Form 1095 A

Urgent Wait To File Taxes If You Received A Form 1095 A From Healthcare Gov Shindelrock

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement 19 Templateroller

Info Nystateofhealth Ny Gov Sites Default Files Tax credits form 1095 A and b january 18 Pdf

Http Hbex Coveredca Com Toolkit Webinars Briefings Downloads 1095 A B C Quick Guide Final Pdf

What Is Form 1095 Infographic H R Block

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

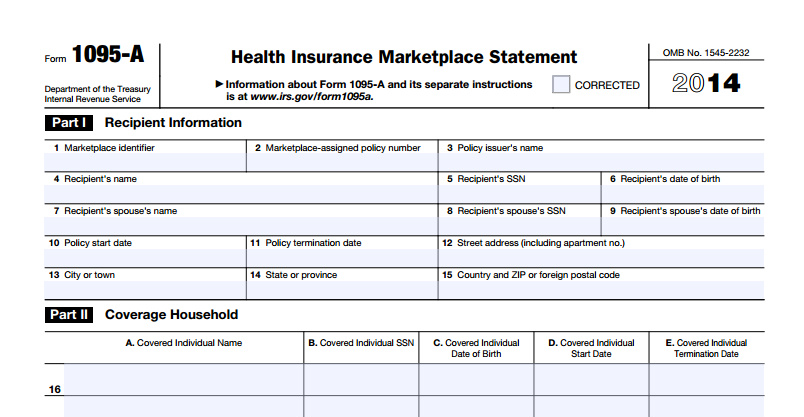

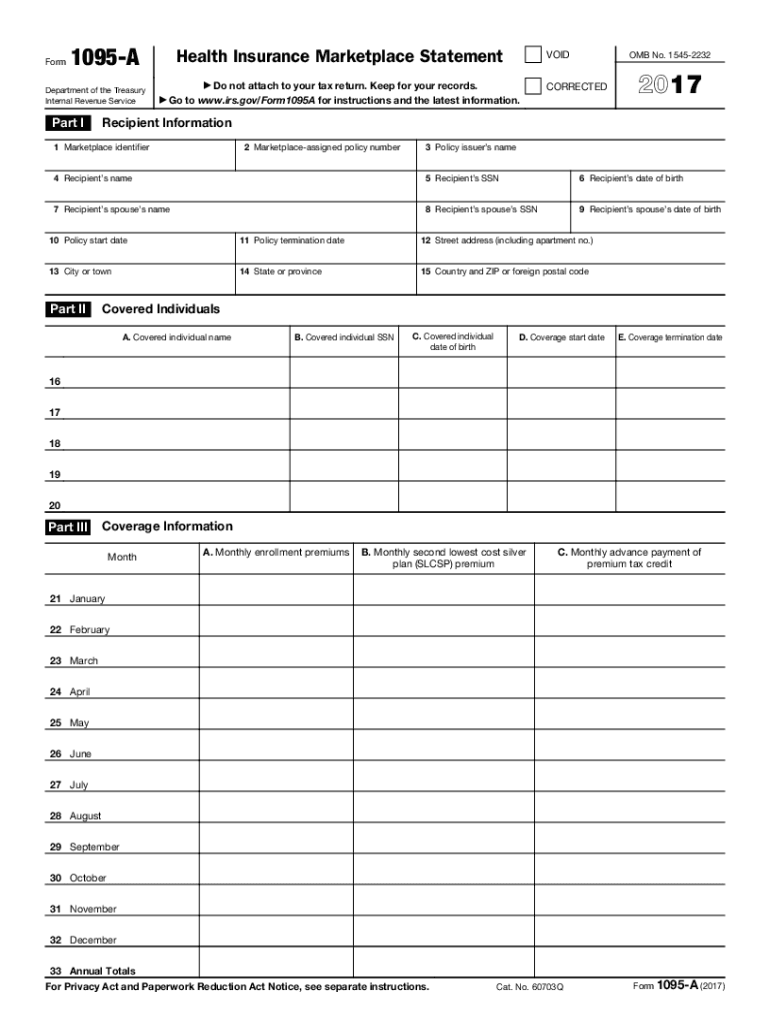

The form 1095A is used to report health insurance purchased through Healthcargov or your state's Health Insurance agency The form 1095A is mailed to taxpayers on January 31 of the year You may call your Health Insurance Marketplace to avail a copy or visit the website.

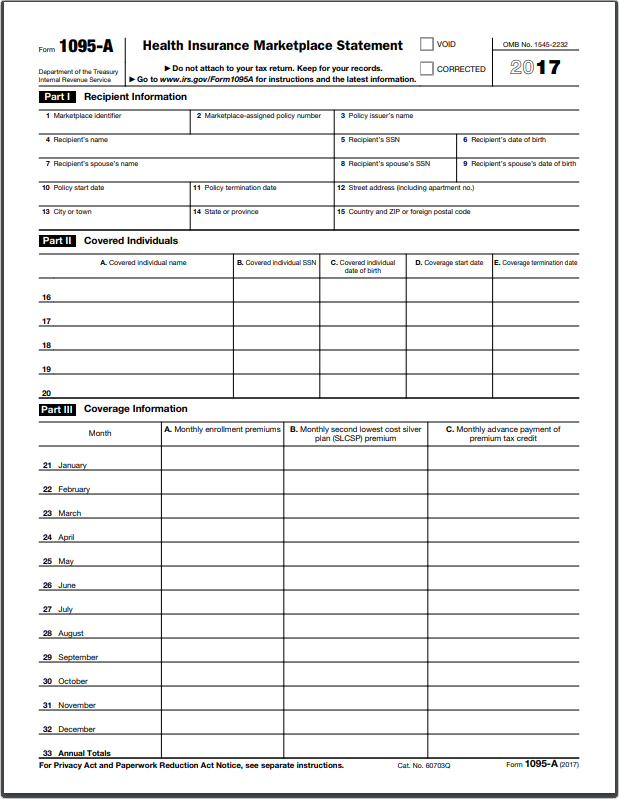

Form 1095 a. A) Form 1095B is an IRS document that shows you had health insurance coverage considered Minimum Essential Coverage during the last tax yearUnder the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 18. The Form 1095A shows that all four (Ryan, Alexis, Andrew and Haley) were covered by health insurance and the 1095A is in Ryan’s name and social security number I know no other way to proceed on this without triggering an IRS notice about not properly reporting this under Ryan’s social security number. Form 1095A–Health Insurance Marketplace Statement is the tax form used for taking the premium tax credit or reconciling the advance payments of the premium tax credit This tax form is not filled out by individuals Marketplaces file this tax form to provide the necessary information about the coverage such as the monthly enrollment premiums.

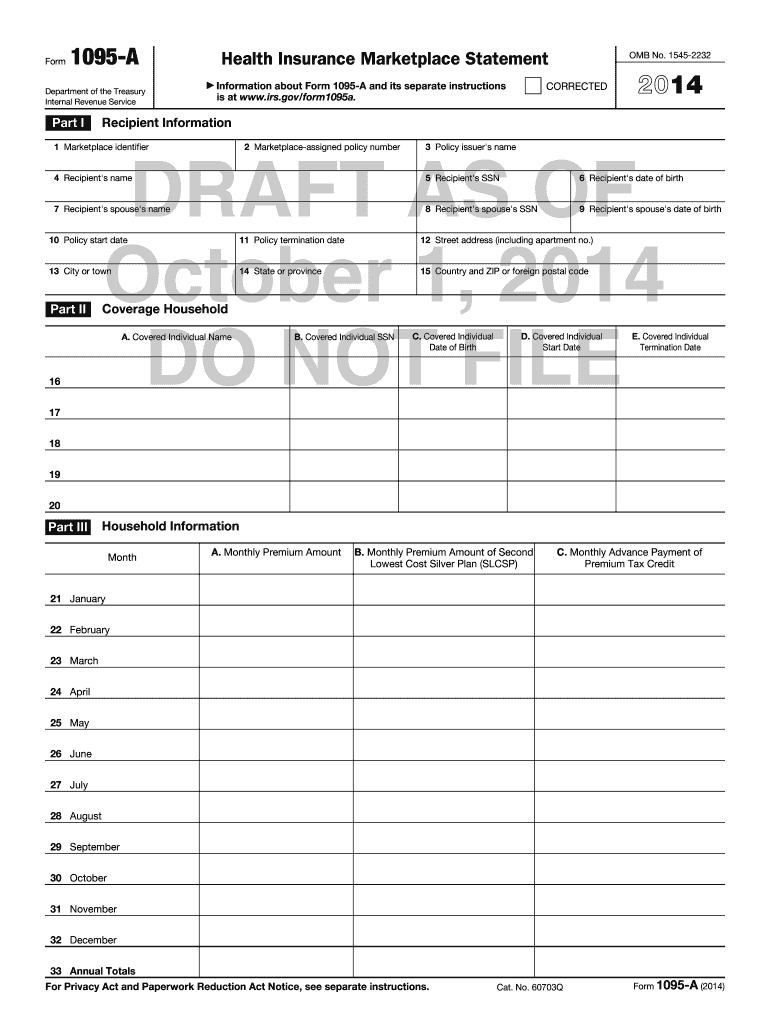

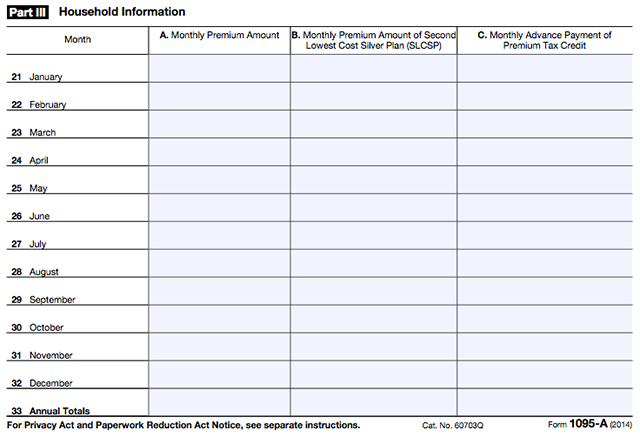

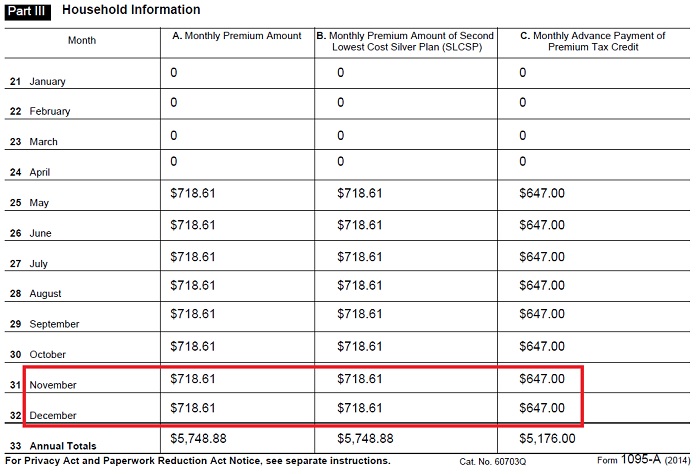

The Form 1095A only reports medical coverage, not catastrophic coverage or standalone dental and vision plans The purpose of this form is to provide information about how long you have been covered by the plan, and how much advance premium tax credit (APTC) subsidy you received to assist you in paying the premiums. • One Form 1095A will be sent to Jane, who is the account holder The form will include both Jane’s and John’s enrollment information Jane and John also enrolled Mary, their 25 year old daughter, in their family policyMary is not a dependent and is in a separate tax household • One Form 1095A will be sent to Jane. Form 1095A–Health Insurance Marketplace Statement is the tax form used for taking the premium tax credit or reconciling the advance payments of the premium tax credit This tax form is not filled out by individuals Marketplaces file this tax form to provide the necessary information about the coverage such as the monthly enrollment premiums.

If you or anyone in your household are enrolled in a health plan through the Health Insurance Marketplace, you’ll get a 1095A form in the mail This form, which will come from the Health Insurance Marketplace, will include premium tax credit information, if applicable. The information on Form 1095A is used to complete IRS Form 62 (Premium Tax Credit) This form must be filed if APTC payments were applied to your insurance premiums or if you want to claim the premium tax credit on your annual tax return. Home » Questions And Answers » 1095A form 1095A form Amandasm 1 day ago I am currently working on my taxes and I need to enter info from my 1095A form How can I get a copy of this form?.

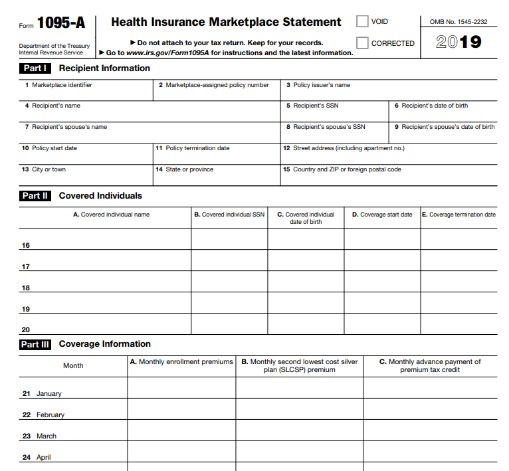

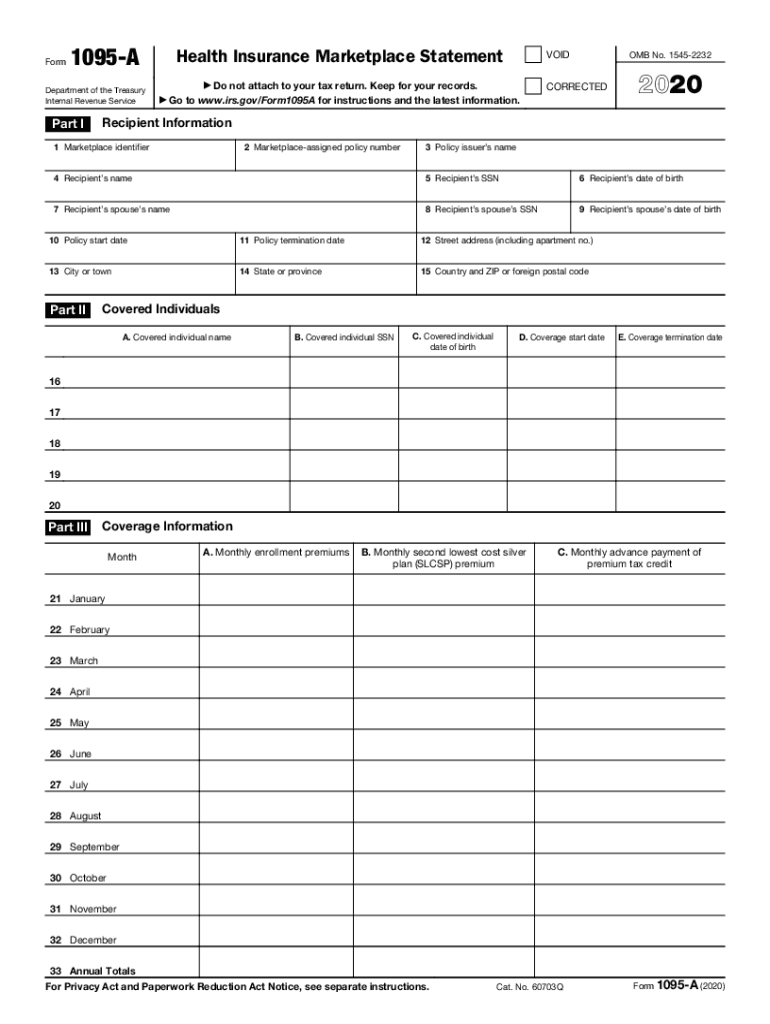

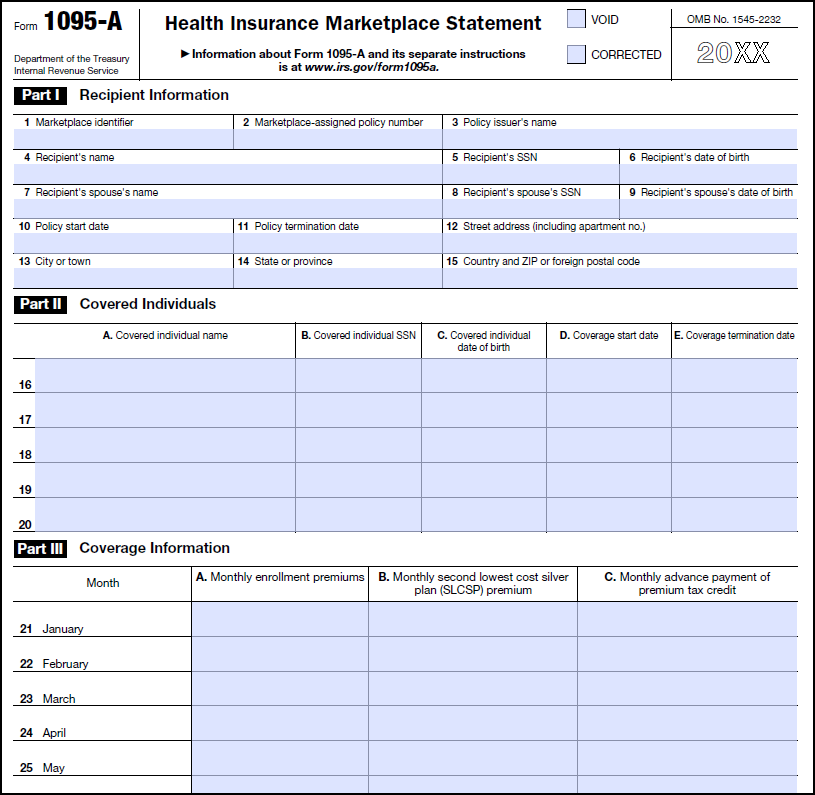

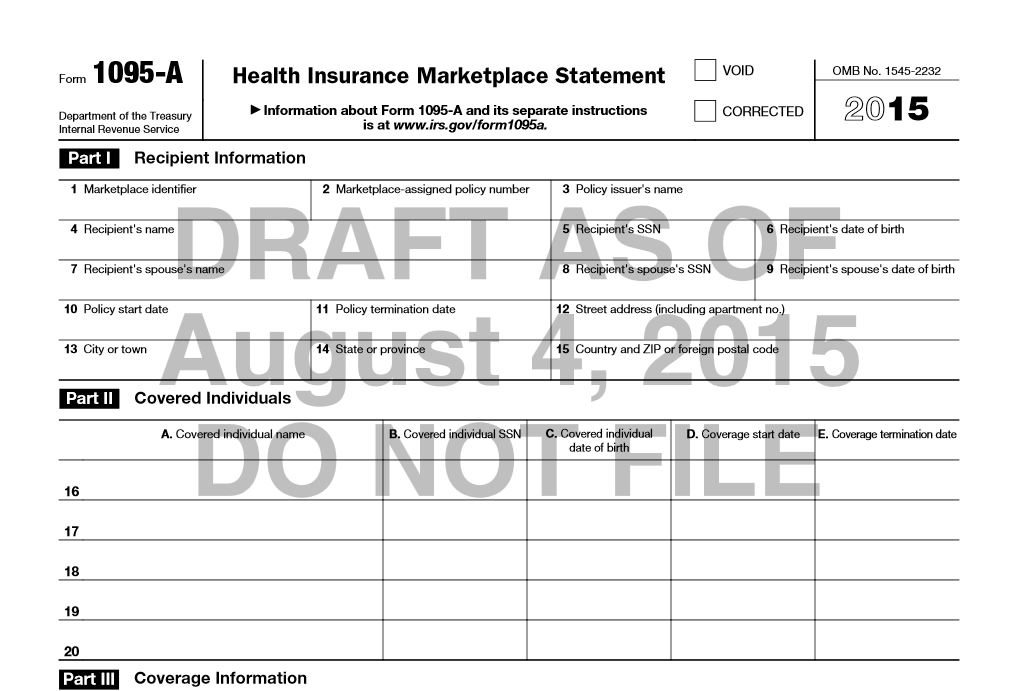

And • Report the corrected information to the IRS Consumers can update demographic information that is incorrect on Form 1095A when they file their federal income tax return without the need to generate a corrected Form 1095A. If I received a 1095A, what forms do I need to submit with my tax return?. Form 1095A includes the identifying information about the client and any other individuals covered by the health insurance plan, as well as information on the type and duration of coverage How Does it Look?.

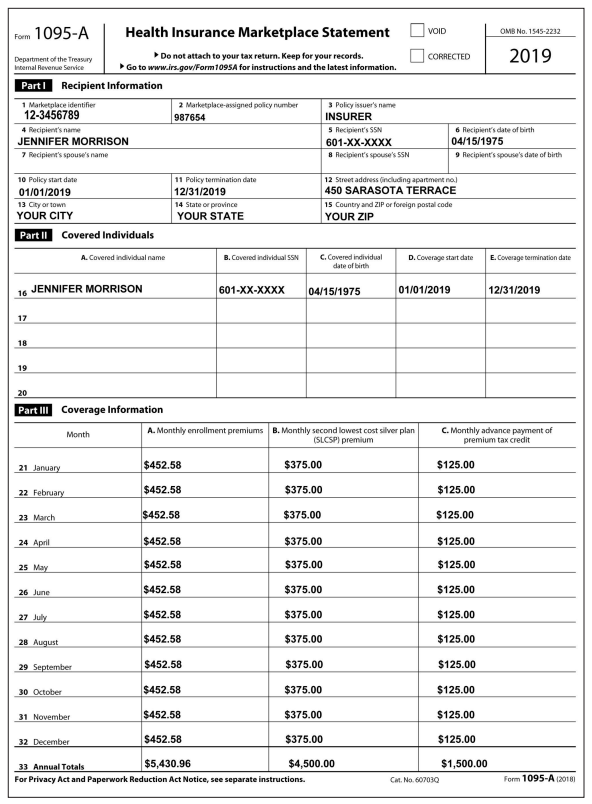

The Form 1095A only reports medical coverage, not catastrophic coverage or standalone dental and vision plans The purpose of this form is to provide information about how long you have been covered by the plan, and how much advance premium tax credit (APTC) subsidy you received to assist you in paying the premiums. Form 1095A is the reporting document for health insurance purchased through the Health Insurance Marketplace Each person who, at the time of enrollment, expected to file a tax return and enrolled in a qualified health plan through the Health Insurance Marketplace will receive Form 1095A or a similar statement for each policy. The healthcare 1095 A Form is designed to gather your tax information related to the federal subsidy that you could get in 16 and the actual costs of your health insurance plan The 16 subsidy is also known as the Premium Tax Credit (PTC).

Form 1095A–Health Insurance Marketplace Statement is the tax form used for taking the premium tax credit or reconciling the advance payments of the premium tax credit This tax form is not filled out by individuals Marketplaces file this tax form to provide the necessary information about the coverage such as the monthly enrollment premiums. Form 1095A includes the identifying information about the client and any other individuals covered by the health insurance plan, as well as information on the type and duration of coverage How Does it Look?. Form 1095A–Health Insurance Marketplace Statement is the tax form used for taking the premium tax credit or reconciling the advance payments of the premium tax credit This tax form is not filled out by individuals Marketplaces file this tax form to provide the necessary information about the coverage such as the monthly enrollment premiums.

Use your 1095A to complete IRS Form 62 Premium Tax Credit Download 62 Tax Form If you used tax credits to lower the cost of your monthly premium, or you’d like to claim your tax credit as a lump sum, you must file a federal tax return and attach Form 62. The 1095A form is a Health Insurance Marketplace Statement that comes in the mail and you need to include in your tax return This form should arrive in your mailbox by January 31, Read on to get answers to 7 of the most common questions about Form 1095A Why Do I Need Form 1095A?. Complete IRS 1095A online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documents.

Health Conditions & Prevention;. My wife and I our filling out the portion of our taxes which ask if we had health insurance through the market place and we did We listed my son and daughter as dependents under are health insurance but my son whose 22 does files his own taxes and is not considered a dependent We did get an advanc. Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A Health Insurance Marketplace Statement 19 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 19 Form 1095A Health Insurance Marketplace Statement 18.

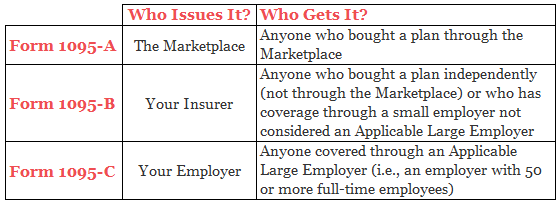

Form 1095A Health Insurance Marketplace Statement is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier 1 The form does not. Related Health & Wellness;. The Affordable Care Act requires nearly all Americans have health insurance The 1095 tax forms provide proof that you and your family had health insurance during that year Which form you get depends on whether you get your insurance through an employer or buy it yourself The forms also list who had coverage and for how many months.

Look for Form 1095A If anyone in your household had Marketplace coverage in 17, you can expect to get a Form 1095A, Health Insurance Marketplace® Statement, in the mail by midFebruary It comes from the Marketplace, not the IRS Store this form with your important tax information. Frequently asked questions Updated on January 7, 21 Q) What is the Form 1095B?. What’s a 1095A form?.

When You Should Receive Form 1095A You should receive Form 1095A from the Marketplace by the end of January of the tax year If you do not receive your 1095A by then, visit the Marketplace's website (healthcaregov) for information on how to request a copy of your form online from the Marketplace. In short, the 1095A form is the document provided to people who purchase their health insurance through the governmentrun healthcare Marketplace The form includes basic personal information, such as your name, address, and insurance provider. Form 1095A When you buy your health insurance plan through Connect for Health Colorado, you can get financial help in the form of a tax credit to lower the monthly payment At the beginning of each year, we will provide you with a tax form, Form 1095A.

The 1095A form is a Health Insurance Marketplace Statement that comes in the mail and you need to include in your tax return This form should arrive in your mailbox by January 31, Read on to get answers to 7 of the most common questions about Form 1095A Why Do I Need Form 1095A?. Form 1095A–Health Insurance Marketplace Statement is the tax form used for taking the premium tax credit or reconciling the advance payments of the premium tax credit This tax form is not filled out by individuals Marketplaces file this tax form to provide the necessary information about the coverage such as the monthly enrollment premiums. You need Form 1095A to complete IRS Form 62.

How to use Form 1095A If anyone in your household had a Marketplace plan in , you should get Form 1095A, Health Insurance Marketplace® Statement, by mail no later than midFebruary It may be available in your HealthCaregov account as soon as midJanuary IMPORTANT You must have your 1095A before you file. Covered California will send IRS Form 1095A Health Insurance Marketplace Statement to all enrolled members It is used to fill out IRS Form 62 Premium Tax Credit, as part of your federal tax return. About Form 1095A, Health Insurance Marketplace Statement About Form 1095A, Health Insurance Marketplace Statement Health Insurance Marketplaces furnish Form 1095A to IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

Form 1095A will have the “corrected” check box marked);. You received this Form 1095A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095A provides information you need to complete Form 62, Premium Tax Credit (PTC). Where to find your Form 1095A Connect for Health Colorado mails Form 1095A to the primary tax filer in the household at the end of January Additionally, you can get an electronic version of Form 1095A in the “My Documents” section of your Connect for Health Colorado online account.

You can find an example Form 1095A here What we do. You received this Form 1095A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095A provides information you need to complete Form 62, Premium Tax Credit (PTC). Frequently asked questions Updated on January 7, 21 Q) What is the Form 1095B?.

You can find an example Form 1095A here What we do. Sign in to your MNsure account and navigate to your account homepage Select Notifications from the navigation panel on the left If a 1095A form is available, it will be here Click the small arrow next to the notice to expand the information for the notice. Look for Form 1095A If anyone in your household had Marketplace coverage in 17, you can expect to get a Form 1095A, Health Insurance Marketplace® Statement, in the mail by midFebruary It comes from the Marketplace, not the IRS Store this form with your important tax information.

A) Form 1095B is an IRS document that shows you had health insurance coverage considered Minimum Essential Coverage during the last tax yearUnder the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 18. If you don't have your 1095A form you can view it online You can also contact the Marketplace Call Center if you find any errors on your 1095A NOTE This page was compiled over the years in a response to people's questions with 1095A forms The information below remains important However, we suggest anyone dealing with 1095A issues see the latest update from Treasury and the IRS issued on. Form 1095A should be mailed to you, but you can also usually find it in your online marketplace account If you were due a 1095A and didn’t get it, contact the state or federal marketplace in charge of your coverage Form 1095B Health Coverage Form 1095B is the catchall form that is issued for any type of coverage not on a Form 1095A or C.

Due to these changes form 1095B and 1095C are no longer required to be entered into the tax return and should be kept by the taxpayer for their records If your client received a form 1095A for Health Insurance Marketplace Statement this information is still required for tax year 19. The 1095A form (Health Insurance Marketplace Statement) is for people who have health insurance through the Health Insurance Marketplace, often called an exchange What is 1095B The 1095B form (Health Coverage) is mailed to individuals by the insurer to report minimum essential coverage. And they’ll give you a Health Coverage Information Statement Form 1095B or Form 1095C) as proof you had coverage If you enrolled in coverage through the Marketplace, you will receive a Health Insurance Marketplace Statement, Form 1095A You can learn more about this topic at the IRS website, or talk with your tax advisor Or you can call.

The Insurance Marketplace sends out the 1095A forms by January 31st, 21 If you did not receive it, or you misplaced it, we can help!. My wife and I our filling out the portion of our taxes which ask if we had health insurance through the market place and we did We listed my son and daughter as dependents under are health insurance but my son whose 22 does files his own taxes and is not considered a dependent We did get an advanc. What Is The 1095A Form?.

The Form 1095A only reports medical coverage, not catastrophic coverage or standalone dental and vision plans The purpose of this form is to provide information about how long you have been covered by the plan, and how much advance premium tax credit (APTC) subsidy you received to assist you in paying the premiums. Frequently asked questions Updated on January 7, 21 Q) What is the Form 1095B?. My wife and I our filling out the portion of our taxes which ask if we had health insurance through the market place and we did We listed my son and daughter as dependents under are health insurance but my son whose 22 does files his own taxes and is not considered a dependent We did get an advanc.

Form 1095A is by far the most important of these forms Again, you’ll receive this form only if you obtain your health insurance from an Affordable Care Act (ACA) Marketplace (also called the exchange) The exchange prepares and sends this form to you It also sends a copy to the IRS. 1095Aformcom is a 100% FREE Service offered to all insurance customers that purchased their health insurance on the Health Insurance Marketplace (Healthcaregov). • One Form 1095A will be sent to Jane, who is the account holder The form will include both Jane’s and John’s enrollment information Jane and John also enrolled Mary, their 25 year old daughter, in their family policyMary is not a dependent and is in a separate tax household • One Form 1095A will be sent to Jane.

For those enrolled through the Marketplace, Form 1095A is essential for filling out and completing Form 62 This form is used to reconcile any advance payments of the premium tax credit or claim the premium tax credit Form 62 is crucially needed to file a tax return. Form 1095A is sent to individuals so that they may take the Obamacare premium tax credit or to reconcile the existing credit on their tax returns with advance payments of the premium tax credit (advance credit payments) If you haven’t gotten your form 1095A yet, you can view it online through the marketplace at healthcaregov. Know the forms you will be receiving You will receive a Form 1095A if you had qualified coverage through Access Health CT If someone in your household had HUSKY/Medicaid coverage in , they can request a form called a Form 1095B from the Connecticut Department of Social Services You should expect a Form 1095C if you had coverage through your employer or through Medicare.

Form 1095A Entering Health Insurance Marketplace Statement in Program To enter or review Form (s) 1095A Health Insurance Marketplace Statement From within your TaxAct® return (Online or Desktop), click Federal On smaller devices click the icon in the upper lefthand corner, then select Federal. Form 1095A Health Insurance Marketplace Statement is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier 1 The form does not. If you bought health insurance through one of the Health Care Exchanges, also known as Marketplaces, you should receive a Form 1095A which provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the people in your household covered by the policy.

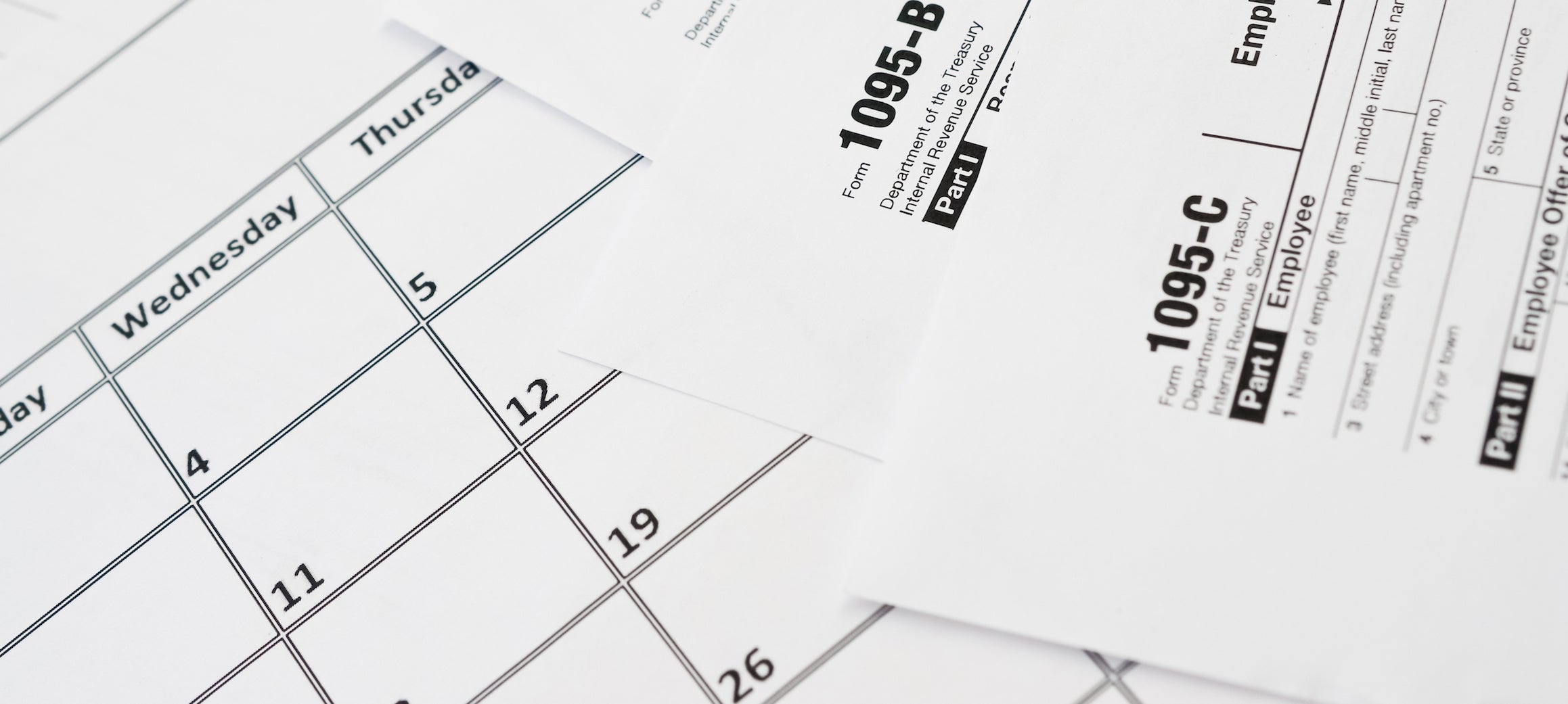

• One Form 1095A will be sent to Jane, who is the account holder The form will include both Jane’s and John’s enrollment information Jane and John also enrolled Mary, their 25 year old daughter, in their family policyMary is not a dependent and is in a separate tax household • One Form 1095A will be sent to Jane. Form 1095A Health Insurance Marketplace Statement 10/08/ Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 10/08/ Form 1095B Health Coverage 10/15/ Form 1095C EmployerProvided Health Insurance Offer and Coverage. Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A Health Insurance Marketplace Statement 19 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 19 Form 1095A Health Insurance Marketplace Statement 18.

The 1095A form (Health Insurance Marketplace Statement) is for people who have health insurance through the Health Insurance Marketplace, often called an exchange What is 1095B The 1095B form (Health Coverage) is mailed to individuals by the insurer to report minimum essential coverage. Complete IRS 1095A online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documents. Form 1095A is an IRS form for individuals who enroll in a Qualified Health Plan (QHP) through the Health Insurance Marketplace Typically it is sent to individuals who had Marketplace coverage to allow them to Claim Premium Tax Credits Reconcile the Credit on their returns with Advanced Premium Tax Credit Payments.

Aca Affordable Care Act Information Vita Resources For Volunteers

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 19 12 Ty 19 Premium Tax Credits Pdf

Irs Form 1095 A Refundtalk Com

Fill Free Fillable Form 1095 A Health Insurance Marketplace Statement Pdf Pdf Form

Annual Health Care Coverage Statements

What Are The Differences Between Form 1095 A 1095 B And 1095 C

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Understanding Your Form 1095 A Youtube

What Agents And Their Clients Need To Know About Irs Form 1095 A Healthsherpa Blog

Irs Fax Number For 1095a Fill Out And Sign Printable Pdf Template Signnow

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Q Tbn And9gcr0tcqznqt0cis3ybofz0gslk0vpwq37upk Rkdizh2cpzn Don Usqp Cau

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them Obamacare Facts

Www Irs Gov Pub Irs Prior I1095a 19 Pdf

Tax Information

Cengage Resource Center

The New Form 1095 A Reporting Health Insurance Coverage Strategic Tax Planning Accounting Services Business Advisors Moore Stephens Tiller

Code Series 2 For Form 1095 C Line 16

3 Things To Know About Form 1095 A

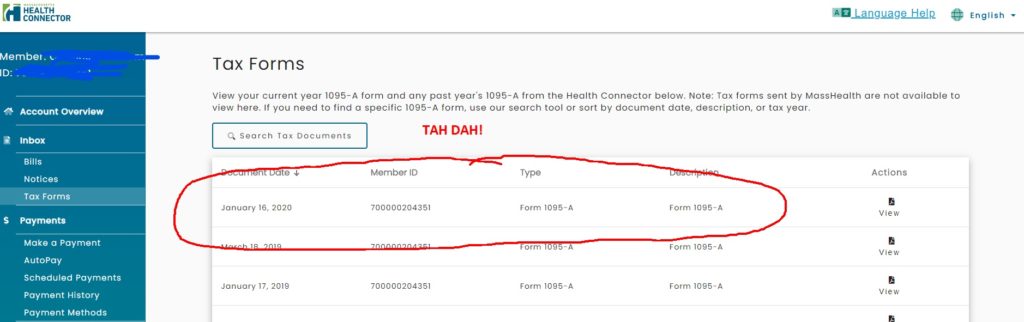

Mass Health Connector 1095 A How To Find

A Simple Guide To 1095 A Tax Forms Carolina Insurance Professionals

How To Use Form 1095 A During Tax Season Legacy Health Insurance

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

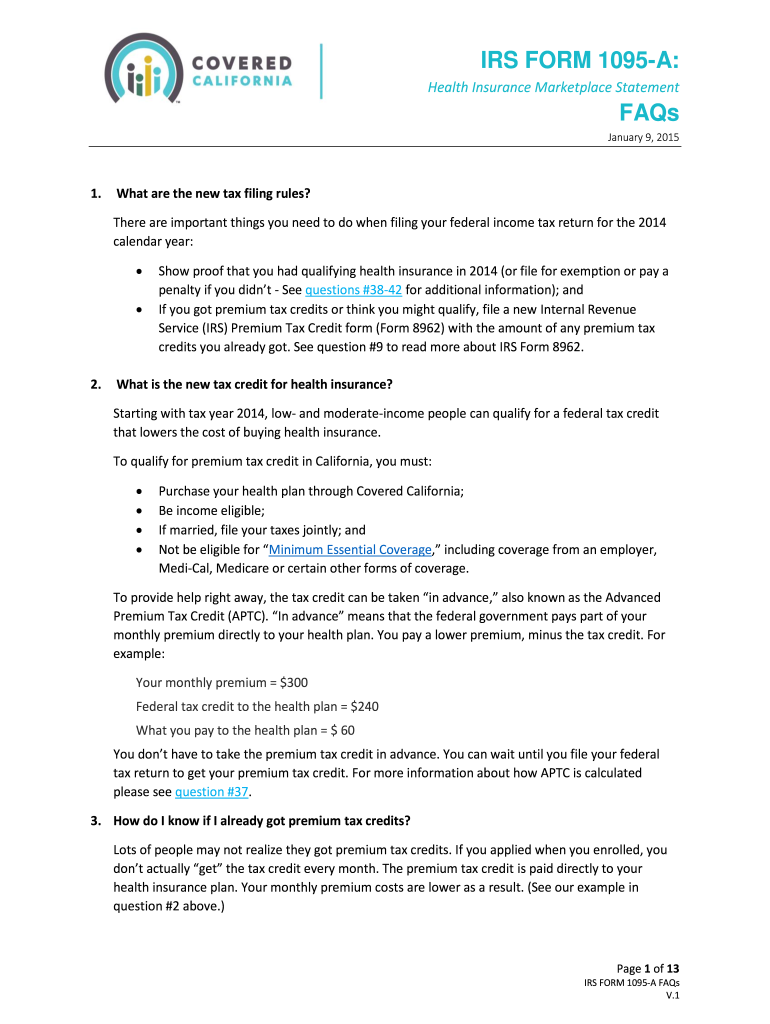

2

Form 1095 A Community Tax

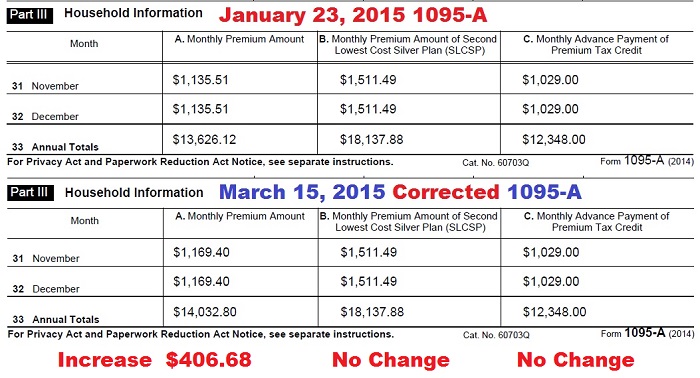

How Obamacare Screwed Up 800 000 Tax Returns Americans For Tax Reform

Irs Form 1095 A Health Insurance Marketplace Statement Tax Blank Lies On Empty Calendar Page Buy This Stock Photo And Explore Similar Images At Adobe Stock Adobe Stock

Aca Affordable Care Act Information Vita Resources For Volunteers

1095 A Health Insurance Marketplace Statement Overview Youtube

Form 1095 C Guide For Employees Contact Us

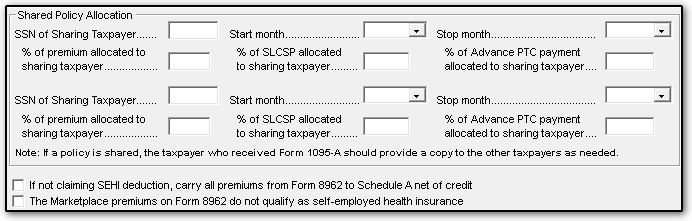

Solved Shared Policy Allocation Form 1095 A Intuit Accountants Community

Form 1095a What How Why Internal Revenue Code Simplified

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

1095 A Irs Fill Out And Sign Printable Pdf Template Signnow

Form 1095 A Archives Savingadvice Com Blog

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Submit Taxes 18 Ask My Accountant

Form 1095 A 1095 B 1095 C And Instructions Obamacare Facts

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

How To Make Sure Your Form 1095 A Is Accurate Before You File Healthcare Gov

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

Form 1095 B Health Coverage Definition

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

1095a 17 Fill Out And Sign Printable Pdf Template Signnow

Premium Tax Credit Making Too Much Money Anthony W Imbimbo Cpa

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page Tax Period Concept Copy Space For Text Stock Photo Alamy

3

Index Of Forms

Wrong Obamacare Form Tax Filers Get Relief From Irs

Pdf Form 1095 A For Irs Sign Personal Tax Eform Aplicaciones En Google Play

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

What Are 1095 Tax Forms San Diego Sharp Health News

The Abcs Of Form 1095

Why Wasn T I Asked To Submit My 1095 A On My Feder

Breakdown Form 1095 A Liberty Tax Service

Tax Forms 1095 A 1095 B 1095 C Business Benefits Group

Department Of Human Services Filing Your Taxes Can Affect Your Healthcare Coverage

Pdf Form 1095 A For Irs Sign Personal Tax Eform For Android Apk Download

Ok Everyone It S Time To Shift Your Focus To Irs Form 1095 A And 62

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them Obamacare Facts

Where To Find Form 1095 A Mnsure

See 5 Important Things To Know About Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Health Insurance Coverage Basics Forms 1095 A B And C Sweetercpa

1095 Tax Info Access Health Ct

Irs Form 1095 A Health Insurance Marketplace Statement Tax Blank Lies On Empty Calendar Page Stock Photo Image Of Insurance Accountant

:max_bytes(150000):strip_icc()/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

Form 1095 B Health Coverage Definition

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Tax Forms 1095 A 1095 B And 1095 C

Many Obamacare Forms 1095 A Wrong Edmundson Cpa Pllc

What Is Irs Form 1095 Katz Insurance Group

1095 A Form Fortune Insurance Agency

Www Masshealthmtf Org Sites Masshealthmtf Org Files 1095 Faq Final Eng Pdf

Solved 1095 A Entry

1095 A Reveals Excess Aca Tax Credits Paid To Blue Cross From Covered California

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

What You Need To Know About Form 1095 A Health Insurance Marketplace Statement

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

Form 1095 B Health Coverage Definition

Form 1095 A Community Tax

Charlotte Inside At Jwu

1040 Affordable Care Act Aca Data Entry And Faqs Where Do I Enter Health Care Coverage Information For The Affordable Care Act Aca Screen Hc Screen 95a Screen 62 Screen 65 Screen Hc If The Taxpayer Had Insurance For The Entire Year That

What You Need To Know About Forms 1094 1095

Irs Form 1095 A Health For California Insurance Center

Form1095a 19 5 Pages 1 8 Flip Pdf Download Fliphtml5

3

You Received A Form 1095 A Now What Djl Accounting And Consulting Group Inc

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Forgot To Add Pediatric Dental To 1095 As

18 Tax Form 1095 A Washington Health Benefit Exchange

Irs Courseware Link Learn Taxes

Premium Tax Credits

1

Marketplace Cms Gov Technical Assistance Resources 1095a And Exemptions Processing Overview Pdf

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net