Form 1120

Do I Need To File A Form 11 If The Business Had No Income

Do I Need To File A Form 11 If The Business Had No Income Quora

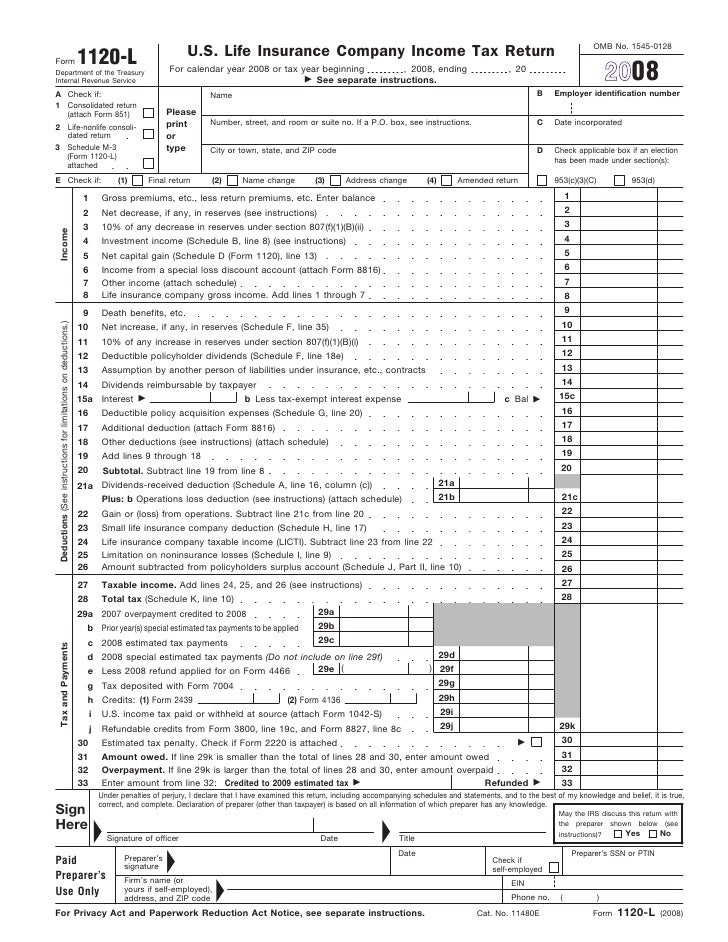

Form 11 L U S Life Insurance Company Income Tax Return

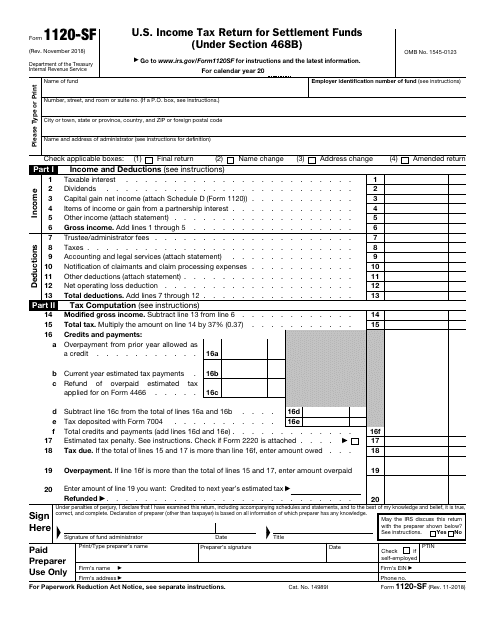

Irs Form 11 Sf Download Fillable Pdf Or Fill Online U S Income Tax Return For Settlement Funds Under Section 468b Templateroller

How To Fill Out A Self Calculating Form 11 Corporation Tax Return With Depreciation Schedule Youtube

What Is Form 11 Definition How To File More

Form 11 amended return So, what is a Form 11 amended return?.

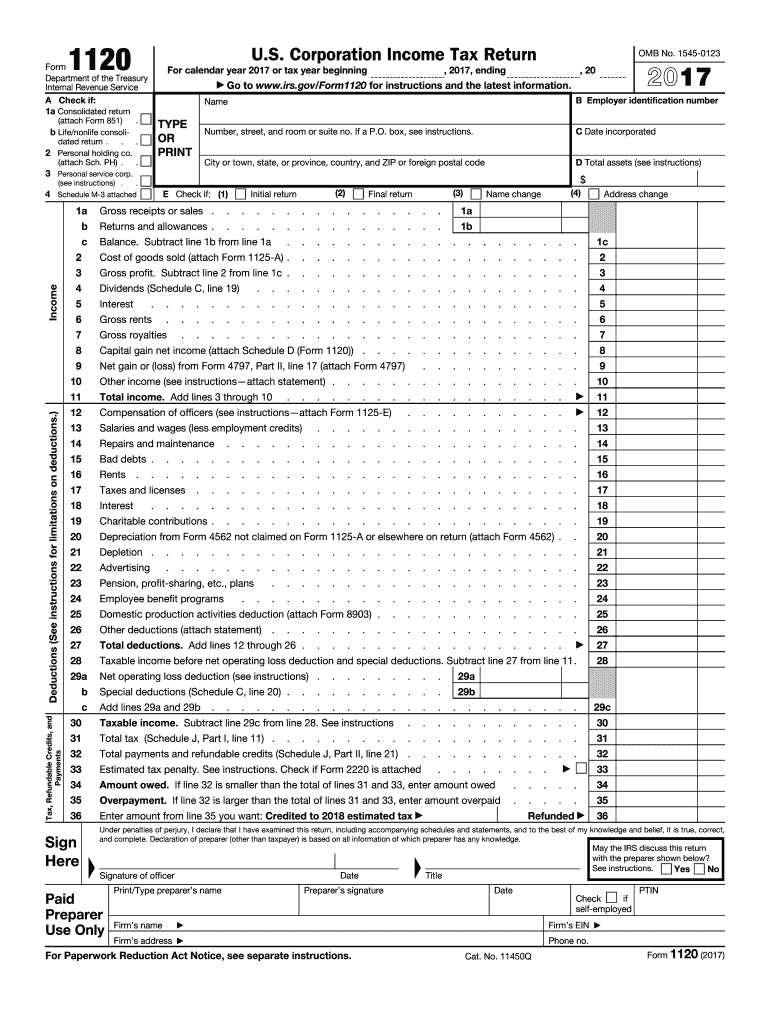

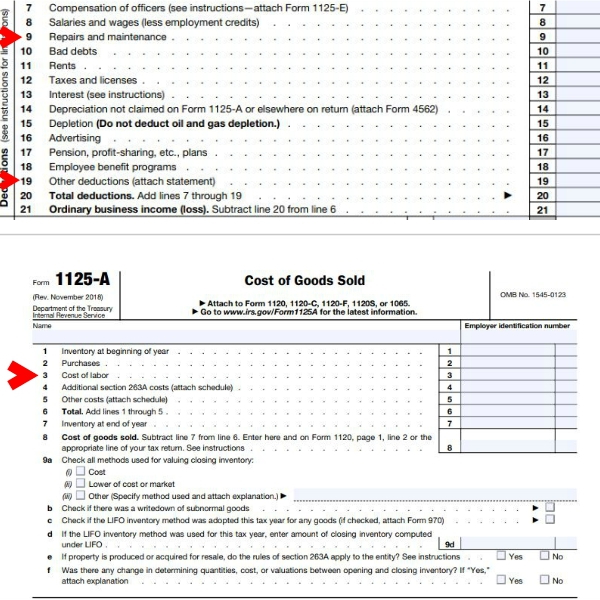

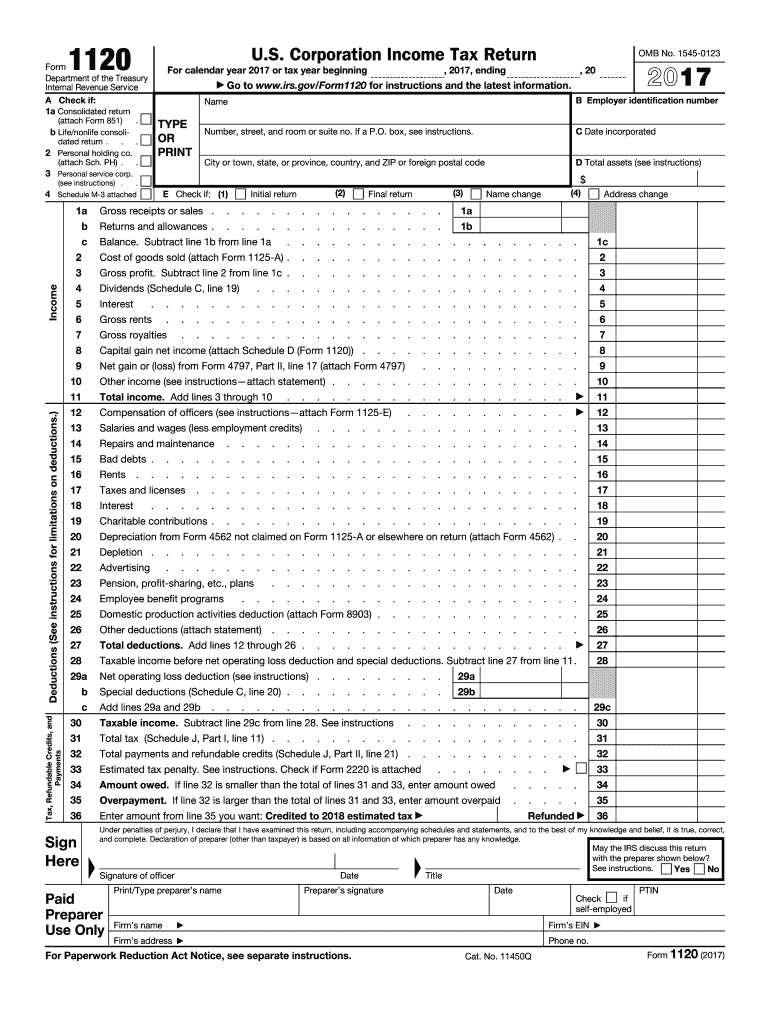

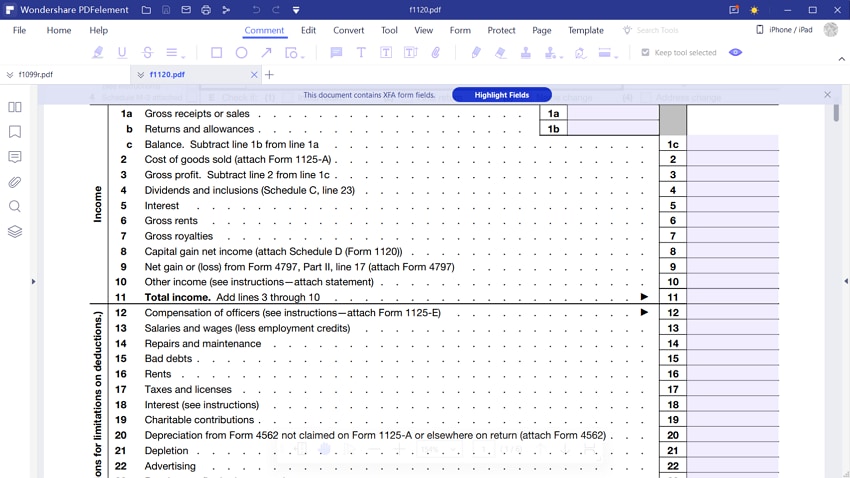

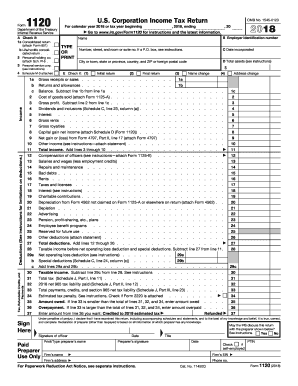

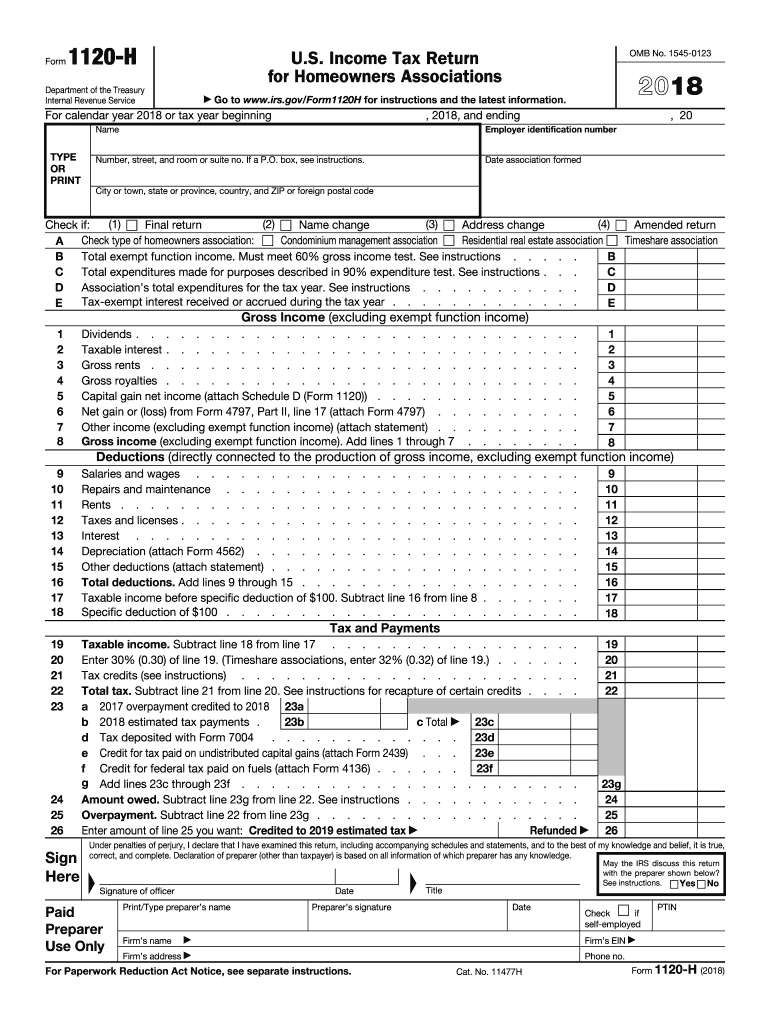

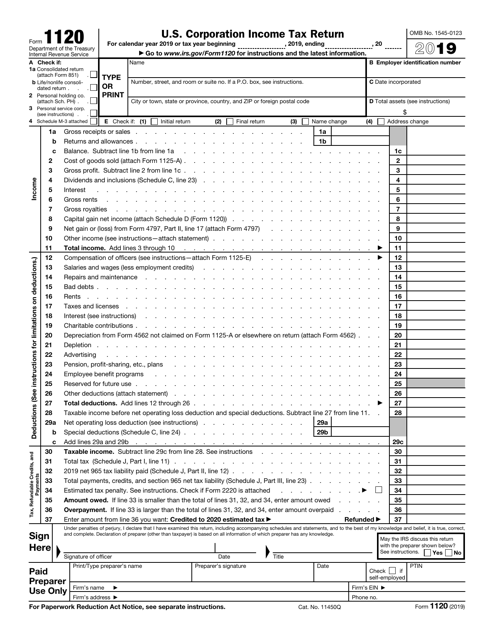

Form 1120. All corporations including corps in bankruptcy must file an income tax return whether they have taxable income Purpose of Form IRS Form 11, US Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Note that if you do NOT file form 2553, you cannot file an 11S The IRS will flag this activity and alert you to the fact that you’re missing form 2553 This could lead to you only being able to file at a C Corp for that year, using a form 11, but working with an experienced tax preparer who specializes in corporate taxes can help you. Title Form 11H Author SEWCARMP Subject US Income Tax Return for Homeowners Associations Keywords Fillable Created Date 11/23/ PM.

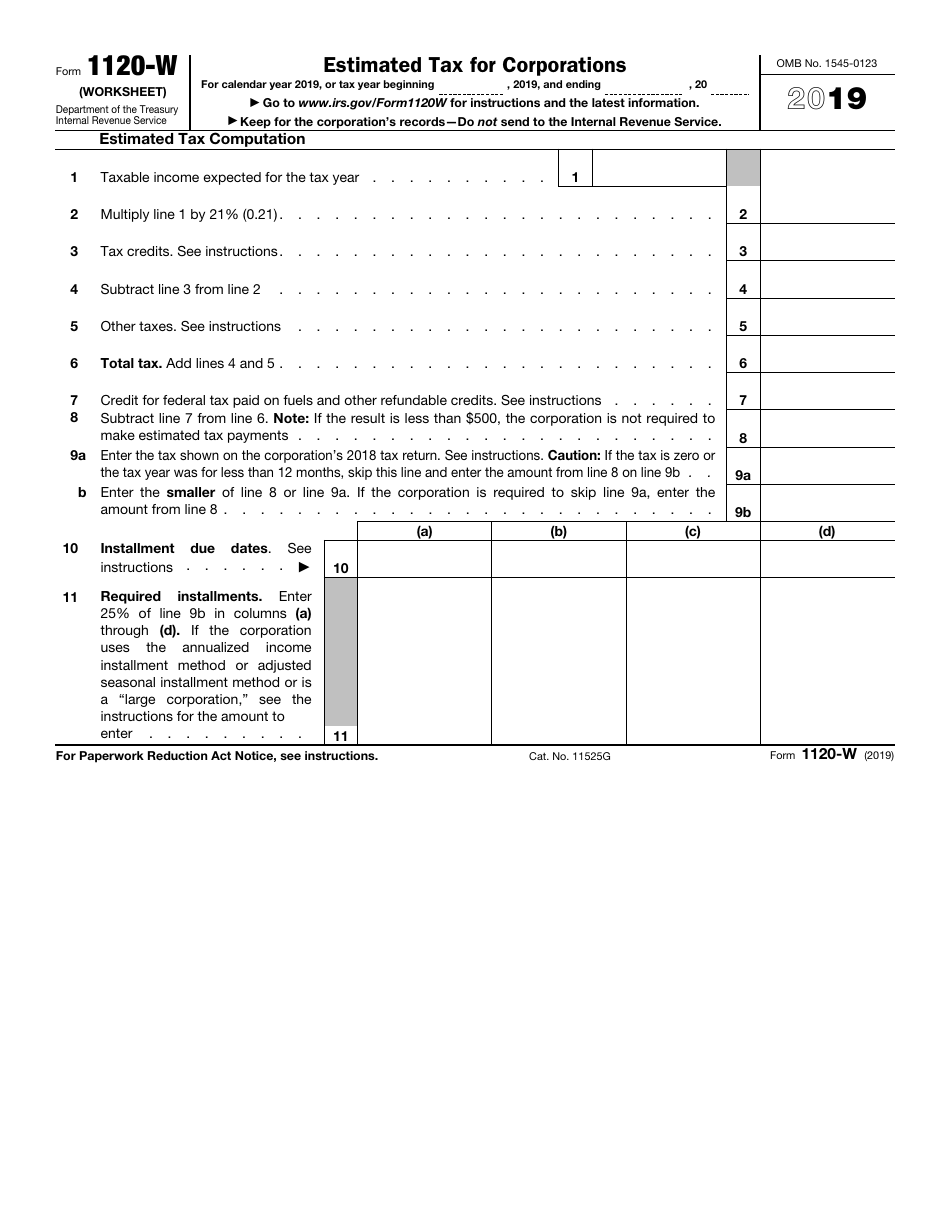

Form Number By Title or Keyword or By Area All Area Forms Accounting Service Center Aeronautics Attorney General BOBS Bridge Construction BOBS Geotechnical Services Section BOBS Structural Fabrication Unit BOBS Structure Management Section Bay Region Bureau of Bridges & Structures (BOBS) Bureau of Field ServicesSafety & Security Admin. Every corporation is required to pay quarterly estimated taxes IRS. IRS Form 11, the US Corporation Income Tax Return, is used to report corporate income taxes to the IRS It can also be used to report income for other business entities that have elected to be taxed as corporations, such as an LLC that has filed an election to use this tax option.

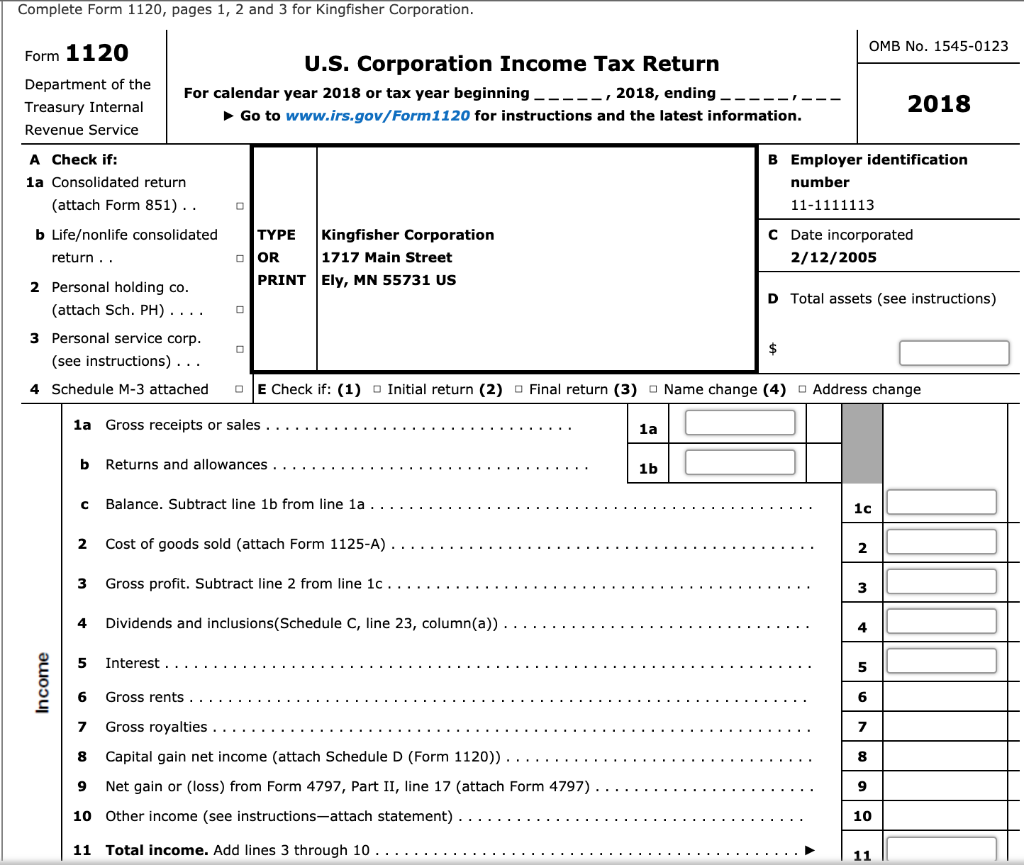

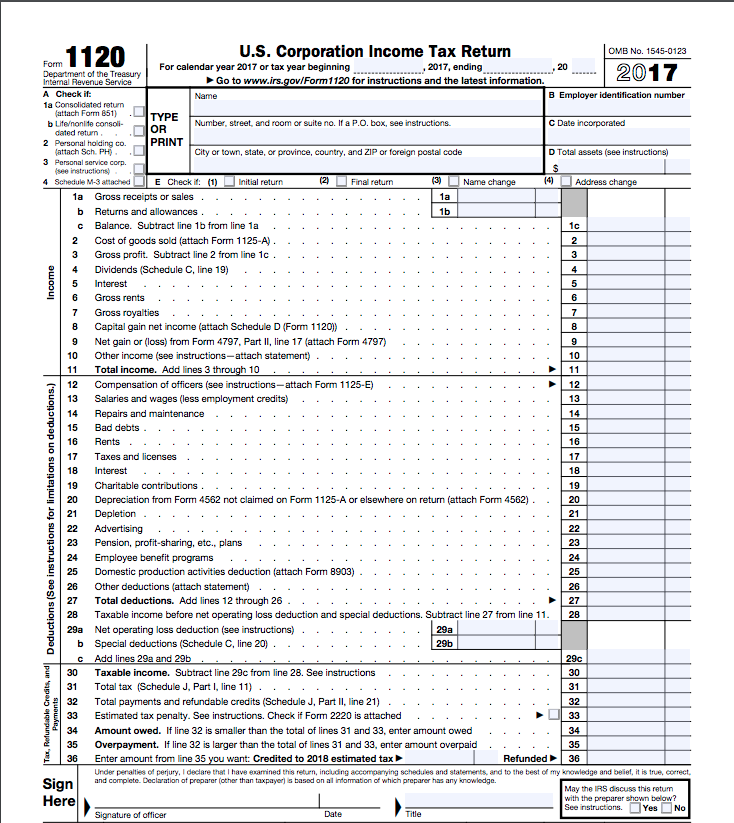

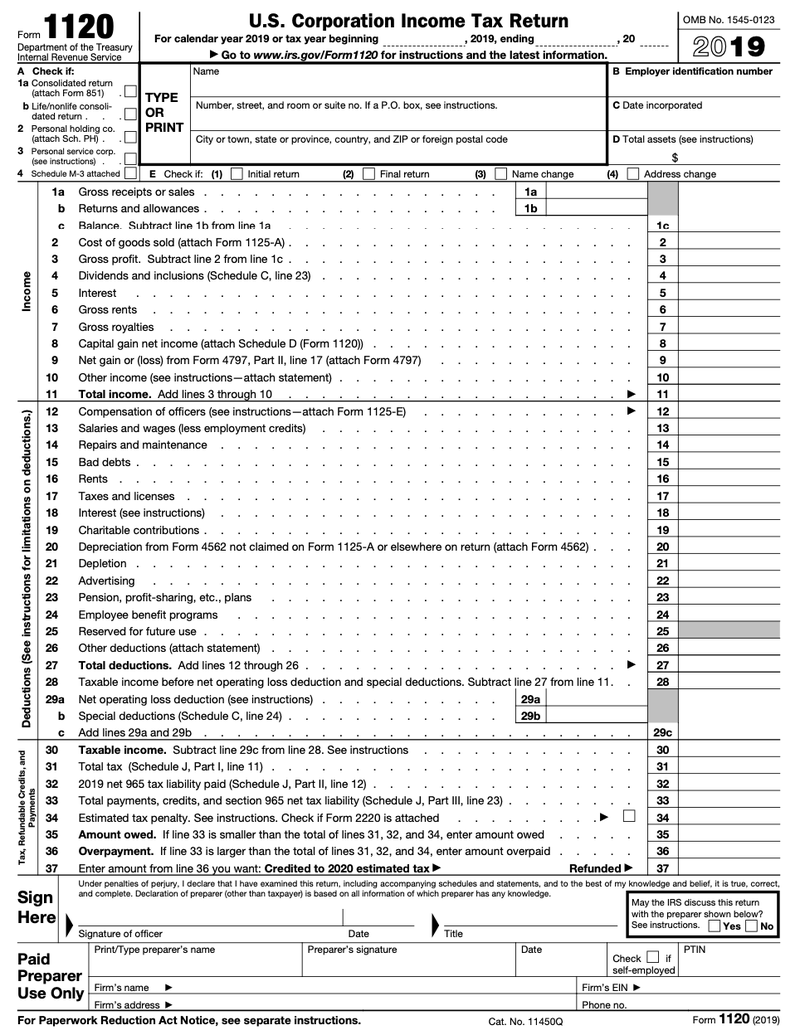

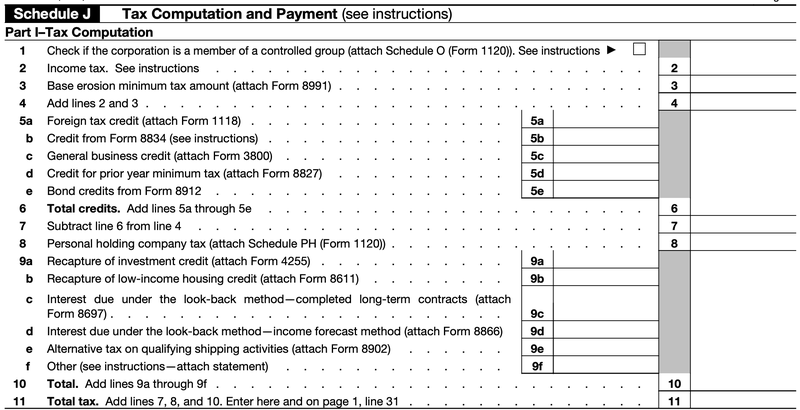

I needed the form this week, so the mail option may not work Thanks for trying. Form 11 must be completed and filed no later than the 15 th day of the 3 rd month following the close of your corporate tax year For example, if the close of your corporation's tax year is December 31, your completed form must be received by the IRS by March 15. Form 11 consists of seven major sections, though not every corporation that must fill out Form 11 is required to complete all seven sections Credit Karma Tax® — Always free Learn More Page 1 Page 1 asks for basic information about the corporation and a list of types of income and deductions.

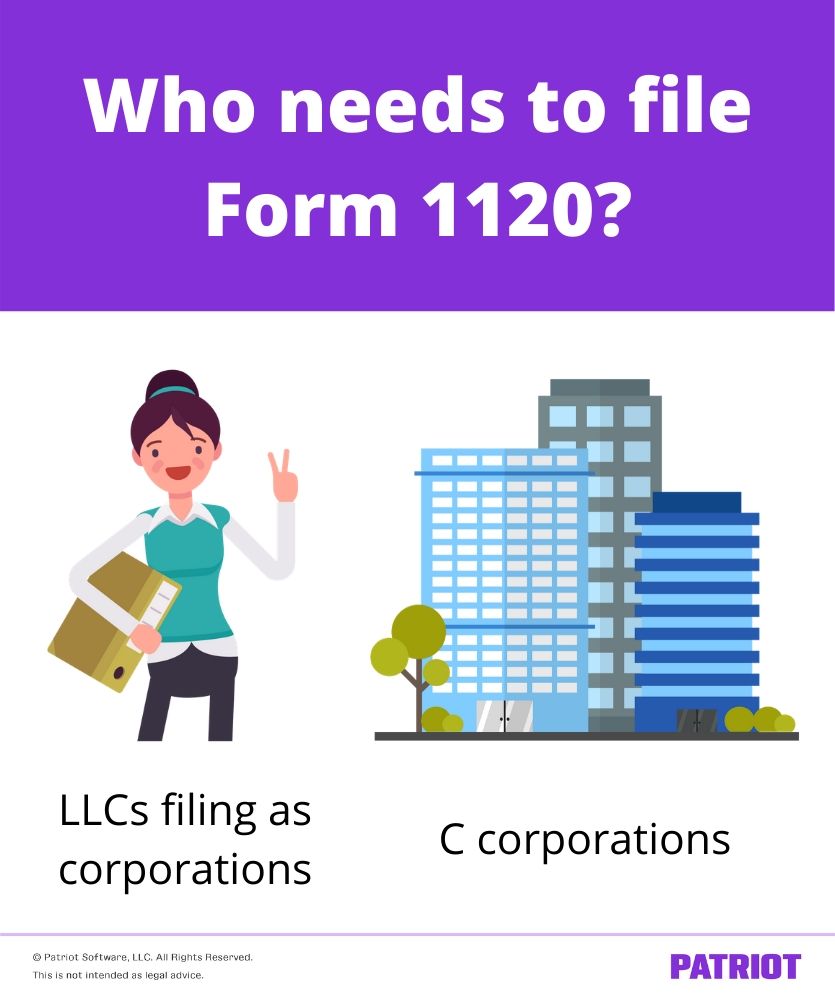

Form 11 is the tax form C corporations (and LLCs filing as corporations) use to file their income taxes Once you’ve completed Form 11, you should have an idea of how much your corporation needs to pay in taxes But that money doesn’t go to the IRS all in one lump sum;. From shareholder transactions, investments, uniform capitalization rules, longterm contracts, elections, foreign transactions, state considerations, basis issues and a plethora of other complex S corporation matters, this checklist is a comprehensive tool to use when preparing a complex Form 11S, US Income Tax Return for an S CorporationIt’s also useful when working with a new client. We last updated Federal Form 11 in January 21 from the Federal Internal Revenue Service This form is for income earned in tax year , with tax returns due in April 21We will update this page with a new version of the form for 22 as soon as it is made available by the Federal government.

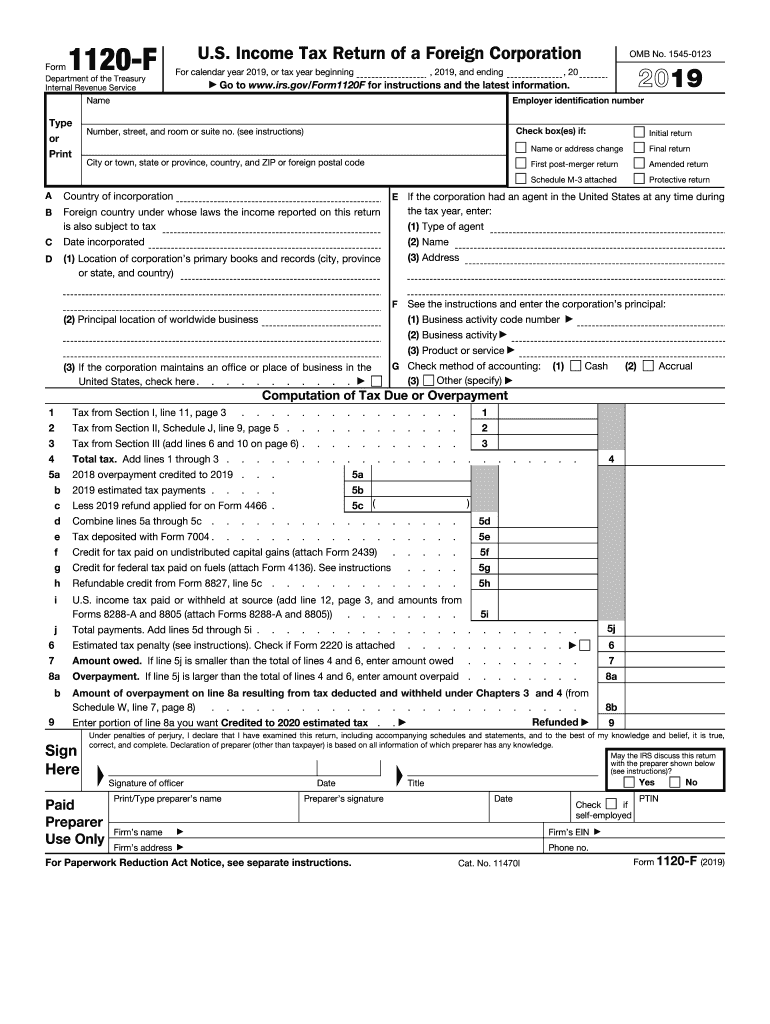

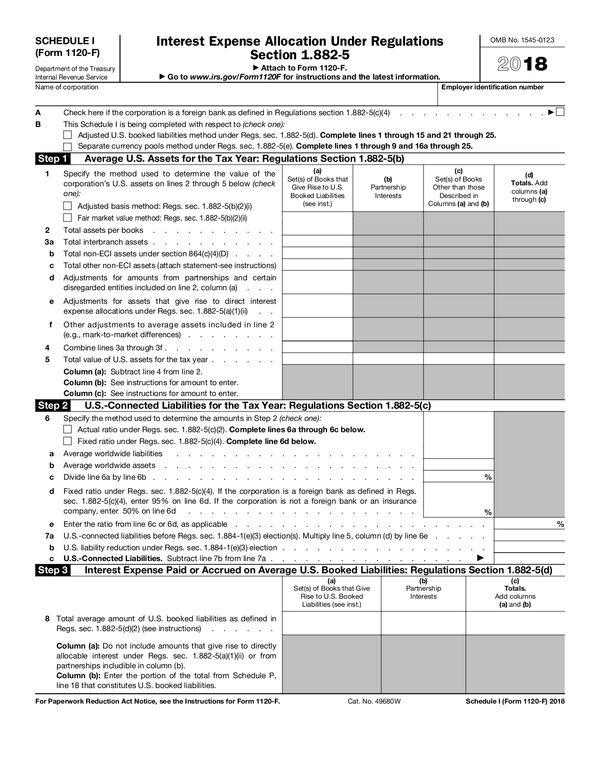

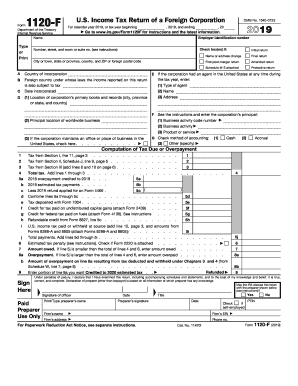

From shareholder transactions, investments, uniform capitalization rules, longterm contracts, elections, foreign transactions, state considerations and a plethora of other complex C corporation matters, this checklist is a comprehensive tool to use when preparing a complex Form 11, US Corporation Income Tax ReturnIt’s also useful when working with a new client while you are in the. I did what you said and after 40 min the girl didn't know about the form 11 so she transferred me I waited another 44 minutes and then my call was disconnected The IRS is the worst!. Form 11F Foreign corporations.

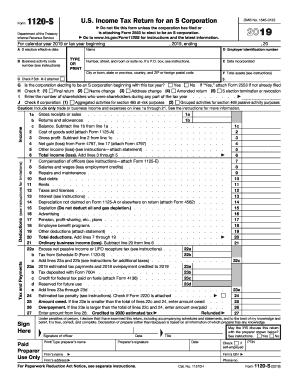

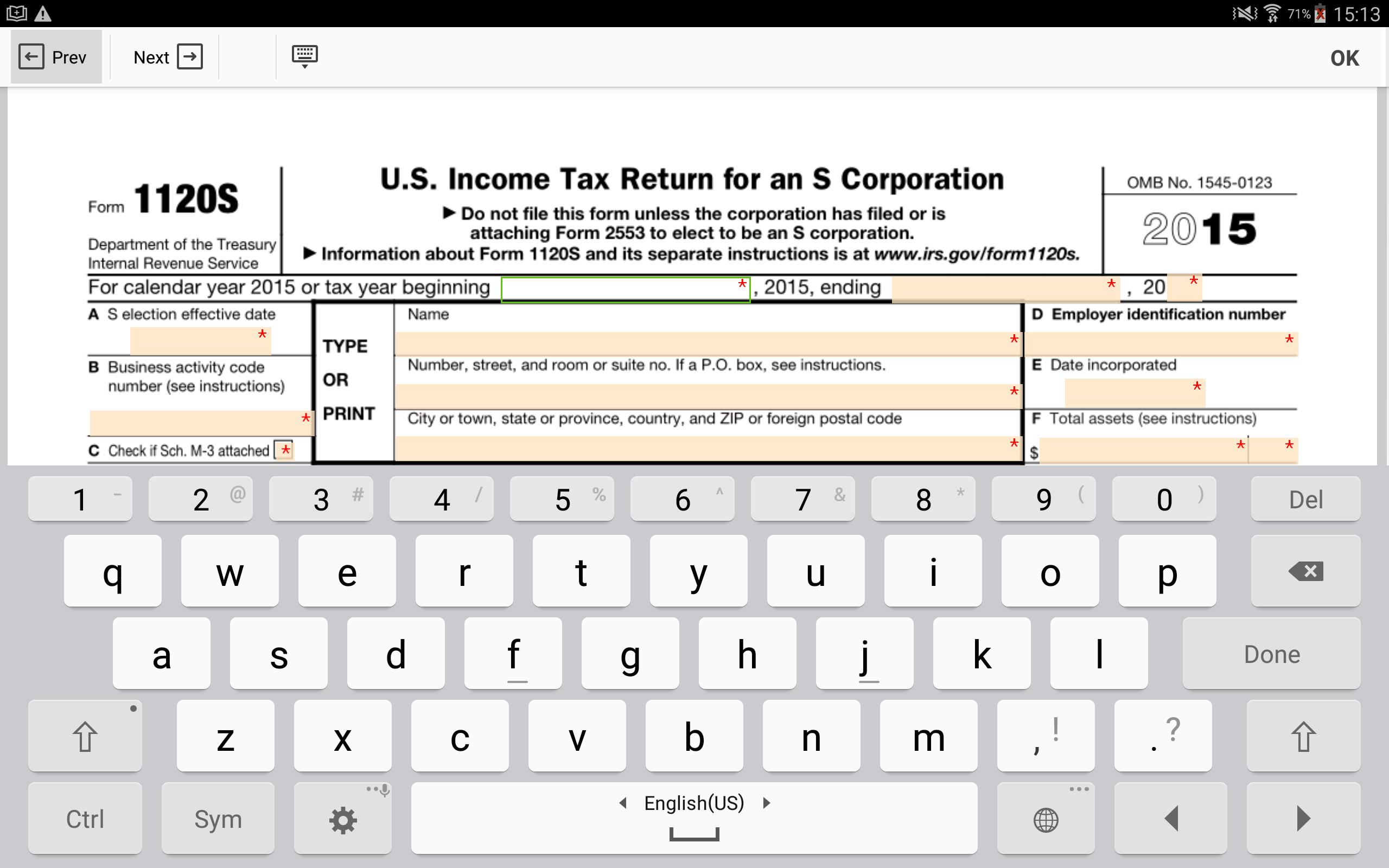

Click print and then click the document name to view and/or print it The document will appear in a PDF readonly format and at that time you can click the printer icon on the screen to actually print, or close the window without printing. An amended Form 11, also called Form 11X, comes into play when you make a mistake on the corporate income tax return Form 11X, Amended US Corporation Income Tax Return, allows businesses to correct mistakes made on their already filed Form 11 You may need to file an. Form 11S () Form 11S () Schedule B 12 13 14a b 15 Income (Loss) Deductions Credits Yes During the tax year, did the corporation have any nonshareholder debt that was canceled, was forgiven, or had terms modified so as to reduce the principal amount of the debt?.

Form 11 amended return So, what is a Form 11 amended return?. Instructions for Form 11S, US Income Tax Return for an S Corporation 02/04/21 Inst 11S (Schedule K1) Instructions for Schedule K1 (Form 11S), Shareholder's Share of Income, Deductions, Credits, etc 02/04/21 Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts. IRS Form 11 – Who Must File it?.

Select the Form11 Page 6 Schedules L, M1, and M2 to print;. Form 11H on page 1, lines (either) C or D requires an expense number, one being Total expenditures for the 90% test and the other being Total expenditures In an 11 filing the filer is required to DETAIL all expenses on its Page 1, as well as detailing the "Other Expenses", as well as, to a smaller extent possibly, detailing its Cost of. We last updated Federal Form 11 in January 21 from the Federal Internal Revenue Service This form is for income earned in tax year , with tax returns due in April 21We will update this page with a new version of the form for 22 as soon as it is made available by the Federal government.

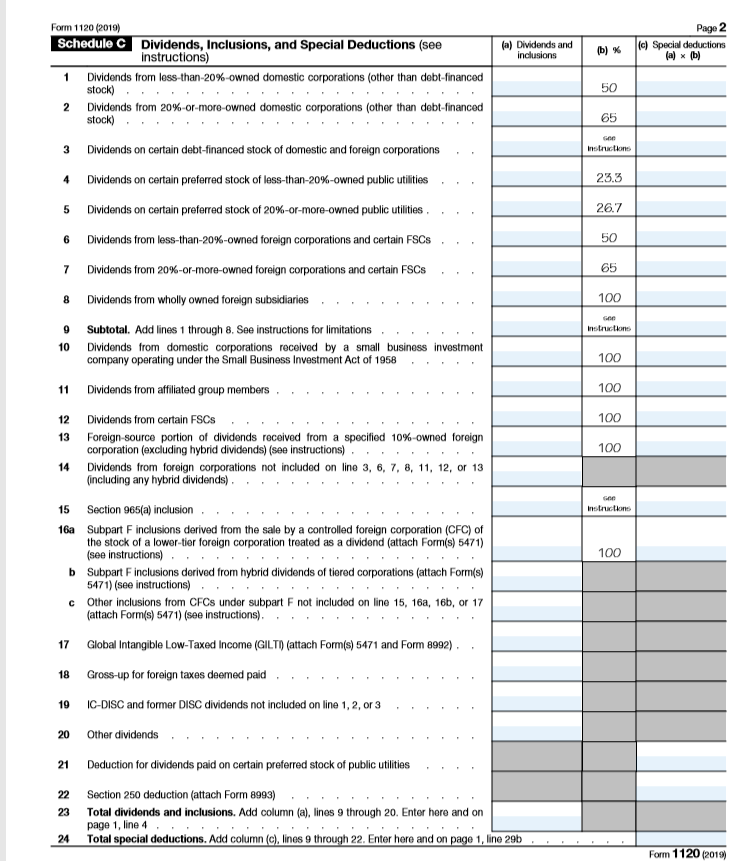

Form 11 US Corporation Income Tax Return is the form used to report corporate income taxes to the IRS Form 11 is also used to report income for other business entities that have elected to be taxed as a corporation (an LLC that has filed an election to be taxed as a corporation, for example). It is an S corporation's tax return Form 11S is part of the Schedule K1 document It. The last block of the Form 11 sample is the analysis of unappropriated retained earnings per books and reconciliation of income (loss) per books with income per return Fill IRS 11 Online 11 Form Instructions Examples Guides Tips Form 11 Schedules Schedule A Schedule B Schedule C.

Form 11S US Income Tax Return for an S Corporation Inst 11S Instructions for Form 11S, US Income Tax Return for an S Corporation. An entity filing a Form 11 US Corporation Income Tax Return is a domestic corporation (or association electing to be taxed as a corporation) Such an entity must file a tax return (Form 11) each year whether or not they have taxable income Such an entity is commonly referred to as a C Corporation and it is recognized as a separate. Irs Form 11 Fill out, securely sign, print or email your IRS Form 11 17 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!.

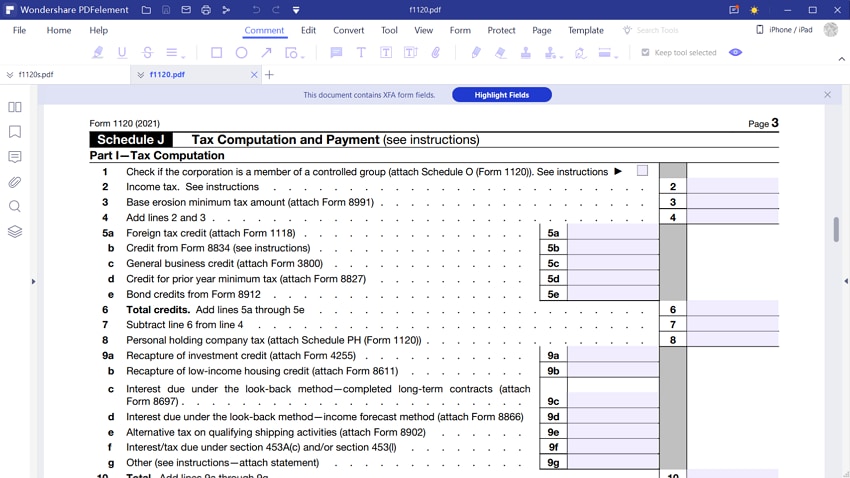

About Form 11, US Corporation Income Tax Return Domestic corporations use this form to Report their income, gains, losses, deductions, credits Figure their income tax liability. Send us your tax form improvement suggestions You are leaving ftbcagov We do not control the destination site and cannot accept any responsibility for its contents, links, or offers Review the site's security and confidentiality statements before using the site. Form 11 US Corporation Income Tax Return 12/17/ Inst 11 Instructions for Form 11, US Corporation Income Tax Return 19 01/31/ Form 11 (Schedule B) Additional Information for Schedule M3 Filers 1218 11/15/18 Form 11 (Schedule D).

Form 11 is the US corporation income tax return It is an Internal Revenue Service (IRS) document that American corporations use to report their credits, deductions, losses, gains and income It also helps corporations find out how much income tax they need to pay,. All corporations including corps in bankruptcy must file an income tax return whether they have taxable income Purpose of Form IRS Form 11, US Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. What information goes on Form 11?.

Every corporation is required to pay quarterly estimated taxes IRS. Irs Form 11 Fill out, securely sign, print or email your IRS Form 11 17 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!. Note that if you do NOT file form 2553, you cannot file an 11S The IRS will flag this activity and alert you to the fact that you’re missing form 2553 This could lead to you only being able to file at a C Corp for that year, using a form 11, but working with an experienced tax preparer who specializes in corporate taxes can help you.

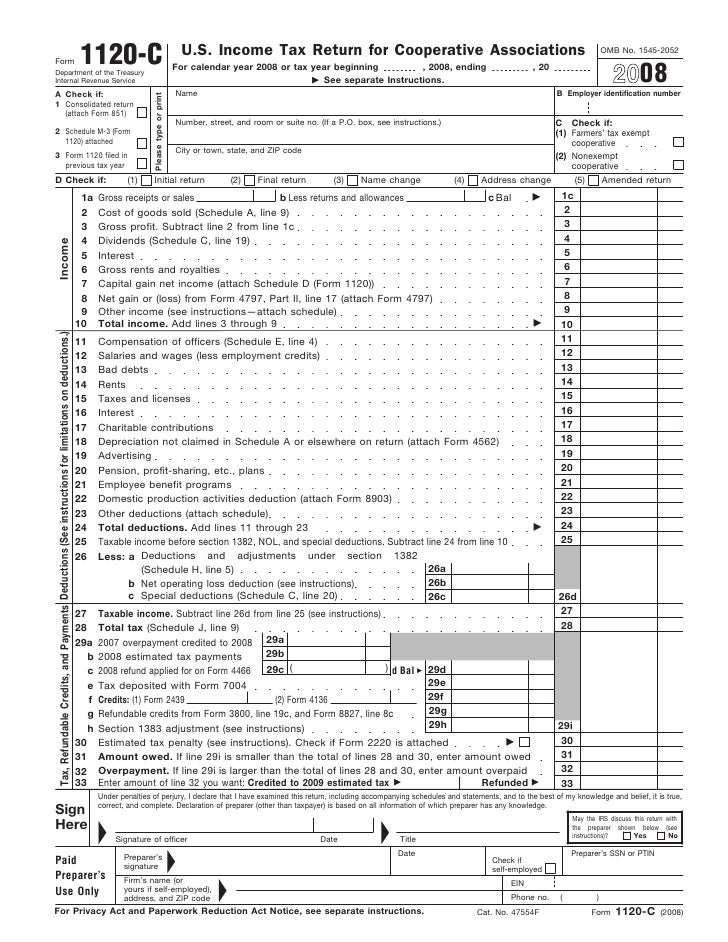

IRS Form 11 – Who Must File it?. An amended Form 11, also called Form 11X, comes into play when you make a mistake on the corporate income tax return Form 11X, Amended US Corporation Income Tax Return, allows businesses to correct mistakes made on their already filed Form 11 You may need to file an. Form 11C US Income Tax Return for Cooperative Associations 12/18/ Inst 11C Instructions for Form 11C, US Income Tax Return for Cooperative Associations 19 02/06/ Form 11F US Income Tax Return of a Foreign Corporation 12/07/.

Form 11S Standard Mileage Method for Vehicle Expenses Generally, the Scorporation reimburses the employee for vehicle expenses incurred when using their personal vehicle for company purposes Corporate employers may not use the standard mileage rate to compute the vehicle expenses for companyowned vehicles. Instructions for Form 11S, US Income Tax Return for an S Corporation 02/04/21 Inst 11S (Schedule K1) Instructions for Schedule K1 (Form 11S), Shareholder's Share of Income, Deductions, Credits, etc 02/04/21 Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts. All corporations including corps in bankruptcy must file an income tax return whether they have taxable income Purpose of Form IRS Form 11, US Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

IRS Form 11 – Who Must File it?. With Form 11, this is always one of the biggest issues and it can lead to extra penalties and more taxable income being discovered IRS Form 11H is a relatively safe form to file This form is specifically designated for “qualifying” homeowners’ associations If the homeowners’ association qualifies to file Form 11H, only its. Form 11S A tax document used to report the income, losses and dividends of S corporation shareholders;.

Depending on the nature of your business, there are many different versions of IRS Form 11 Most corporations will just fill out the standard Form 11, but a number of industries have special versions of IRS Form 11 Those include Form 11C For cooperatives, including farmers’ cooperatives ;. Form 11 US Corporation Income Tax Return 12/17/ Form 11 (Schedule B) Additional Information for Schedule M3 Filers 1218 11/15/18 Form 11 (Schedule D) Capital Gains and Losses 12/11/ Form 11 (Schedule G) Information on Certain Persons Owning the Corporation's Voting Stock. An entity filing a Form 11 US Corporation Income Tax Return is a domestic corporation (or association electing to be taxed as a corporation) Such an entity must file a tax return (Form 11) each year whether or not they have taxable income Such an entity is commonly referred to as a C Corporation and it is recognized as a separate.

Deducts the "calculated" state tax on Form 11S , line 12 The program only accrues state taxes to ordinary income on Form 11S , page 1 If the state tax applies to rental real estate, other rental activities, or farm activities, you must manually accrue the state tax to the federal return 2. The last block of the Form 11 sample is the analysis of unappropriated retained earnings per books and reconciliation of income (loss) per books with income per return Fill IRS 11 Online 11 Form Instructions Examples Guides Tips Form 11 Schedules Schedule A Schedule B Schedule C. Generally, an S Corporation must file Form 11S US Income Tax Return for an S Corporation by the 15th day of the third month after the end of its tax year For calendar year corporations, the due date is March 15 A corporation that has dissolved must generally file by the 15th day of the third month after the date it dissolved.

Product Number Title Revision Date;. About Form 11S, US Income Tax Return for an S Corporation Use Form 11S to report the income, gains, losses, deductions, credits, etc, of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. Form 11 must be completed and filed no later than the 15 th day of the 3 rd month following the close of your corporate tax year For example, if the close of your corporation's tax year is December 31, your completed form must be received by the IRS by March 15.

Form 11 Department of the Treasury Internal Revenue Service US Corporation Income Tax Return For calendar year or tax year beginning, , ending,. Product Number Title Revision Date;. Form 11 is infamously longwinded, so engage a tax professional to help you complete Form 11 You may be tempted to file Form 11 by yourself for a small, uncomplicated C corporation.

Instructions for Schedule O (Form 11), Consent Plan and Apportionment Schedule for a Controlled Group 1218 12/10/18 Inst 11FSC Instructions for Form 11FSC, US Income Tax Return of a Foreign Sales Corporation 0219 02/13/19 Form 11 (Schedule M3). A Form 11 tax return is filed on a yearly basis for corporations A Form 11S tax return is filed by corporations that have elected the “S” status The income reported on an 11S tax return typically flows through directly to the owner of the business As a result, that income is taxed on the owners’ federal Form 1040 tax return. Some C corporation tax returns are simple and routine with few complexities In those instances, use this checklist as a tool to help prepare simple C corporation income tax returns (Form 11, US Corporation Income Tax Return) This checklist is an abbreviated version of the AICPA Tax Section’s Annual Tax Compliance Kit’s Form 11 long checklist.

Form 11 is infamously longwinded, so engage a tax professional to help you complete Form 11 You may be tempted to file Form 11 by yourself for a small, uncomplicated C corporation. Generally, an S Corporation must file Form 11S US Income Tax Return for an S Corporation by the 15th day of the third month after the end of its tax year For calendar year corporations, the due date is March 15 A corporation that has dissolved must generally file by the 15th day of the third month after the date it dissolved. Form 11 is the tax form C corporations (and LLCs filing as corporations) use to file their income taxes Once you’ve completed Form 11, you should have an idea of how much your corporation needs to pay in taxes But that money doesn’t go to the IRS all in one lump sum;.

We last updated Federal Form 11S in January 21 from the Federal Internal Revenue Service This form is for income earned in tax year , with tax returns due in April 21We will update this page with a new version of the form for 22 as soon as it is made available by the Federal government. Political organizations that file Federal Form 11POL S corporations that pay federal income tax on Line 22c of Federal Form 11S Taxexempt organizations that have "unrelated trade or business income" for federal income tax purposes are subject to Florida corporate income tax and must file either Form F11 or Form F11A. Irs Form 11 Fill out, securely sign, print or email your IRS Form 11 17 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!.

Form 11 with Form 5472 attached by the due date (including extensions) of the return See the Instructions for Form 5472 for additional information and coordination with Form 5472 reporting by the domestic DE Qualified opportunity fund To be certified as a qualified opportunity fund (QOF), the corporation must file Form. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income Domestic corporations must file Form 11, unless they are required, or elect to file a special return See Special Returns for Certain Organizations, below". We last updated Federal Form 11H in January 21 from the Federal Internal Revenue Service This form is for income earned in tax year , with tax returns due in April 21We will update this page with a new version of the form for 22 as soon as it is made available by the Federal government.

Form 11S US Income Tax Return for an S Corporation Inst 11S Instructions for Form 11S, US Income Tax Return for an S Corporation.

Income Tax Q A Irs Form 11 For Corporations Xendoo

Where To Report Payment Made To Independent Contractors On Form 11 S Nina S Soap

Pdf 15 Form 11 Schedule M 3 Tien Tran Academia Edu

11 Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Us Tax Form 11 With Pen And Calculator Tax Form Law Document Stock Photo Picture And Royalty Free Image Image

Form 11 S U S Income Tax Return For An S Corporation Stock Photo Alamy

3 12 217 Error Resolution Instructions For Form 11 S Internal Revenue Service

Form 11 L U S Life Insurance Company Income Tax Return 15 Free Download

Form 11 For Fill Out And Sign Printable Pdf Template Signnow

Learn How To Fill The Form 11 U S Corporation Income Tax Return Youtube

Download Form 11 S For Irs Sign Income Tax Return Eform Free For Android Form 11 S For Irs Sign Income Tax Return Eform Apk Download Steprimo Com

Form 11 Fill Out And Sign Printable Pdf Template Signnow

What S New On 16 Forms 11 11s And 1065 Accountingweb

Irs Form 11 W Download Fillable Pdf Or Fill Online Estimated Tax For Corporations 19 Templateroller

Pdf 14 Form 11 Tien Tran Academia Edu

Solved U S Corporation Income Tax Return Omb No 1545 01 Chegg Com

C Corporation Income Tax Form 11 Gold Warez Com

How To Complete Form 11s S Corporation Tax Return Bench Accounting

Irs 11 S Form Pdffiller

Irs Form 11 Complete This Form With Pdfelement

Irs Form 11 A Complete Guide Accounts Confidant

Irs Form 11 Complete This Form With Pdfelement

Drakecpe Fundamentals Of Preparing Form 11 S

Form 11 S For Irs Sign Income Tax Return Eform Pour Android Telechargez L Apk

Premium Photo Irs Form 11 U S Corporation Income Tax Return

F 11

Draft 19 Form 11 S Instructions Adds New K 1 Statements For 199a Current Federal Tax Developments

Form 11 Reit Income Tax Return For Real Estate Investment Trusts 14 Free Download

Www Usag24 Com Doc Instruction11 Pdf

Irs 11 Form Pdffiller

Irs 11 C 19 Fill And Sign Printable Template Online Us Legal Forms

Learn How To Fill The Form 11 U S Corporation Income Tax Return Video Dailymotion

17 Form Irs 11 F Fill Online Printable Fillable Blank Pdffiller

Form 11 S U S Income Tax Return For An S Corporation

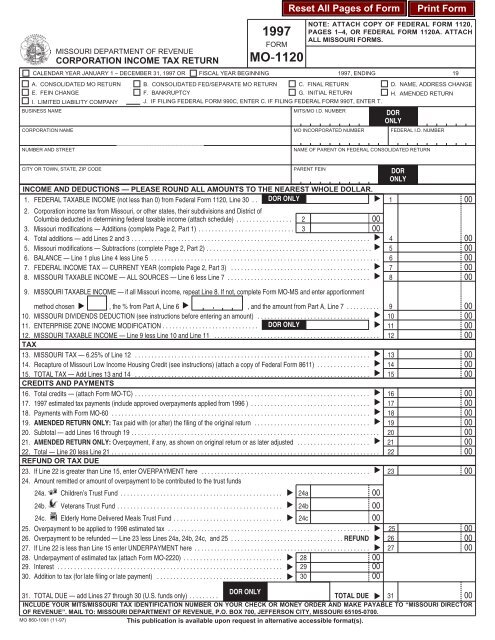

Mo 11 Corporation Income Tax Return Mo Ft Franchise Tax Form

Corporate Tax Returns Are Latest Forms To Get Irs Once Over Don T Mess With Taxes

Tax Filing Due Date Nears For Many Businesses Accountingweb

Www Irs Gov Pub Irs Access F11sn Accessible Pdf

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

Irs Form 11 What Is It

Form 11 Line 29a Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Complete Form 11 Pages 1 2 And 3 For Kingfishe Chegg Com

Q Tbn And9gctejmpkluf6vsvodh5kziqrgvq8ripcy Xhpbzjl63hv7jtjp9e Usqp Cau

Kingfisher Corporation Tax Return Pdf 11 U S Corporation Income Tax Return Form Department Of The Treasury Internal Revenue Service A Check If 1a Course Hero

Tax Form 11 What It Is How To File It Bench Accounting

Form 11 U S Corporation Income Tax Return Stock Photo Alamy

File Us Corporation Income Tax Return 11 Form 11 Jpg Wikimedia Commons

Form 11 U S Corporation Income Tax Return

Form 11 F U S Income Tax Return Of A Foreign Corporation

Form 11 Corporate Income Tax Return 14 Free Download

Q Tbn And9gctzllcyjkbom8mg2n5zu Oc4qef Eqooswwp Qewqtpenpl0puq Usqp Cau

How To File Tax Form 11 For Your Small Business The Blueprint

Form 11 S For Irs Sign Income Tax Return Eform For Android Apk Download

S Corp Tax Return Irs Form 11s White Coat Investor

What Is The Purpose Of Schedule M 1 On Form 11 Youtube

Let S Talk Tax Returns Emily Caryl Ingram

Form 11 Stock Photos Images Photography Shutterstock

Filing Corporation Income Tax Return Form 11 Editorial Image Image Of Annual Finance

Form 11 F U S Income Tax Return Of A Foreign Corporation 14 Free Download

Drakecpe Fundamentals Of Preparing Form 11

Corporate Tax Returns Are Latest Forms To Get Irs Once Over Don T Mess With Taxes

How Should One Fill Out Form 11 For A Company With No Activity And No Income And That Has Not Issued Shares

Instructions For Form 11 F Pdf Free Download

What Is Form 11s And How Do I File It Ask Gusto

How To File Tax Form 11 For Your Small Business The Blueprint

Filing Corporation Income Tax Return Form 11 Stock Photo Picture And Royalty Free Image Image

Fill Free Fillable Form 11 18 Corporation Income Tax Return Pdf Pdf Form

Form 11 Us Corporation Income Tax Stock Photo Edit Now

Irs Form 11 F Us Tax Return Required For Australian Amazon Sellers

U S Corporation Income Tax Return Form 11 Meru Accounting

Form 11 Corporate Image Photo Free Trial Bigstock

3

Form 11 13 Schedule C Dividends And Schedule C Dividends And Specia A Alternative Minimum Tax 11 If The Corporation Has An Nol For The Tax Year And Is Electing To Forego

Corporate Tax Return Form 11 Editorial Image Image Of Schedule Budget

Form 11 H Example Complete In A Few Simple Steps Infographic

Fill Free Fillable Form 11 H U S Income Tax Return Homeowners Associations 18 Pdf Form

What Is Form 11s And How Do I File It Ask Gusto

Fillable Online 16 Instructions For Form 11 F Instructions For Form 11 F U S Income Tax Return Of A Foreign Corporation Fax Email Print Pdffiller

Tax Form 11 Phone Image Photo Free Trial Bigstock

Hoa Tax Return Guide Moneyminder

Printed Form 11 W 4 On Paper Close Up Editorial Stock Photo Image Of Background Season

Draft 19 Form 11 S Instructions Adds New K 1 Statements For 199a Current Federal Tax Developments

Irs Form 11s Definition Download 11s Instructions

Premium Photo Irs Form 11 U S Corporation Income Tax Return

11 H 18 Tax Form Fill Out And Sign Printable Pdf Template Signnow

Dean T Carson Ii C P A Taxes And Taxation Tax Services Economic Research Income

Form 11 H Fill Out Online Instructions Pdf Example Formswift

Form 11 S For Irs Sign Income Tax Return Eform For Android Apk Download

Printed Form 11 Paper Close Stock Photo C Alfexe

Form 11 C U S Income Tax Return For Cooperative Associations

What Is Form 11s And How Do I File It Ask Gusto

Irs Form 11 Download Fillable Pdf Or Fill Online U S Corporation Income Tax Return 19 Templateroller

Form 11 F Us Protective Income Tax Return Securing Deductions Ecovis Barcelona

What You Need To Know About Form 11 H Condo Manager Usa

:max_bytes(150000):strip_icc()/Screenshot110-01724b16a02e441b8565e7b7dfc95b02.png)

Irs Form 11s What Is It

Tax Evasion Concept Tax Form 11 And Handcuffs Image Stock By Pixlr

E File 11 Pol Irs Form 11 Pol Online Political Organization

Form 11 S For Irs Sign Income Tax Return Eform Programme Op Google Play