To Irs Ebay

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

10 Pack 18 Tax Form 1096 Annual Transmittals Only For 1099 Misc To Irs Ebay

What You Need To Know About 1096 Forms Blue Summit Supplies

Q Tbn And9gcrtdsklrckv5gfdgvcj4fouj5d Munebguz8bq2 D3 Toc8qhel Usqp Cau

1096 Form 1099 Forms

Forms 1099 And Form 1096 By Noel D Tallon Cpa Youtube

18 Irs 1096 Transmittal Form

Dd 1096 Cavalacafe Com

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

Fillable Online Usa Corporate Form 1096 Example Pdf Fax Email Print Pdffiller

Laser 1096 Transmittal Form

Irs 1096 Form Pdffiller

Tops 1096 Tax Form Office Microsystems

Form 1096 1958 Irs Fill Out And Sign Printable Pdf Template Signnow

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Business Industrial Forms Record Keeping Supplies For 1099 S To Irs 18 Irs Tax Form 1096 Annual Summary And Transmittal Studio In Fine Fr

Tangible Values 1099 Misc Laser Forms 18 Kit With Env For 25 Vendors 3 Form 1096 S 4 Part Tax Forms

Form 1096 21

Paper Form 1099 Misc Form 1096 Irs Tax Forms Png Clipart Area Contractor Form 1096 Form

Fillable Online Form 1096 For 03 Fax Email Print Pdffiller

Egp Irs Approved 1096 Laser Transmittal Summary Form 5 Pack Buy Online In Burundi At Burundi Desertcart Com Productid

Amazon Com 1096 Transmittal Summary Tax Form 19 25 Pack Office Products

Pdf Form 1096 For Irs Sign Income Tax Eform Google Play 應用程式

2 Sheets 4 Recipients 1 Form 1096 16 Irs Tax Form 1099 Misc Carbonless

Pdf Form 1096 For Irs Sign Income Tax Eform Pour Android Telechargez L Apk

2 Sheets 4 Recipients 1 Form 1096 16 Irs Tax Form 1099 Misc Carbonless

Form 1096 Transmittal Of Forms 1098 1099 5498 And W 2g To The Irs

Form 1096 Fill Out And Sign Printable Pdf Template Signnow

Who Are Independent Contractors And How Can I Get 1099s For Free

Http Www Freedom Accounting Com Assets 16 Form 1096 Pdf

Learn How To Fill The Form 1096 Annual Summary And Transmittal Of U S Information Return Youtube

Office Depot Brand 1096 Laser Tax Forms 1 Part 8 12 X 11 Pack Of 10 Forms Office Depot

Introducing The New Form 1099 Meghan Birmingham

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

3 Three Sheets Of Irs Tax Form 1096 Annual Summary Transmittal For Year 16 Office Paper Products Office Supplies

Printable 1096 Form 19 Fill Out And Sign Printable Pdf Template Signnow

Correcting Your Hsa Reporting Two Steps Two Forms Ascensus

Www Foody

Paper Background Png Download 600 600 Free Transparent Form 1096 Png Download Cleanpng Kisspng

:max_bytes(150000):strip_icc()/IRSForm1096-60acf9a6e83d4a7fafd2d93c34777831.jpg)

Irs Form 1096 What Is It

Irs 1096 13 Fill Out Tax Template Online Us Legal Forms

1099 And 1096 Forms Open Forum

Quickbooks 1096 Forms For Copy A Transmittal Discounttaxforms Com

Form 1096 Sample Templates Statement Template Invoice Template

Irs Form 1096 Download Printable Pdf Or Fill Online Annual Summary And Transmittal Of U S Information Returns 19 Templateroller

Sale Tax Form 1096 For 7 Advantage Laser

Form 1096

Irs 1096 Form Pdffiller

Form 1096 Annual Summary And Transmittal Of U S Information Returns Info Copy Only

Calameo E File 1099 Int Interest Income File Form 1099 Int Online

Paper Form 1099 Misc Form 1096 Irs Tax Forms Form 1098t Text Income Tax Png Pngegg

Bis Forms Division

Irs Form 1096 Filling Instructions For How To Fill It Out

Pdf Form 1096 For Irs Sign Income Tax Eform Apps En Google Play

Printable 1096 Form 15 Vincegray14

Tops 22 Tops 1096 Tax Form Top22 Top 22 Office Supply Hut

Do I Need To File A Form 1096 With Irs 1099 Misc By Form1099online Com Authorized Irs E File Provider Medium

Www Irs Gov Pub Irs Pdf F1096 Pdf

1096 Annual Summary Item 5100

Q Tbn And9gcsny6bzhcrimfg T72ywhpyz4u27q Tvk4wtvddhoquc9cwndks Usqp Cau

Fillable 1096 Form Fill Online Download Free Zform

Form 1096 Instructions 401k Fedforms

2 Sheets 4 Recipients 1 Form 1096 16 Irs Tax Form 1099 Misc Carbonless

Microsoft Dynamics Gp Year End Update Payables Management Form Changes Including The New 1099 Nec Microsoft Dynamics Gp Community

1099 Software Worldsharp 1099 Software Features

1099 Printable Form 18 Fill Out And Sign Printable Pdf Template Signnow

1096 17 Pdfrun

Ezw2 Software How To Print 1096 Form For Irs

3