Form 1065

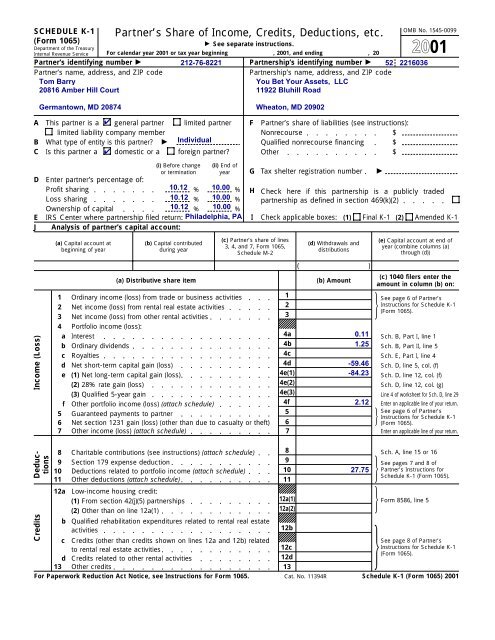

08 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Irs Form 1065 Download Fillable Pdf Or Fill Online U S Return Of Partnership Income 19 Templateroller

Form 1065 For Irs Sign Income Tax Return Eform Applications Sur Google Play

Income Tax Q A Irs Form 1065 For Partnerships Xendoo

What Is Form 1065 Partnership Tax Return Guide

Form 1065 For Irs Sign Income Tax Return Eform For Android Apk Download

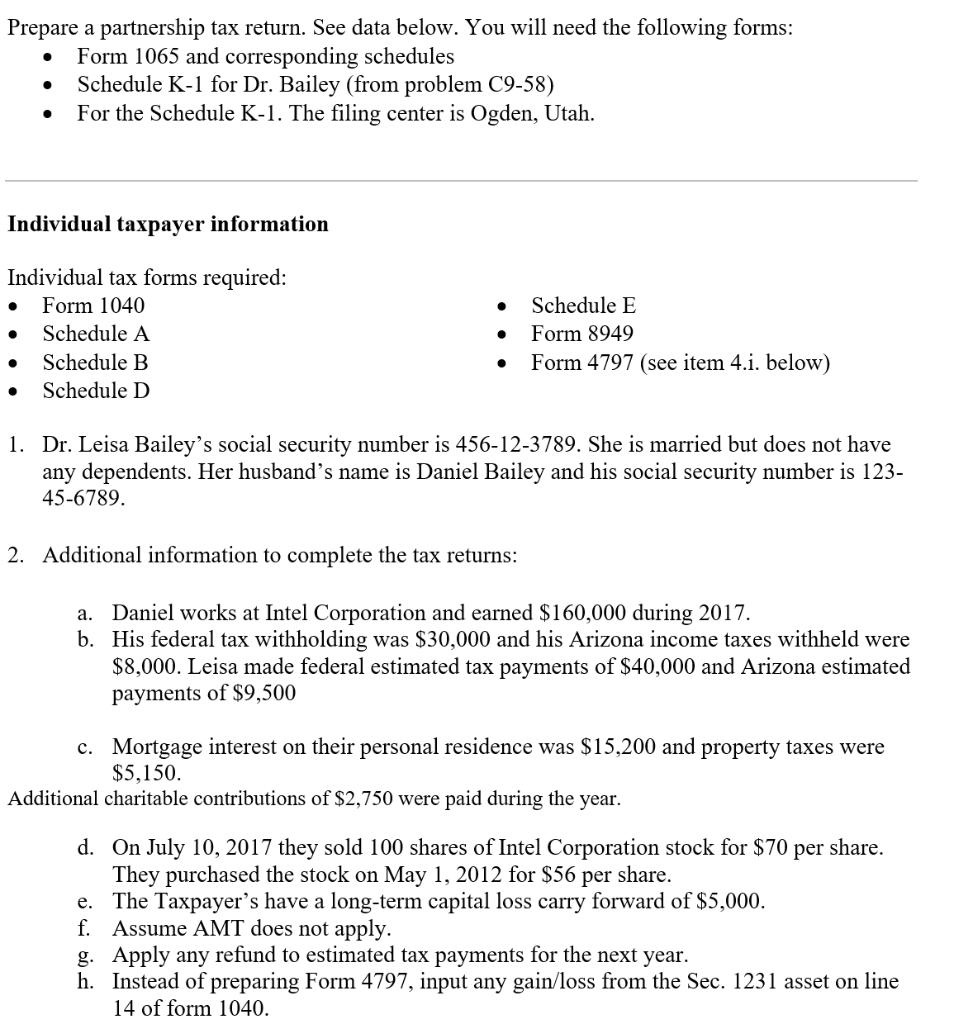

Generally, a domestic partnership must file Form 1065 US Return of Partnership Income by the 15th day of the third month following the date its tax year ended (as shown at the top of Form 1065) For partnerships that keep their records and books of account outside the United States and Puerto Rico, an extension of time to file and pay is granted to the 15th day of the sixth month following.

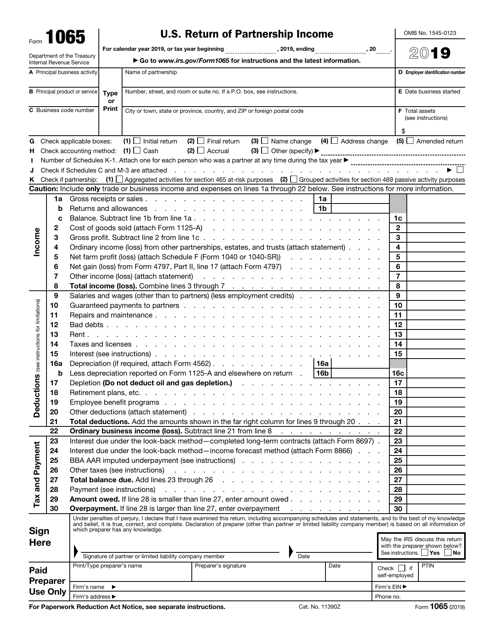

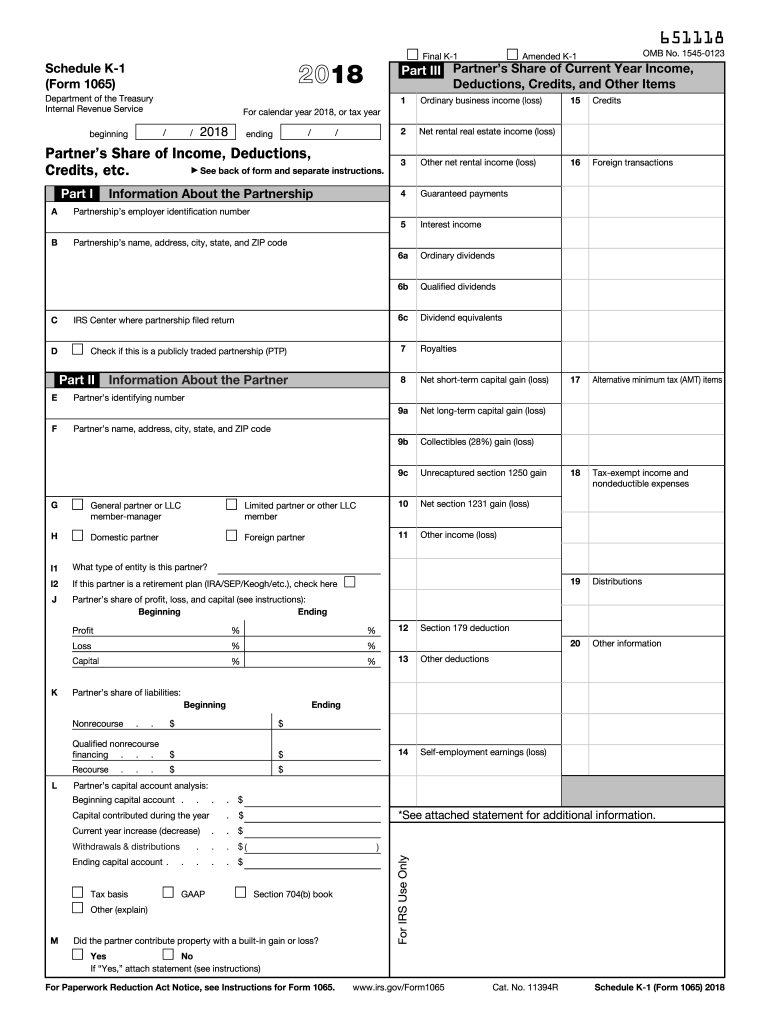

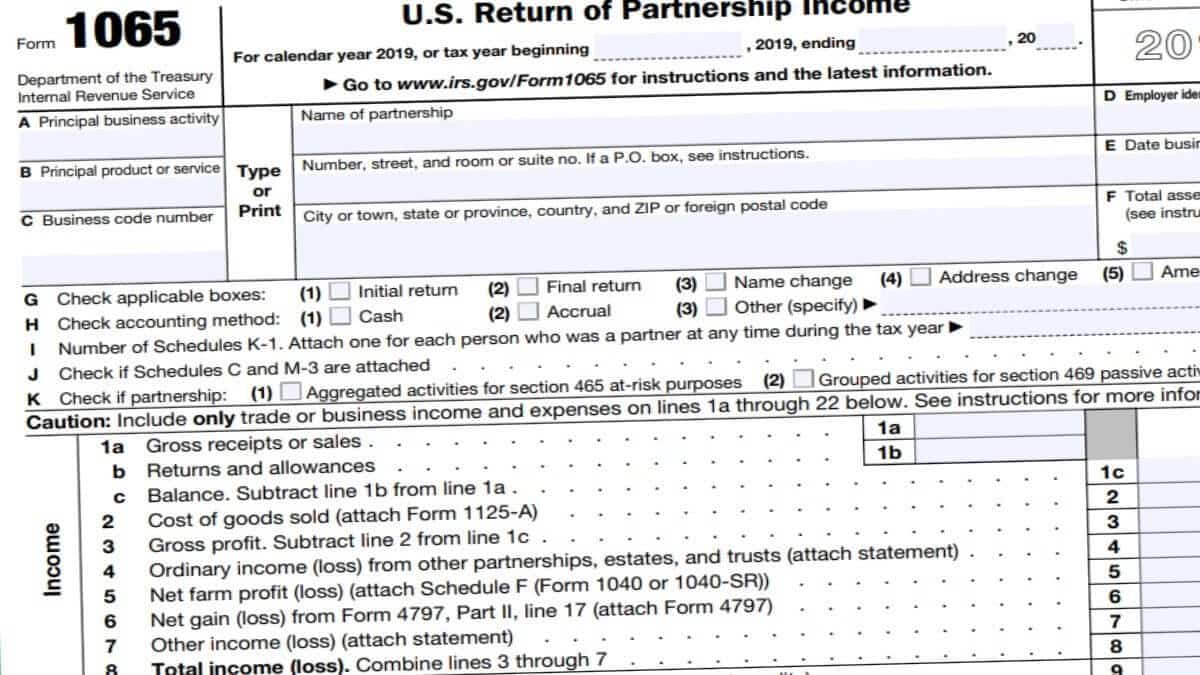

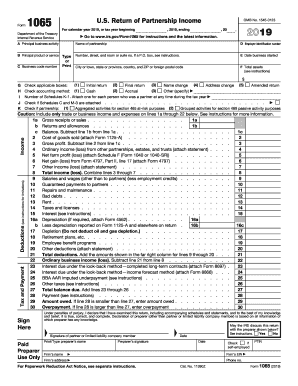

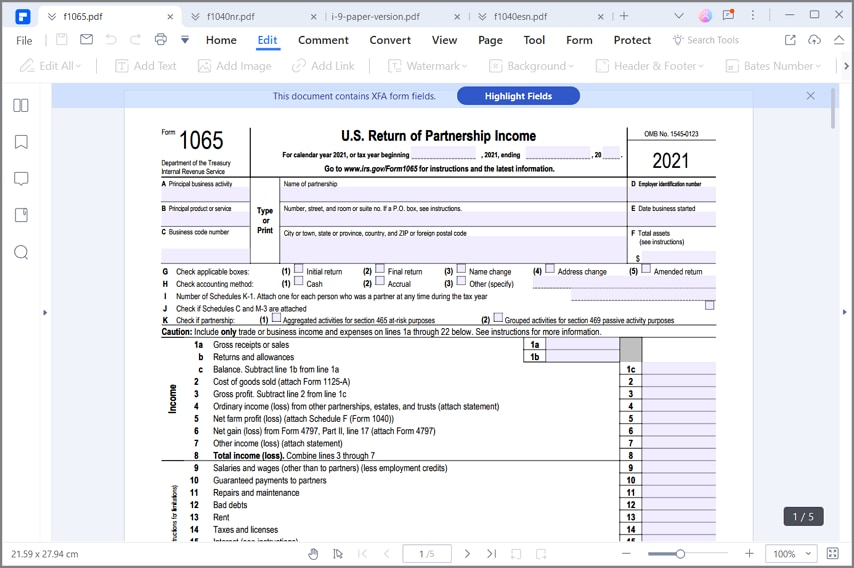

Form 1065. IRS Form 1065 Form 1065, also known as the US Return of Partnership Income, is an informational tax form used to report the income, gains, losses, deductions, credits, and other applicable information concerning the operations of a partnership. There is NOT a Form 1065 listed in the Home & Business edition There is a Schedules K1 (Form 1065) A Schedule K1 from a partnership tax return Form 1065, is not a Form 1065. All rental activities regardless of the partner’s participation.

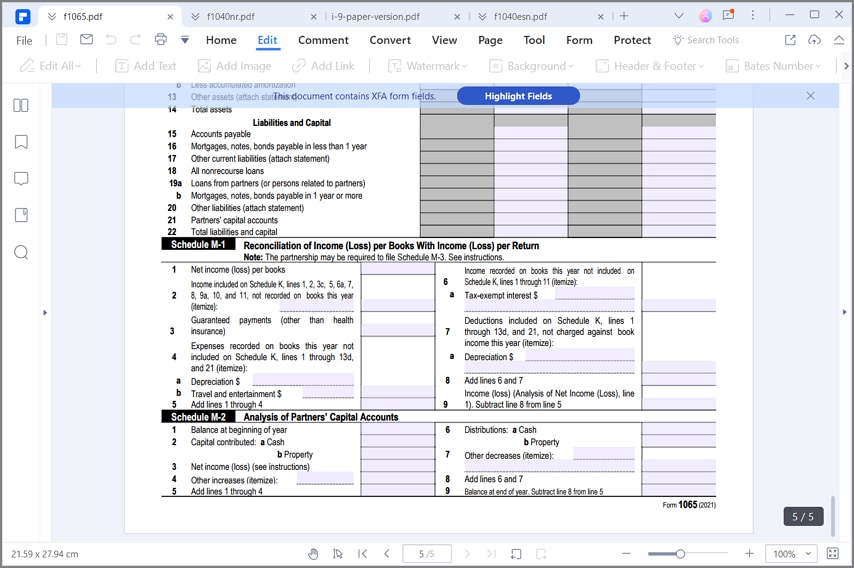

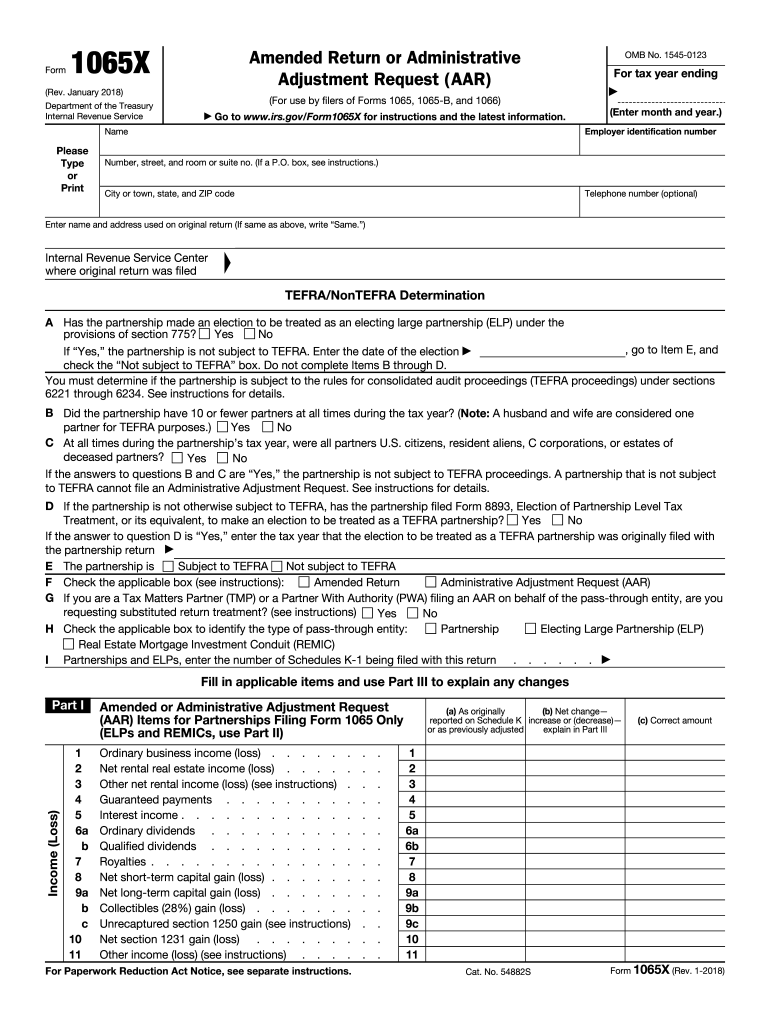

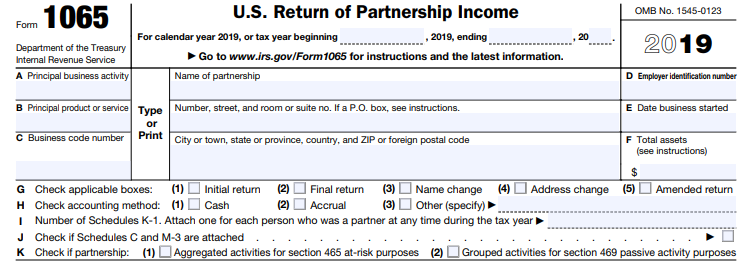

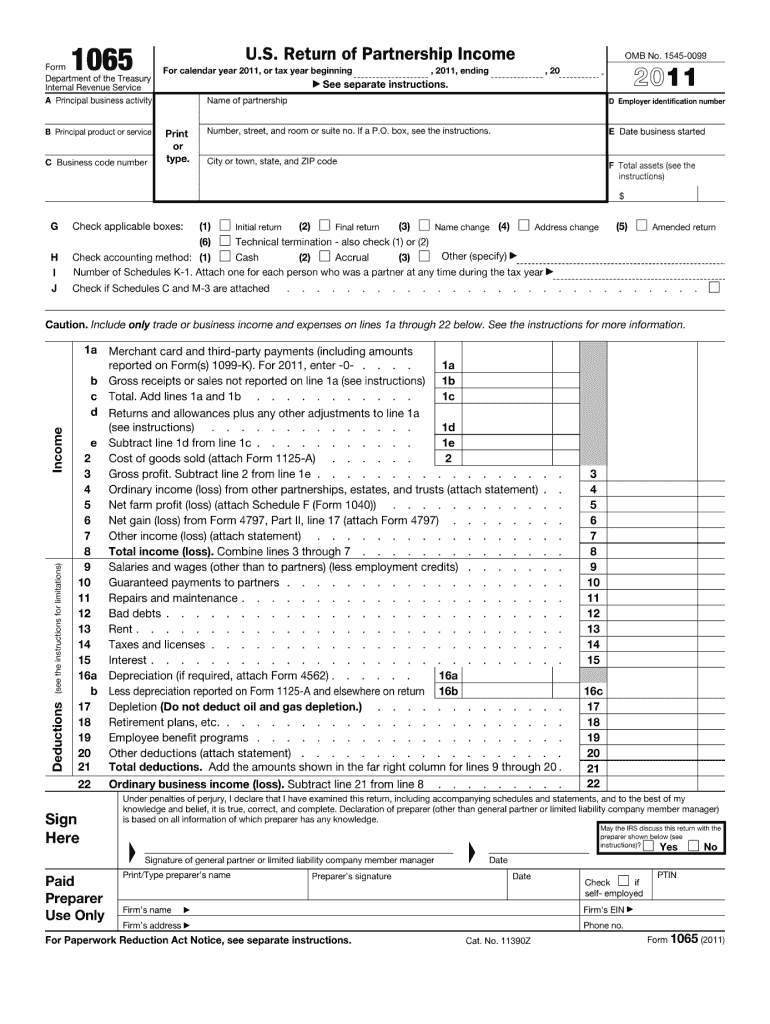

On Form 1065 p12, check box G(5) to indicate an amended return Make the necessary changes to the return Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of the reasons for each change This statement should be mailed with the amended return or attached. Page five of the Form 1065 has an analysis of net income or loss that breaks down the business’ income or loss It also divides the income or loss among general partners and limited partners and by the type of partner There are two schedules listed on page five, the Schedule L and Schedule M1. IRS Form 1065 Form 1065, also known as the US Return of Partnership Income, is an informational tax form used to report the income, gains, losses, deductions, credits, and other applicable information concerning the operations of a partnership.

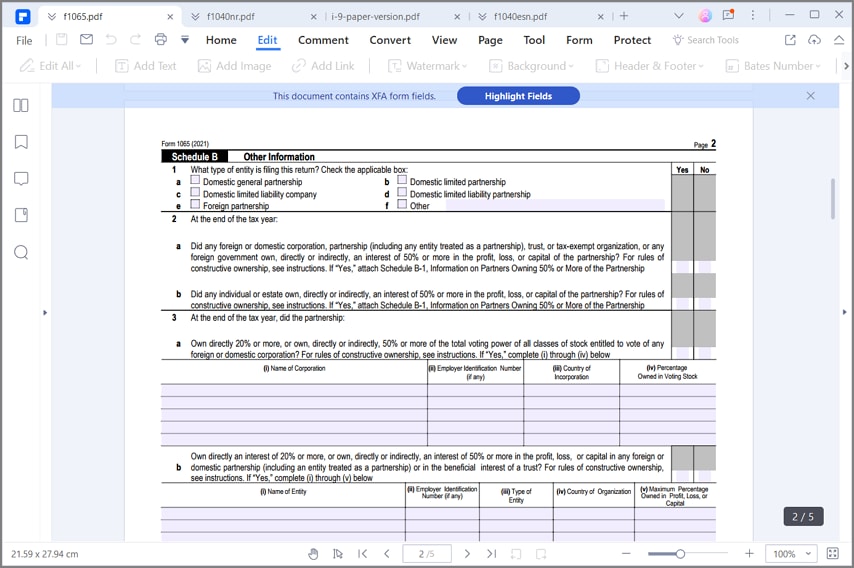

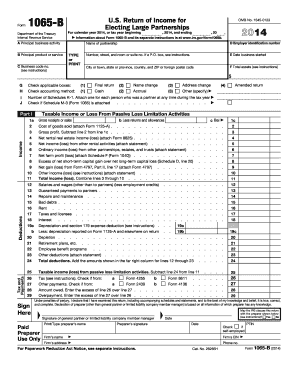

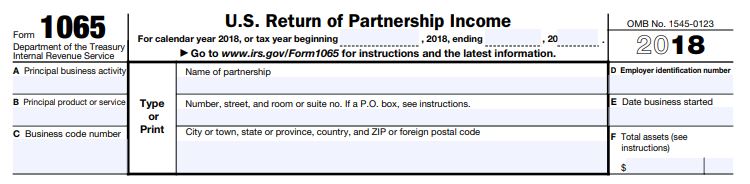

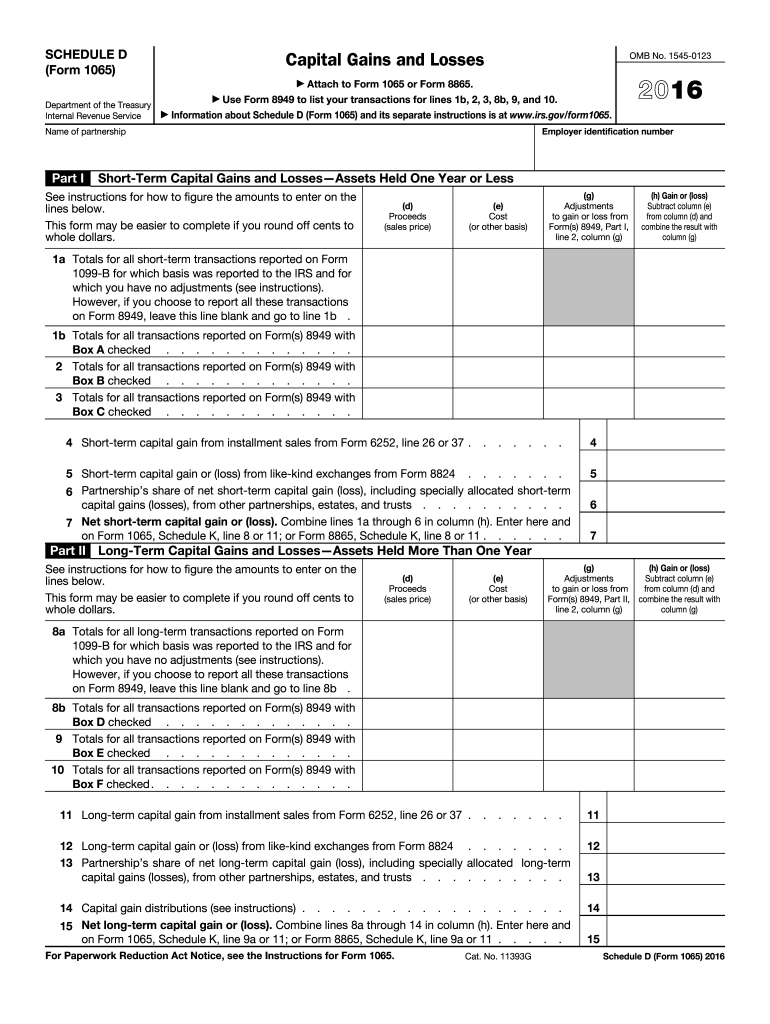

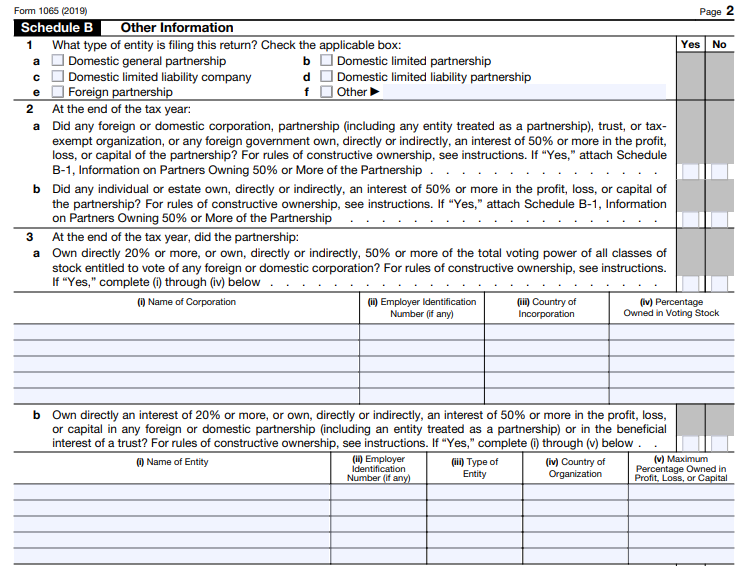

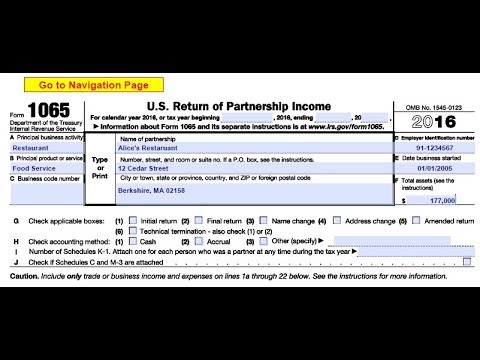

Form 1065 US Return of Partnership Income 01/05/21 Inst 1065 Instructions for Form 1065, US Return of Partnership Income 19 02/19/ Form 1065 (Schedule B1) Information on Partners Owning 50% or More of the Partnership 0819 11/12/19 Form 1065 (Schedule B2). Check the applicable box Yes No a Domestic general partnership b Domestic limited partnership c Domestic limited liability company d. Form 1065 Instruction on Filling Out There are 5 pages in the IRS tax Form 1065 Let’s figure out what each page is to understand how to complete Form 1065 The 1st page is designed to collect general information about your partnership, including its official name, legal address, the type of main business activity, EIN (Employer Identification Number), the total amount of assets, and the.

What Is Form 1065 US Return of Partnership Income?. On Form 1065 p12, check box G(5) to indicate an amended return Make the necessary changes to the return Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of the reasons for each change This statement should be mailed with the amended return or attached. Each partner is responsible for filing an individual tax return reporting their share of income, losses, tax deductions and tax credits that the business reported on the informational 1065 tax form As a result, the partnership must prepare a Schedule K1 to report each partner’s share of these tax items.

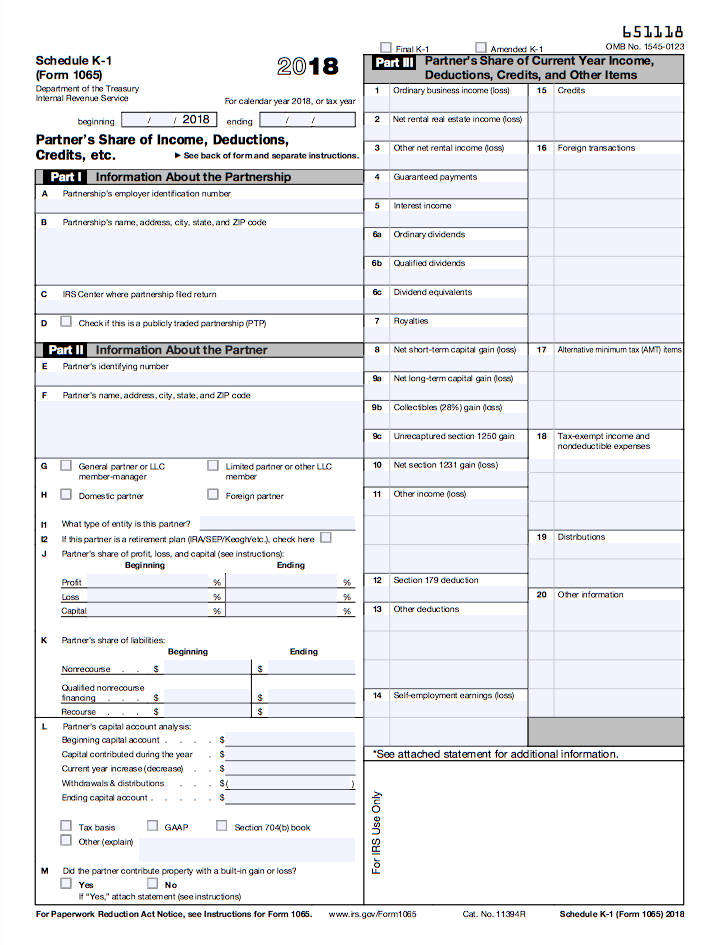

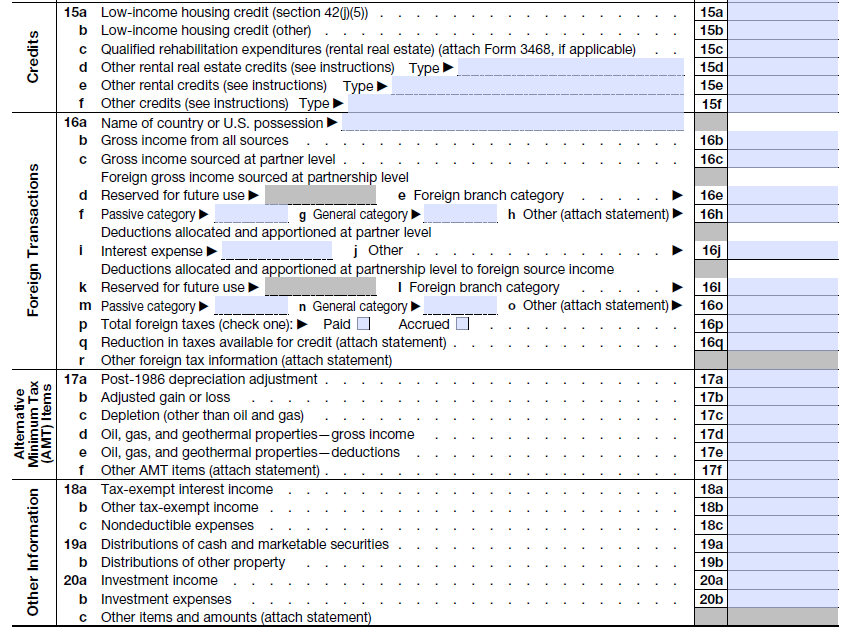

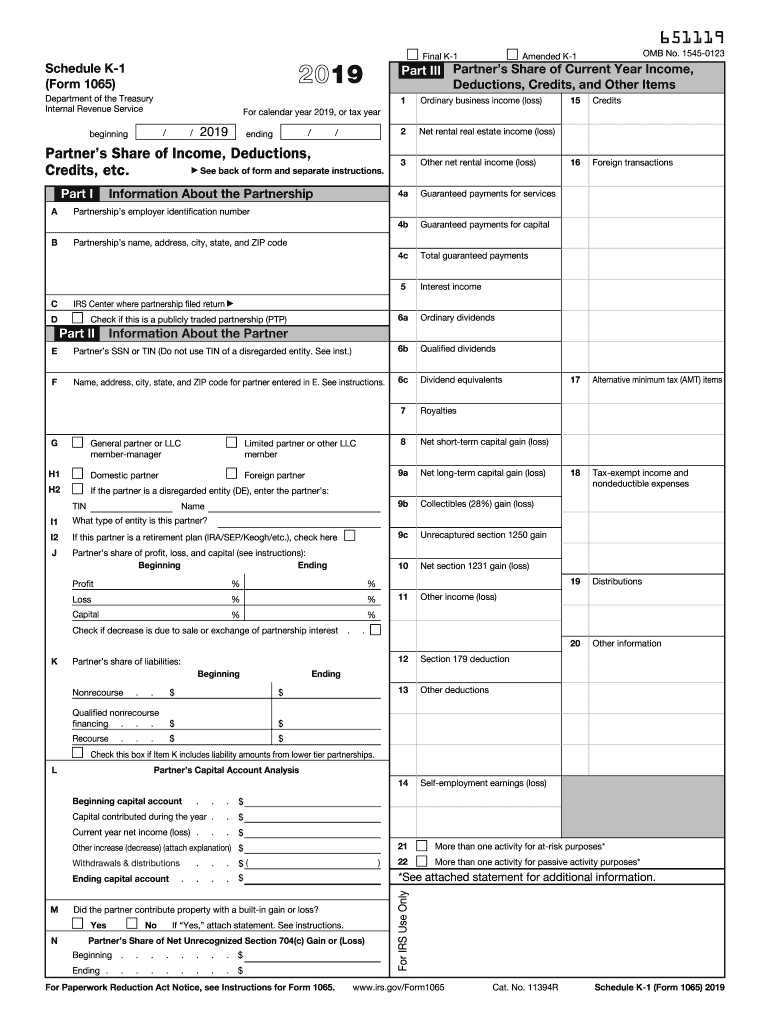

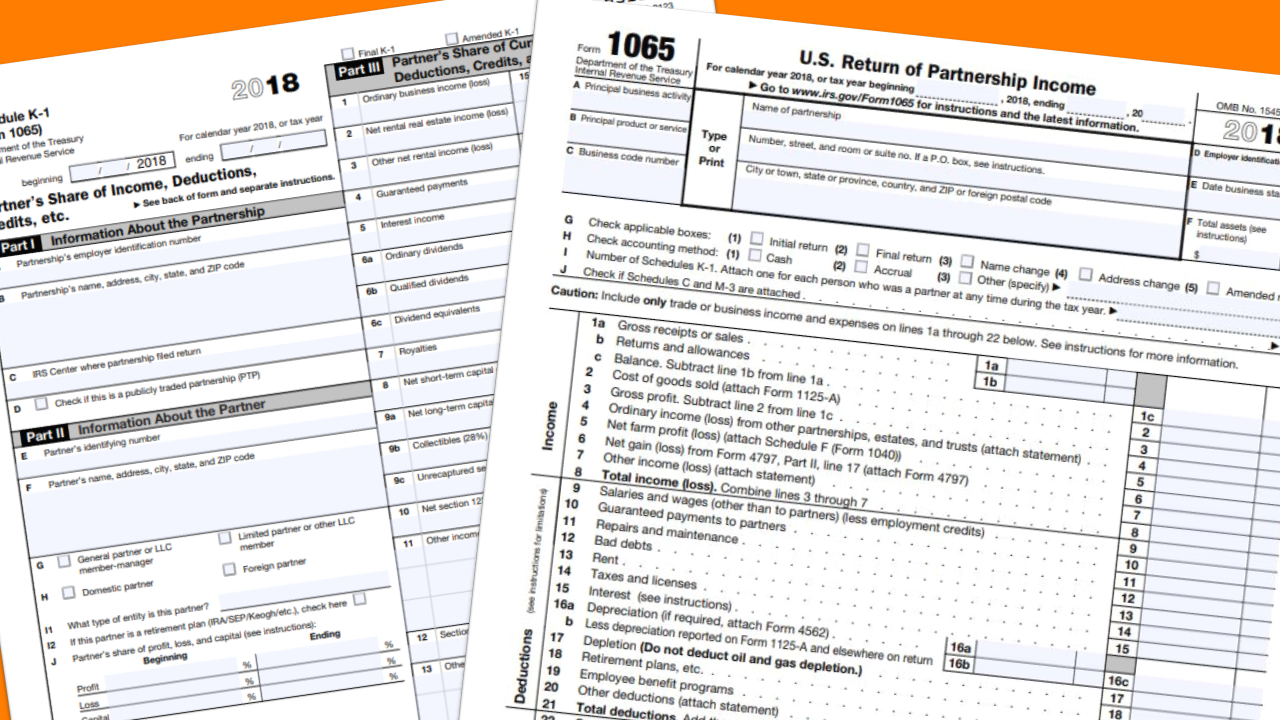

Form 1065, US Return of Partnership Income, is an IRS tax form that partnerships use to report their business’s annual financial information Partners must include information about their company’s profits or losses, deductions, and taxes and payments on the form If your business must file, you also need to file Schedule K1, a form. Developments related to Form 1065 and its instructions, such as legislation enacted after they were published, go to IRSgov/ Form1065 What's New Retroactive Legislation These instructions have been revised to reflect changes made by the Taxpayer Certainty and Disaster Relief Act of 19 This act extended several provisions including the. Schedule K1 (Forms 1065 and 11S) Partnerships use Form 1065, Schedule K1, to report the taxpayers’ share of the partnership’s income, deductions, credits, etc In general, a partnership is not subject to income tax and is a flowthrough entity This means the income flows through to the partners, who pay tax on their allocated share of the.

Attachment to Form IT2658, Report of Estimated Personal Income Tax for Nonresident Individuals;. How to read a K1, Form 1065 Most of the information you’ll need to complete your Schedule K1 will come from the Income and Expenses section of Form 1065 Beyond ordinary business income (or losses), Schedule K1 also captures things like real estate income, bond interest, royalties and dividends, capital gains, foreign transactions, and any other payments that you might have received as. Cat No Z Form 1065 () Form 1065 () Page 2 Schedule B Other Information 1 What type of entity is filing this return?.

The form 1065 can be generated in TurboTax Business This is where you have to file for a partnership A multimember LLC cannot use TurboTax SelfEmployed for their business. Form 1065 / Partnership Return • Five pages long • First page follows the typical tax form pattern ‒ Income listed ‒ Deductions taken ‒ Taxable income/loss derived • Second, third fifth pages are Schedules ‒ Every partnership completes the schedules, so they are part of the form Partnership Form 1065 with K1 18. File Form 1065 at the applicable IRS address listed below If Schedule M3 is filed, Form 1065 must be filed at the Ogden Internal Revenue Service Center as shown below If the partnership’s principal business, office, or agency is located in And the total assets at.

A 1065 extension must be filed by midnight local time on the normal due date of the return In the case of a 1065, this is by the 15th day of the 3rd month after the end of the tax year for the return For a calendar year filer, the deadline is March 15 We recommend that you efile at least several hours before the deadline to ensure a timely. IRS Form 1065 Form 1065, also known as the US Return of Partnership Income, is an informational tax form used to report the income, gains, losses, deductions, credits, and other applicable information concerning the operations of a partnership. How to file Form 1065 To file Form 1065, you’ll need all of your partnership’s important yearend financial statements, including a profit and loss statement that shows net income and revenues, a list of all the partnership’s deductible expenses, and a balance sheet for the beginning and end of the year If your business sells physical goods, you’ll need to provide information for.

The K1 1065 Edit Screen in the tax program has an entry for each box found on the Schedule K1 (Form 1065) that the taxpayer received A description of the income items contained in boxes 1 through 11, including each of the Codes for Other Income (Loss) that can be entered in Box 11 can be found below. Generally, a domestic partnership must file Form 1065 US Return of Partnership Income by the 15th day of the third month following the date its tax year ended (as shown at the top of Form 1065) For partnerships that keep their records and books of account outside the United States and Puerto Rico, an extension of time to file and pay is granted to the 15th day of the sixth month following. 1065 Form Fill out, securely sign, print or email your form 1065 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!.

A 1065 extension must be filed by midnight local time on the normal due date of the return In the case of a 1065, this is by the 15th day of the 3rd month after the end of the tax year for the return For a calendar year filer, the deadline is March 15 We recommend that you efile at least several hours before the deadline to ensure a timely. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc, from the operation of a partnership A partnership doesn't pay tax on its income but "passes through" any profits or losses to its partners on a Schedule K1 Due Dates for Form 1065 are March 15, 21 (September 15, 21 with extension) for tax returns. Form CT1065/CT11SI Business Information logOn prepare verify payment submit confirmation/print IMPORTANT If you have a Connecticut Tax Registration Number (CT REG) for this PassThrough Entity, DRS recommends that you log into the Taxpayer Service Center (TSC) to initiate this transaction and to have access to the other TSC features.

Entering charitable contributions for Form 1065 SOLVED • by Intuit • ProConnect Tax • 2 • Updated April 24, This article will help you enter charitable contributions to flow to Schedule K, line 13, and the Schedule K1, line 13. Entering charitable contributions for Form 1065 SOLVED • by Intuit • ProConnect Tax • 2 • Updated April 24, This article will help you enter charitable contributions to flow to Schedule K, line 13, and the Schedule K1, line 13. There is NOT a Form 1065 listed in the Home & Business edition There is a Schedules K1 (Form 1065) A Schedule K1 from a partnership tax return Form 1065, is not a Form 1065.

Form 1065, US Return of Partnership Income, is an IRS tax form that partnerships use to report their business’s annual financial information Partners must include information about their company’s profits or losses, deductions, and taxes and payments on the form If your business must file, you also need to file Schedule K1, a form. Form 1065 Return Due Date Generally, a domestic partnership must file Form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of Form 1065 For partnerships that keep their records and books of account outside the United States and Puerto Rico, an extension of time to file and pay is granted to the. Learn more about myconneCT Walkin services at all DRS branch office locations remain suspended Please check our COVID19 Response FAQ's.

Form 1065 Passive vs Nonpassive Activity Generally, passive activities include Activities that involve the conduct of a trade or business if the partner does not materially participate in the activity and;. Form 1065 US Return of Partnership Income 19 On average this form takes 94 minutes to complete The Form 1065 US Return of Partnership Income 19 form is 5 pages long and contains 0 signatures;. Form 1065 US Return of Partnership Income is a tax document issued by the IRS used to declare the profits, losses, deductions, and credits of a business partnership.

Entering charitable contributions for Form 1065 SOLVED • by Intuit • ProConnect Tax • 2 • Updated April 24, This article will help you enter charitable contributions to flow to Schedule K, line 13, and the Schedule K1, line 13. Fillable forms cannot be viewed on mobile or tablet devices Follow the steps below to download and view the form on a desktop PC or Mac Note Open the PDF file from your desktop or Adobe Acrobat Reader DC Do not click on the downloaded file at the bottom of the browser since it will not open the. Information about Schedule K1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc, including recent updates, related forms, and instructions on how to file Schedule K1 (Form 1065) is used for reporting the distributive share of a partnership income, credits, etc filed with Form 1065.

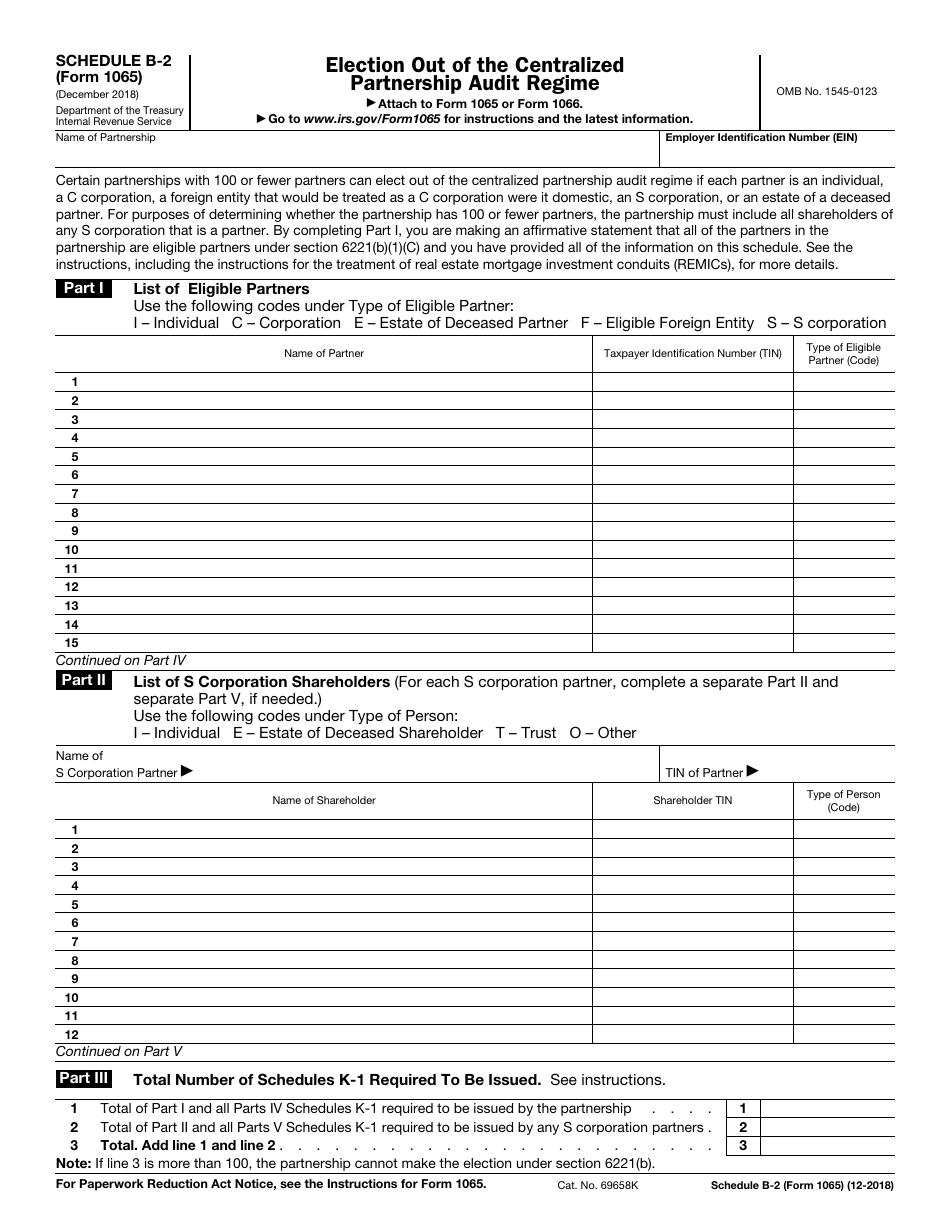

There is NOT a Form 1065 listed in the Home & Business edition There is a Schedules K1 (Form 1065) A Schedule K1 from a partnership tax return Form 1065, is not a Form 1065. " every domestic partnership must file Form 1065, unless it neither receives income nor incurs any expenditures treated as deductions or credits for federal income tax purposes Entities formed as LLCs that are classified as partnerships for federal income tax purposes have the same filing requirements as domestic partnerships". Form 1065 US Return of Partnership Income 01/05/21 Form 1065 (Schedule B1) Information on Partners Owning 50% or More of the Partnership 0819 11/12/19 Form 1065 (Schedule B2) Election Out of Partnership Level Tax Treatment 1218 12/19/18 Form 1065 (Schedule C).

Form LLC 1065, or Return of US Partnerships Income, is required when filing earnings for a business partnership A business may choose to be an LLC under their state, but the government won't let them file federal income taxes when they're an LLC A business can file taxes as either a corporation or a partnership. Instructions for Schedule K1 (Form 1041) for a Beneficiary Filing Form 1040 12/11/ Form 1065 (Schedule K1) Partner's Share of Income, Deductions, Credits, etc 01/05/21 Inst 1065 (Schedule K1). Form 1065 US Return of Partnership Income 01/05/21 Inst 1065 Instructions for Form 1065, US Return of Partnership Income 19 02/19/ Form 1065 (Schedule B1) Information on Partners Owning 50% or More of the Partnership 0819 11/12/19.

The Analysis of Net Income is reported on a 1065 return (page 5 in view mode) Per the IRS 1065 Instructions, "For each type of partner shown, enter the portion of the amount shown on line 1 that was allocated to that type of partner The sum of the amounts shown on line 2 must equal the amount shown on line 1 " Amounts flow to row 2a or 2b based on the Partnership entity type, and. A complete federal Form 1065 including all schedules and supporting attachments may be required during the course of an audit NJ1065 Page of Partnership name as shown on Form NJ1065 Federal EIN Partners Directory List all partners, including principal address Add additional sheets as necessary. Form 1065 BBA Partnerships Filing Amended Returns for CARES Act Relief 13 APR Clarifications for Disregarded Entity Reporting and section 743(b) Reporting 26 MAR – MicroCaptive Arrangements 23MAR Corrections to the 19 Instructions for Form 1065 10MAR.

Form 1065 Our blank samples are fillable and editable online Irs Form 1065 Put your information, print, download or send your template Get access via all gadgets, including PC, mobile and tablet Secure and userfriendly tools. Form 1065 has a due date on the 15th day of the third month after the end of the entity's tax year March 15 for a calendar year entity A partnership currently can obtain an automatic sixmonth. The IRS has released a draft of the Form 1065 instructions for returns that contains the IRS’s proposed requirement for reporting partners’ capital on the K1 on the tax basis 1 The IRS issued a news release on the matter at the same time 2 News Release Summary The news release indica.

Form 1065 Amended Return If you need to make changes to your Partnership (Form 1065) return after it has been filed, you may need to file an amended return The IRS supports both paper filing and efiling for amended returns. Essentially, Form 1065 is an informational form you’ll use to report the business income, gains, losses, income deductions, and credits from your operations As the owner of a partnership or LLC, you’ll need to submit this form to the IRS every year. How to file Form 1065 To file Form 1065, you’ll need all of your partnership’s important yearend financial statements, including a profit and loss statement that shows net income and revenues, a list of all the partnership’s deductible expenses, and a balance sheet for the beginning and end of the year If your business sells physical goods, you’ll need to provide information for.

Payments due April 15, June 15, September 15, 21, and January 18, 22 IT2658E (Fillin) (12/19) Instructions on form. Form 1065 US Return of Partnership Income 01/05/21 Inst 1065 Instructions for Form 1065, US Return of Partnership Income 19 02/19/ Form 1065 (Schedule B1) Information on Partners Owning 50% or More of the Partnership 0819 11/12/19. The TurboTax Business Edition can complete a Form 1065 The Business Edition can only be installed on a Windows based personal computer, not on a Mac or online The Business Edition cannot complete a personal tax return, Form 1040.

IRS Form 1065, Partnership Income Tax Return, and related forms Includes schedules B, K, L, M1, and M2, K1, and 1125A These are selfcalculating IRS forms in pdf format for year 18. IRS Form 1065 is the US Return of Partnership Income used to report each partners' share of income or loss of the business No tax is calculated from or paid on Form 1065 It simply reports this information to the IRS Tax liability is passed through to the members who then pay taxes on the income on their personal returns. NJ1065 and NJCBT1065 The Gross Income Tax Act (GIT) at NJSA 54A86 requires entities classified as a partnership for federal income tax purposes having a resident owner or income derived from New Jersey sources to file a Gross Income Tax return, Form NJ1065 Partnerships with more than two owners and.

Form 1065 US Return of Partnership Income 01/05/21 Inst 1065 Instructions for Form 1065, US Return of Partnership Income 19 02/19/ Form 1065 (Schedule B1) Information on Partners Owning 50% or More of the Partnership 0819 11/12/19 Form 1065 (Schedule B2). IRS Form 1065 is the US Return of Partnership Income used to report each partners' share of income or loss of the business No tax is calculated from or paid on Form 1065 It simply reports this information to the IRS Tax liability is passed through to the members who then pay taxes on the income on their personal returns.

Q Tbn And9gct2f56vzodgkkixi 4yg5hf5 8gazdj7ywhwkcofbuhn1dhzfvo Usqp Cau

How Much Did Your Parent Earn From Working In 19 Federal Student Aid

Irs Issues Revised Instructions On 1065 Parter Tax Basis Capital Reporting Cpa Practice Advisor

1065表格的8个步骤的说明 免费清单

Www Irs Gov Pub Irs Prior I1065 14 Pdf

Q Tbn And9gcrgn7mnicxijndjvxpcapvudxektkc6zks6dcnisxjv47gisv5n Usqp Cau

2

Inst 1065 Instructions For Form 1065 U S Return Of Partnership Inco

Partnership Tax Return Preparation Form 1065

Irs Releases Draft 19 Forms 1065 11 S And Schedules K 1 E File Group Professional Tax Services Software

Irs Form 1065 How To Fill It With The Best Form Filler

Formulier 1065 Amerikaanse Terugkeer Van Partnerschap Inkomen Verenigde Staten Belastingformulieren 1617 Amerikaanse Lege Belasting Vormen Fiscale Tijd Stockfoto En Meer Beelden Van Accountancy Istock

Irs Releases New Draft Versions Of Forms 1065 11 S And K 1 Cpa Practice Advisor

Q Tbn And9gcrorouxpojv1uuvedoehv1a8haqudmtaqef Jpifhqbmdzhe724 Usqp Cau

1065 Calculating Book Income Schedules M 1 And M 3 K1 M1 M3

New 1065 Instructions Unveiled Taxing Subjects

Irs Schedule K 1 1065 Form Pdffiller

Irs Form 1065 How To Fill It With The Best Form Filler

Form 1065 19 Partnership Tax Return 1065 Meru Accounting

A Simple Guide To The Schedule K 1 Tax Form Bench Accounting

Tax Forms 1065 Image Photo Free Trial Bigstock

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Form 1065 For Partnership Tax Return Youtube

Drafts Of 19 Forms 1065 And 11s As Well As K 1s Issued By Irs Current Federal Tax Developments

1065表格的8个步骤的说明 免费清单

Understanding The 1065 Form Scalefactor

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs 1065 X 18 Fill Out Tax Template Online Us Legal Forms

Www Irs Gov Pub Irs Prior F1065sm3 17 Pdf

What Is A Form 1065 With Pictures

Form 1065 Instructions In 8 Steps Free Checklist

Fillable K 18 Fill Out And Sign Printable Pdf Template Signnow

Form 1065 For Irs Sign Income Tax Return Eform Applications Sur Google Play

Form 1065 B U S Return Of Income For Electing Large Partnerships

Prepare A Partnership Tax Return See Data Below Chegg Com

Form 1065 Instructions Limited Liability Partnership Business

Drafts Of 19 Forms 1065 And 11s As Well As K 1s Issued By Irs Current Federal Tax Developments

Irs Form 1065 Sign Income Tax Return Eform For Android Apk Download

Inst 1065 Instructions For Form 1065 U S Return Of Partnership Inco

1065 Form App For Iphone Free Download 1065 Form For Iphone Ipad At Apppure

Form 1065 Instructions In 8 Steps Free Checklist

1065 B Fill Out And Sign Printable Pdf Template Signnow

What Is Form 1065 Get Form Filing Instructions For

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Form 1065 Instructions In 8 Steps Free Checklist

Irs Releases Drafts Of The New Form 1065 Schedule K 1 Accounting Today

11 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

16 Form 1065 Irs Tax Forms Pdf Free Download

What Is Form 1065 Get Form Filing Instructions For

Partner S Instructions For Schedule K 1 Form 1065 Stambaugh Ness

Premium Photo Irs Form 1065 U S Return Of Partnership Income

Form 1065 Instructions Information For Partnership Tax Returns

Premium Photo Irs Form 1065 U S Return Of Partnership Income

16 Irs Form 1065 Fill Out And Sign Printable Pdf Template Signnow

Small Business Tax Services

Best Tax Return Workshop Partnerships Llcs Form 1065 Updates

Standard Partnership Or Llc Return Form 1065 Wilson Financial Wealth Management And Financial Planning

12 Partner S Instructions For Schedule K 1 Form 1065

Irs Releases Draft Versions Of New K2 And K3 Partnership Forms Cpa Practice Advisor

What Types Of Business Partnerships Must File Form 1065 Silver Tax Group

Form 1065 Instructions In 8 Steps Free Checklist

1065 Form 21 Irs Forms Zrivo

1065表格的8个步骤的说明 免费清单

Irs 1065 Form Pdffiller

01 Form 1065 Schedule K 1 Bivio

Form 1065 U S Return Of Partnership Income

Form 1065 Partnership Income Tax Return Fill Out Onlne Pdf Formswift

Form 3 M 3 Instructions Is Form 3 M 3 Instructions The Most Trending Thing Now In Instruction Reference Letter Job Reference

A Guide To Changing Previously Filed Partnership Returns

U S Tax Return For Partnership Income Form 1065 Meru Accounting

Learn How To Fill The Form 1065 Return Of Partnership Income Youtube

Us Tax Form 1065 With A Silver Pen Editorial Image Image Of Silver Business

Irs 1065 Schedule K 1 19 Fill And Sign Printable Template Online Us Legal Forms

Q Tbn And9gcqjd0g4sjwt0psu8x Ogzvclpybcimap Ejvzvm1fycwl6rrisx Usqp Cau

Dor Mo Gov Forms Mo 1065 19 Pdf

How To Fill Out A Self Calculating Form 1065 Partnership Tax Return And Schedule K 1 Youtube

Irs Drafts Instructions For Form 1065 Partnership Income Reporting Accounting Today

Irs Form 1065 How To Fill It With The Best Form Filler

Eligible Partnerships Granted Extension To File Form 1065 And Schedules K 1

Us Tax Form 1065 On Table Editorial Photography Image Of Financial

Form 1065 B U S Return Of Income For Electing Large Partnerships 14 Free Download

:max_bytes(150000):strip_icc()/Screenshot55-6fbd092750324b07977e11baa7d9be23.png)

Irs Form 1065 What Is It

Inst 1065 Instructions For Form 1065 U S Return Of Partnership Inco

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs Changes Form 1065 And The Form 1065 K 1 For 19 December 17 19 Western Cpe

Irs Form 1065 Schedule B 2 Download Fillable Pdf Or Fill Online Election Out Of The Centralized Partnership Audit Regime Templateroller

541 Form 1065 Example

What Is Form 1065 Partnership Tax Return Guide

Pin On Templates

Form 1065 Images Stock Photos Vectors Shutterstock

03 Instructions For Form 1065 Schedule K 1

Enter The Amount That Your Parent Reported In Box 14 Code A Of Irs Schedule K 1 Form 1065 For 19 Federal Student Aid

Premium Photo Irs Form 1065 U S Return Of Partnership Income

Irs Releases Drafts Of Revised Forms 1065 11 S And K 1 Taxing Subjects

Understanding The 1065 Form Scalefactor

Www Irs Gov Pub Irs Access F1065sb2 Accessible Pdf

Www Irs Gov Pub Irs Prior I1065sk1 16 Pdf

Form 1065 Fill Out And Sign Printable Pdf Template Signnow